Dive deep into Ethereum’s 2023 market journey, focusing on its NFT dynamics, pivotal metrics, and the emerging world of spot ETFs.

In 2022, the crypto world witnessed an unexpected downturn, with Ethereum (ETH) facing a sharp 68% decline in value.

Although 2023 brought a glimmer of hope, with ETH clawing back nearly 35% of its losses amidst a market-wide resurgence, its price of $1,620 as of Oct. 20 still pales in comparison to its once lofty highs.

Ethereum has also grappled with a series of challenges recently, dampening its once meteoric rise. A testament to its struggles is the drastic dip in ETH’s total value locked (TVL) — plummeting from a whopping $108 billion in November 2021 to a mere $20 billion by October, marking an almost 82% drop.

Let’s delve into the dynamics surrounding Ethereum and try to understand the current market sentiments, key metrics, and insights into what lies ahead for this crypto.

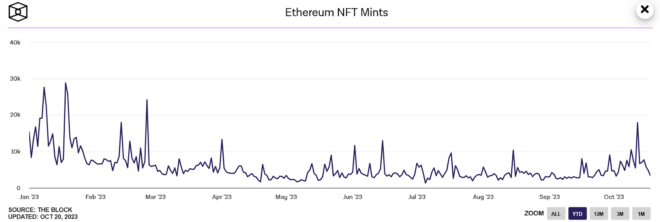

Declining NFT market

In Jan. 2023, Ethereum’s NFT space witnessed significant headwinds. The bustling activity that saw more than 28,000 NFTs being minted daily on Ethereum at the beginning of the year took a sharp downturn.

As of Oct. 20, that enthusiasm has waned, with daily mintings dropping below 3,500. This significant 88% decline can be attributed to increased competition from other blockchain networks, a possible oversupply, and the general volatility of the crypto market.

Trading hasn’t been spared either. Platforms like OpenSea, once brimming with sales, observed a slowdown, particularly after the first quarter, hitting their lowest ebb by Sep. Moreover, from Q1 to Q2 2023, Ethereum’s NFT trading volume shrank by 39.6%, according to CoinGecko.

Parallel to the ebb in NFT momentum, 2023 also marked the entry of Ethscriptions. Launched in June, this platform aimed to transform the NFT space by allowing users to inscribe “non-financial data” on Ethereum’s network.

However, its journey was riddled with hurdles. A major setback occurred when a prominent collection named Ethereum Punks had to be withdrawn from Ethscriptions’ official platform.

This action was taken upon a request from Yuga Labs, the entity behind CryptoPunks. The ripple effect of this removal was evident as it led to the deletion of numerous tweets by the creator of Ethscriptions, Middlemarch, including the pivotal one introducing the Ethscriptions Protocol.

These challenges faced by Ethereum’s NFT and Ethscriptions hint at broader concerns within the Ethereum ecosystem, shedding light on competitive, regulatory, and inherent protocol-based challenges.

What do the metrics suggest?

Several critical metrics can gauge Ethereum’s health and vibrancy. Let’s delve into these to unravel their story about Ethereum in 2023.

ETH daily transactions

These represent the number of transactions processed on the Ethereum blockchain within a day. In May 2023, this number averaged around 1.14 million, but by Oct. 20, it had diminished to 980,000, marking a 14% decline.

Why does this matter? A high transaction count typically indicates robust network usage and utility, making it a bellwether of network health.

The reduction hints at a reduced activity level, possibly due to competition from other blockchains or waning enthusiasm from users and developers.

