The next few days will decide whether cryptocurrencies will fall in tandem with equity and crude oil due to coronavirus or will they buck the trend.

The coronavirus outbreak that started in China has gradually spread to a number of countries across the world. This is creating panic among investors as the death toll continues to rise.

As a result, global equity markets and crude tumbled last week. Though cryptocurrencies also gave up some ground, they are currently attempting a relief rally and most major cryptocurrencies are trading in the green.

Previously, such unforeseen events did not offer large investors a cost-effective way to hedge their crypto portfolio. However, with the recent launch of Bitcoin options, institutional investors can now protect their portfolios using various options strategies. These services by reputed firms are likely to give confidence to the institutional investors to take the plunge into the crypto space.

Crypto market data weekly view. Source: Coin360

The United Kingdom’s legendary Lancashire Cricket Club will use a blockchain-powered mobile tickets platform to sell tickets for all its domestic and international matches. By using the blockchain-based platform, the club aims to track ticket distribution and also get rid of fake tickets. Though these are baby steps, it shows how blockchain technology can be used to find new solutions to old problems.

After the initial fall due to coronavirus, can cryptocurrencies stage a comeback and will the top performers of the past seven days lead from the front? Let’s analyze the charts to find out.

HEDG/USD

Hedge Trade (HEDG) is the top performer of the past seven days with a rise of about 13%. This is relatively a new cryptocurrency but it has quickly climbed the ladder and is trying to break into the list of top-20 cryptocurrencies in terms of market capitalization.

HEDG USD daily chart. Source: Tradingview

The HEDG/USD pair hasn’t been around for long. Hence, we have used the daily chart to analyze it. The pair remained stuck in a range from late August to early December of last year. Thereafter, it broke out of the range on Dec. 5 and has not looked back since.

From an intraday low of $0.68654876 on Dec. 5, the pair rallied to a lifetime high of $2.67010910 on Jan. 24, a rise of 288.91% within a short period. This shows that the pair is backed by strong momentum.

Both moving averages are sloping up and the RSI is close to the overbought zone. The pair has not dipped below the 20-day EMA since Dec. 5, which shows that the bulls have the upper hand.

If the bulls can scale above $2.67010910, a rally to $3 is possible. Conversely, if the bears sink the price below the 20-day EMA, a drop to the 50-day SMA is likely.

DASH/USD

This is the third consecutive week that Dash (DASH) has been a top performer with a gain of about 10% in the past seven days. Let’s study its chart to see if the momentum can carry it higher.

DASH USD weekly chart. Source: Tradingview

The pullback in the DASH/USD pair from the recent highs of $142.3419 was shallow as the bulls purchased the dip close to $90.2989, which is the 50% Fibonacci retracement level of the recent rally. This is a positive sign as it shows that buyers are keen to accumulate at lower levels.

However, we do not expect the pair to resume its up move in a hurry. We anticipate the price to remain range-bound for a few more weeks and digest the recent gains before resuming its up move.

On the upside, a breakout of $142.3419 is likely to attract buyers. Above this level, a rally to $180 is possible. Our bullish view will be invalidated if the bears sink the price below the $90.2989 to $77.7262 support zone.

BSV/USD

Bitcoin SV (BSV) has again found a place among the top performers. This is the fifth successive week that the altcoin has made the list, which shows that it continues to be favored by the bulls.

The price action in BSV has been volatile in the past few weeks as the market participants digested the various news reports on the legal case between Craig Wright and the estate of his former business partner Dave Kleiman.

As a number of questions regarding the court case still remain unanswered, volatility is likely to remain high, albeit in a smaller range. While it is difficult to predict the news flow, let’s study the chart to analyze the likely direction of the next move.

