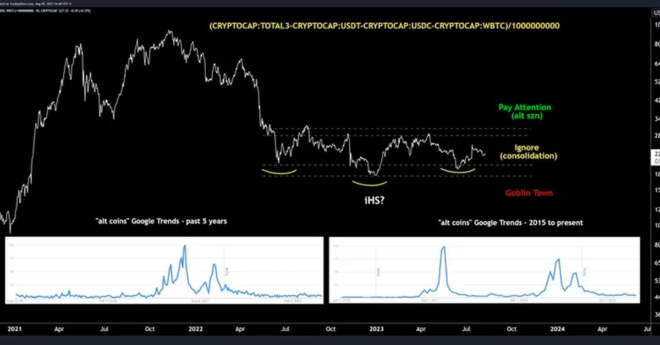

A bullish inverse head-and-shoulders price pattern is building in the combined market capitalization of altcoins. The term “altcoin” is short for “alternative coin” and, in this case, refers to cryptocurrencies other than bitcoin, ether and top stablecoins. A potential completion of the pattern would signal “alt season,” or outperformance of alternative cryptocurrencies relative to bitcoin and ether, according to technical analysis by Josh Olszewicz, a crypto trader and former researcher at Valkyrie Investments. Olszewicz analyzed the charts of altcoins, excluding ether and prominent stablecoins. The inverse head-and-shoulders, one of the most trusted bullish technical analysis patterns in the market, forms when an asset chalks out three price troughs, with the middle one being the lowest. A breakout or a bearish-to-bullish trend change is confirmed once prices rise above the trendline (neckline), connecting the peaks between the lows.

A ‘Head-and-Shoulders’ Case for Altcoins