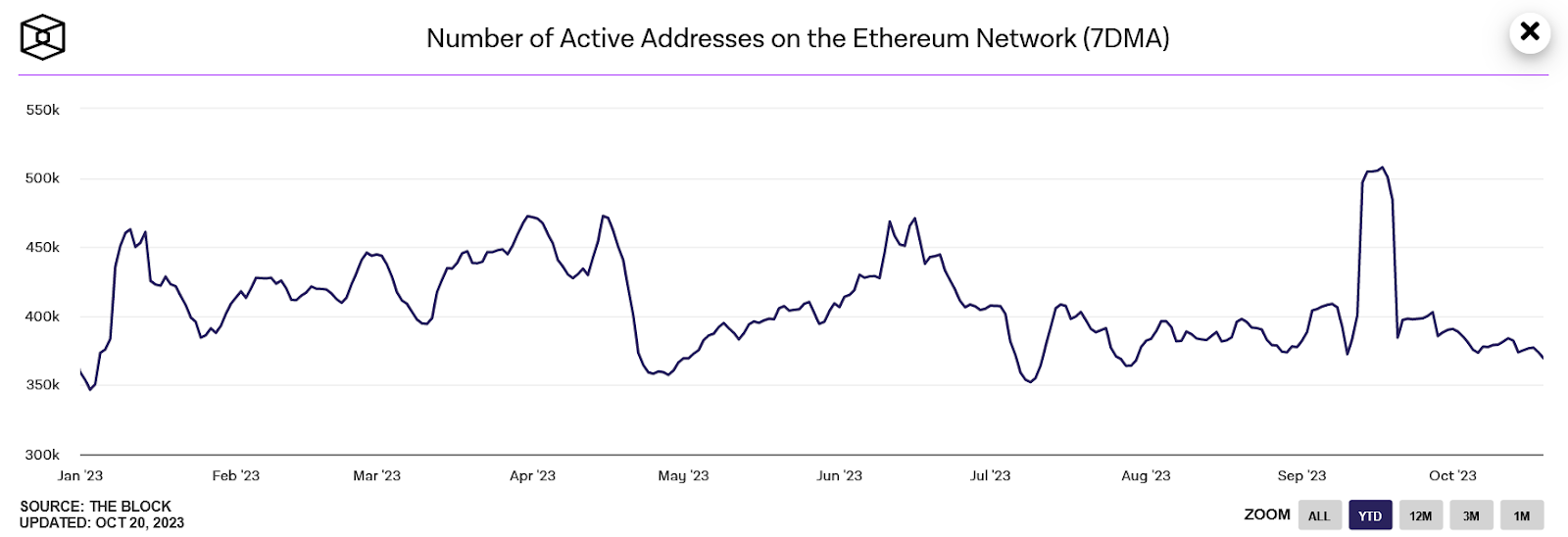

Daily active addresses

This metric denotes the number of unique addresses that actively send or receive Ethereum on a given day. In April 2023, the daily active addresses averaged 471,000, but this number dwindled to 369,000 by Oct. 20, showcasing a 21.7% drop.

Its significance lies in its ability to act as a pulse check for user engagement and network popularity. A declining trend in active addresses might imply that fewer users or entities are interacting with the Ethereum network, possibly signaling a shift of interest or a consolidation phase.

