The crypto market just saw some slight recovery, but the performances are upside down. Opposite to the way sellouts usually play out, the Bitcoin dominance dropped dramatically as the asset is underperforming the Small Cap index.

From last November’s $3 trillion market cap, the crypto market is now down to around $800 billion:

Smaller Altcoins Make A Strong Comeback

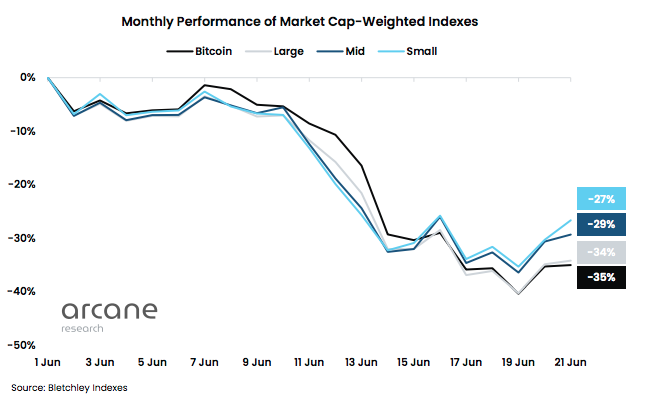

Last week the crypto market saw its bottom, followed now by some slight recovery. As per Arcane Research’s latest weekly report, the smaller altcoins have also been seeing red numbers with the Small Cap index shedding 27%, but it has been the best performer overall.

In contrast, Bitcoin had dropped 35%. Through this small window of relief during June, we have seen the blue-chip coin underperform all other indexes.

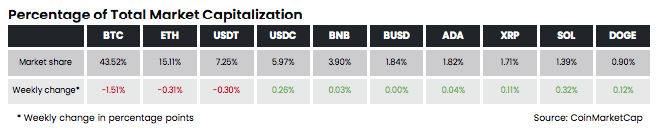

As a result, BTC’s dominance in the market fell -1,51% this week to 43,5% while Ether fell -0,31. The latter has been declining since May from 19.5% to 15%.

What’s Making This Crypto Winter Colder

The report notes that the primary driver of this crypto crash has been the hedge fund Three Arrow Capital (3AC) collapse. Having invested over $200 million in Luna Foundation Guard’s token sale, 3AC’s liquidity ended up being wiped out and its margin call was the last straw for the already pressured market.

Related Reading | How Long Will The CryptoWinter Last? Cardano Founder Provides Answers

As per the Wall Street Journal, the crypto hedge fund hired legal and financial advisers to help work out a solution for its investors and lenders. The firm is looking for a way out, “including asset sales and a rescue by another firm”. The prognostic is not very positive at the moment, seeing the wave of liquidations and mitigations of losses by crypto exchanges that have followed the collapse.

“We were not the first to get hit…This has been all part of the same contagion that has affected many other firms,” Kyle Davies, 3AC’s co-founder, said in an interview.

Arcane Research explained that “In periods of insolvency, creditors unwind the most liquid assets first, which is likely the root cause of BTC and ETH’s relative underperformance in the last week.”

The report adds that “illiquid altcoins are more challenging to sell at size, particularly during pressuring times, which explains why smaller coins have experienced less excessive selling pressure in the last week”.

Meanwhile, Microstrategy CEO Michael Saylor described the events around this winter as a “parade of horribles” in which the consequences of lack of regulation in the crypto field have made it possible for wash trading and cross-collateralized altcoins to weigh down on Bitcoin.

“What you have is a $400 billion cloud of opaque, unregistered securities trading without full and fair disclosure, and they are all cross-collateralized with Bitcoin.”

“The general public shouldn’t be buying unregistered securities from wildcat bankers that may or may not be there next Thursday,” Saylor added, slamming at the recent collapses and suggesting that future actions by regulators could prevent the level of volatility that BTC is now experiencing.

Related Reading | Crypto Investors Find Safety In Stablecoins, Bitcoin, Ditch Altcoins En Masse