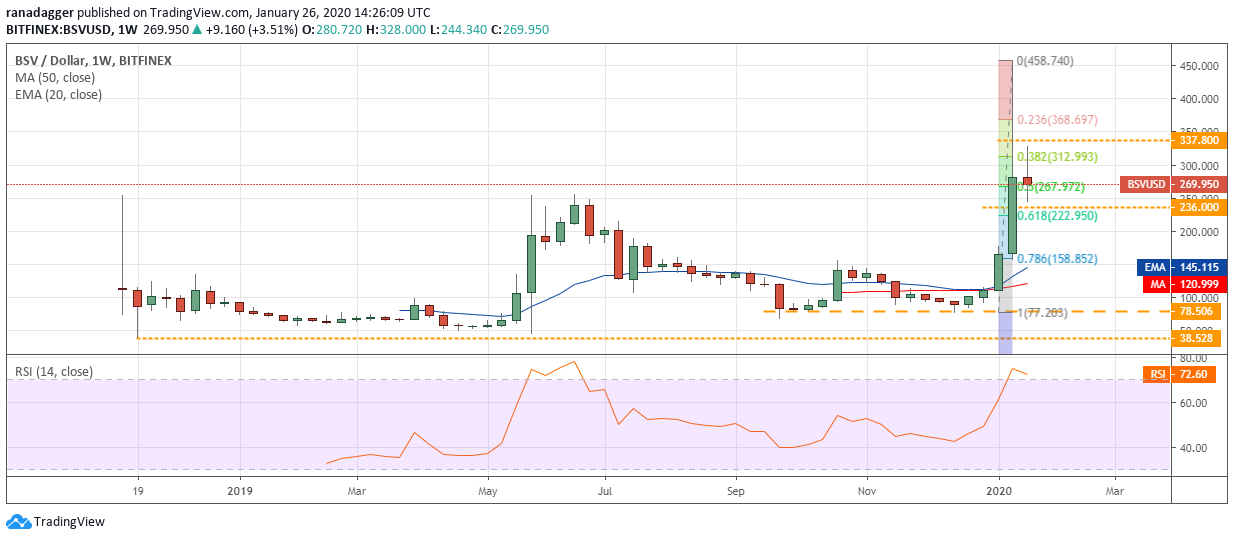

BSV USD daily chart. Source: Tradingview

After the hugely volatile price action in the week before, the past seven days saw a drop in volatility. The pair is likely to remain range-bound between $337.80 and $236 for the next few weeks. After the sharp up move of the past few weeks, we anticipate the BSV/USD pair to digest the gains.

If the bulls push the price above $337.80, the price might rise to $400 and above it to the lifetime highs.

Conversely, if the price dips below $236, it is likely to attract further selling by the traders who are stuck at higher levels. There is minor support at $222.950, which is the 61.8% Fibonacci retracement level of the recent rally, but if this support cracks, the decline can extend to $158.852.

ETC/USD

Ethereum Classic (ETC) rallied roughly 4% in the past seven days. On Jan. 22, The ETC Cooperative announced that Grayscale Investments, the world’s largest digital currency asset manager, will continue to donate up to one-third of Grayscale Ethereum Classic Trust’s annual fees to ETC Cooperative. The funding will help support the growth and development of the Ethereum Classic network.

ETC USD daily chart. Source: Tradingview

The pullback from the recent highs of $12.040 found support close to $8 level, which is a positive sign. This shows that the buyers are keen to get in at lower levels. We expect the ETC/USD pair to consolidate near the top of the $10 to $3.40 range.

If the pair stays between $8 and $10, it will increase the possibility of an upward breakout. We anticipate a new uptrend to start on a close (UTC time) above $10. There is a minor resistance at $12.04, above which a move to $16.60 is possible.

Contrary to our assumption, if the price slips below $8, it is likely to weaken further and dip to the next support at $6. Such a move will keep the pair range-bound for a few more weeks.

XTZ/USD

Tezos (XTZ) has found a place among the top performers with a gain of about 4% in the past seven days. Though there has been no specific event that could be attributed to the rise, let’s analyze its chart to see if we spot any bullish setups.

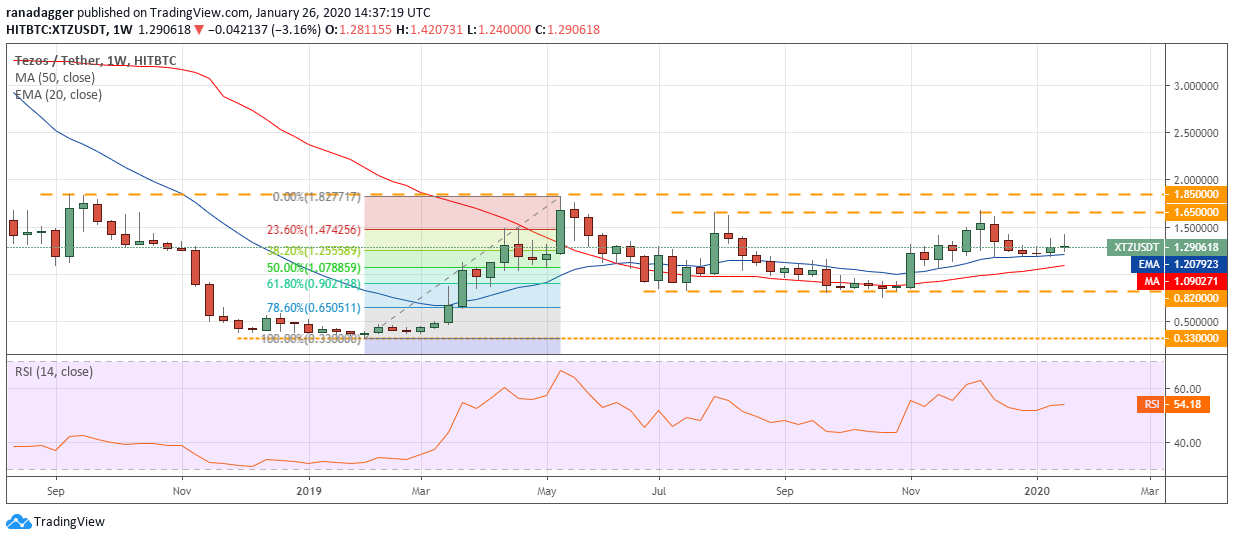

XTZ USD daily chart. Source: Tradingview

The XTZ/USD pair is range-bound between $1.65 and $0.82 for the past few months. This shows that the bulls buy when the price dips to the support of the range and exit their positions close to the highs.

For the past four weeks, the bulls have been attempting to keep the price above the 20-week EMA. Though successful, they have not been able to achieve a meaningful bounce, which shows a lack of buyers at higher levels.

If the price does not pick up momentum quickly and move towards $1.85, the bears will attempt to break below the moving averages. If successful, a drop to $0.82 is possible. The pair will start a new uptrend after it breaks above the $1.65-$1.85 resistance zone. On the other hand, a break below $0.82 will be a huge negative.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.