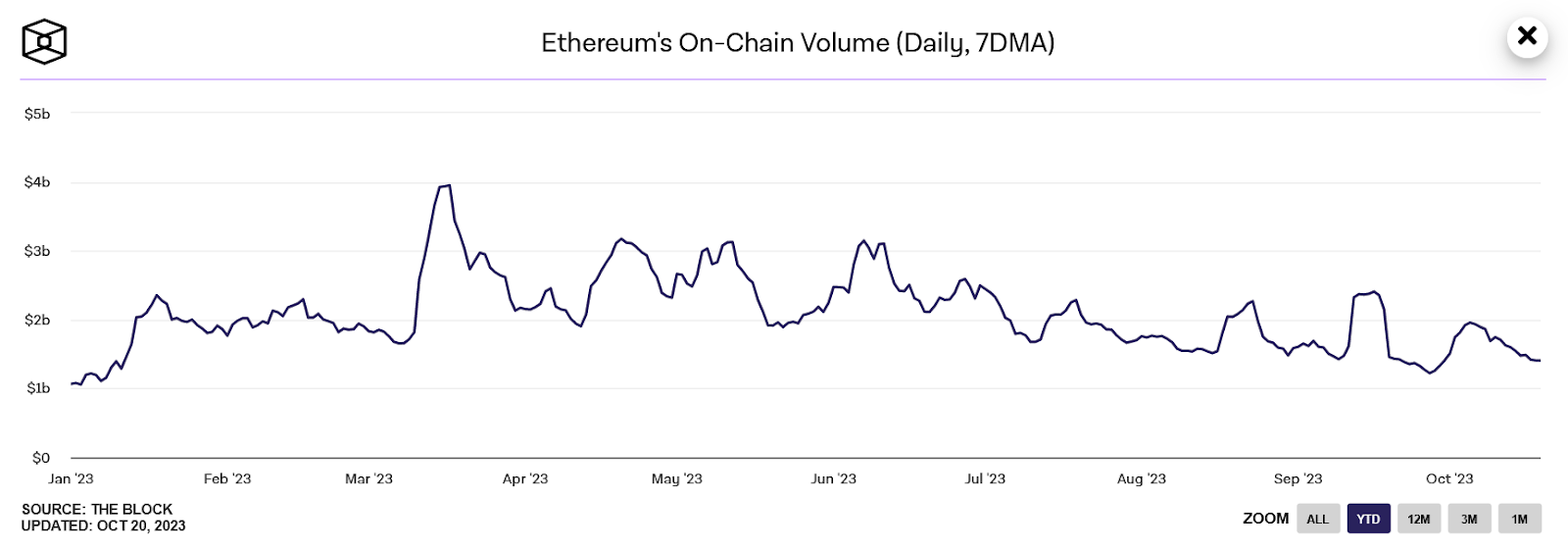

Daily onchain volume

Representing the total value (in USD) of all transactions on the Ethereum blockchain in a day, the daily onchain volume has witnessed a steady decline. From a substantial $3.92 billion in March, it shrank to $1.41 billion by Oct. 20, reflecting a 64% reduction.

This metric is crucial because it sheds light on the monetary value of assets moving within the network. A decline might suggest that fewer high-value transactions are taking place or that the value of assets on Ethereum has decreased.

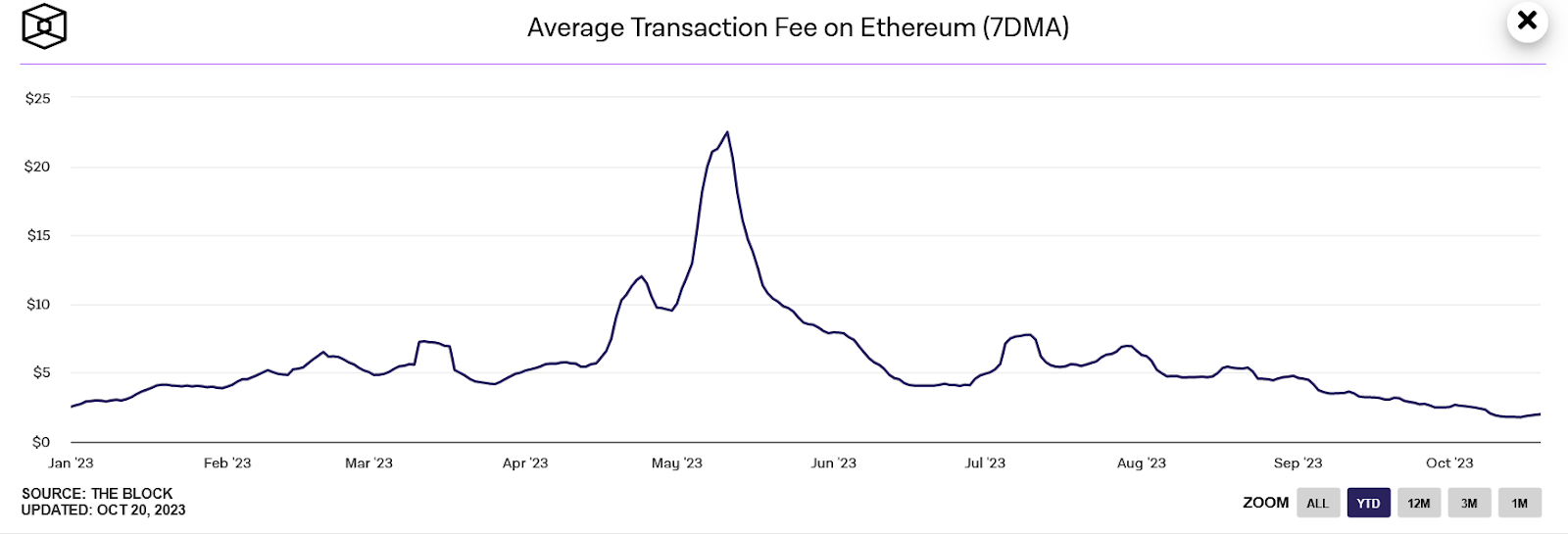

ETH transaction fee

Transaction fees are payments made by users to compensate for the computational energy required to process and validate transactions on the Ethereum network. These fees had reached a staggering annual peak of $21.89 in May but have since nosedived to a mere $1.99 by Oct. 20, indicating a 90.9% decline.

While high fees can be discouraging for users, leading to decreased network usage, the sharp decline might indicate improved network efficiency or reduced demand.

Nonetheless, it’s a double-edged sword. While it’s more cost-effective for users, it might be less profitable for miners, possibly leading to decreased network security in the long run.

Ethereum’s layer 2 evolution in 2023

In 2023, Ethereum’s layer 2 solutions (L2s) saw increased activity. As Ethereum faced various challenges, L2s emerged as an alternative solution, particularly in addressing scalability.

The TVL of Ethereum’s L2 platforms reached $10.62 billion as of Oct. 2023. Of these platforms, Arbitrum One recorded a market share of 54.76%. This TVL growth suggests a heightened activity within the L2 platforms.

Meanwhile, centralized exchanges have begun to integrate L2 solutions. Coinbase‘s introduction of layer 2 Base indicates a growing interaction between centralized platforms and L2s.

In terms of transaction activity, L2s recorded a higher transaction count than Ethereum’s mainnet during the year. This shift might be attributed to factors such as scalability issues and transaction costs on Ethereum’s mainnet.

On the financial front, Ethereum’s network revenue experienced a decline, decreasing by 33.3% from $1.27 billion in Q2 2022 to $847 million in Q2 2023. The value of ETH burned also saw a reduction of 35% over the same period. These changes align with the fluctuations observed in the broader crypto market.

Ethereum’s position in the decentralized finance sector, however, continues to be notable. The platform constitutes a considerable portion of DeFi’s TVL and is used for multiple on-chain stablecoins.

In summary, 2023 observed varied dynamics in Ethereum’s ecosystem, with L2 solutions gaining traction amid the platform’s overarching challenges.

Ethereum and the influence of spot ETFs

Meanwhile, ETFs have taken center stage recently, with their potential to impact the price and adoption of cryptocurrencies significantly.

Galaxy Digital Fund and Invesco have recently joined forces to delve into the Ethereum spot ETF market in the U.S. This makes them the fifth major player to do so, following in the footsteps of renowned entities like VanEck, ARK Invest, Hashdex, and Grayscale.

However, it’s crucial to note that the road ahead for Ethereum spot ETFs is not without hurdles. In many ways, these spot ETFs’ fate is tied to that of Bitcoin spot ETFs.

Before Ethereum can enjoy the green light for its spot ETFs, Bitcoin spot ETFs are awaiting clearance from the Securities and Exchange Commission (SEC). Essentially, Ethereum’s move is pegged to Bitcoin’s lead in this dance of financial products.

Their introduction could play a pivotal role in influencing Ethereum’s price, adoption, and mainstream acceptance in the financial market.

Ethereum price prediction

Standard Chartered’s Geoff Kendrick is optimistic about Ethereum, predicting it could surge past $8,000 and possibly reach between $26,000 and $35,000 by 2025-2026. He cites Ethereum’s growing use cases and the support from layer 2 blockchains as drivers for this growth.

Contrarily, analyst FieryTrading expects Ethereum to dip to around $900.

With such varied forecasts, traders should tread cautiously. It’s vital to remember: never invest more than you can afford to lose.

The road ahead

As we approach the end of 2023, Ethereum’s journey has been a roller coaster of highs and lows. From a peak TVL of $108 billion in 2021 to a significant dip to $20 billion this year, it reflects the volatility and uncertainty surrounding the crypto realm.

Meanwhile, Ethereum’s once-booming NFT market has also faced headwinds, with daily mintings witnessing a sharp decline.

Layer 2 solutions, like Arbitrum, have provided a silver lining, offering scalable alternatives and showing promise for Ethereum’s scalability concerns.

Ethereum’s next significant catalyst might lie in the realm of spot ETFs. With major players like Galaxy Digital Fund and Invesco entering the fray, the potential for Ethereum spot ETFs to drive price, adoption, and mainstream acceptance is palpable.

Yet, amidst optimistic forecasts of Ethereum reaching dizzying heights, caution is crucial. The crypto market remains unpredictable, and prudent decision-making remains the order of the day.