As Bitcoin’s value overtakes major currencies by 99.5%, is this the start of a new era where digital currencies challenge traditional financial systems?

The global economy has faced severe challenges in recent years, including rampant inflation and slowing growth rates since the post-pandemic era.

In the U.S., recent reports indicate a slower-than-expected GDP growth of 1.6% in Q1, missing forecasts of 2.5% growth and falling well below the 3.4% recorded in Q4.

Simultaneously, the core PCE (personal consumption expenditures) price index—an essential gauge of inflation for the Federal Reserve—has risen by 3.7% annually in Q1, overshooting expectations set at 3.4%.

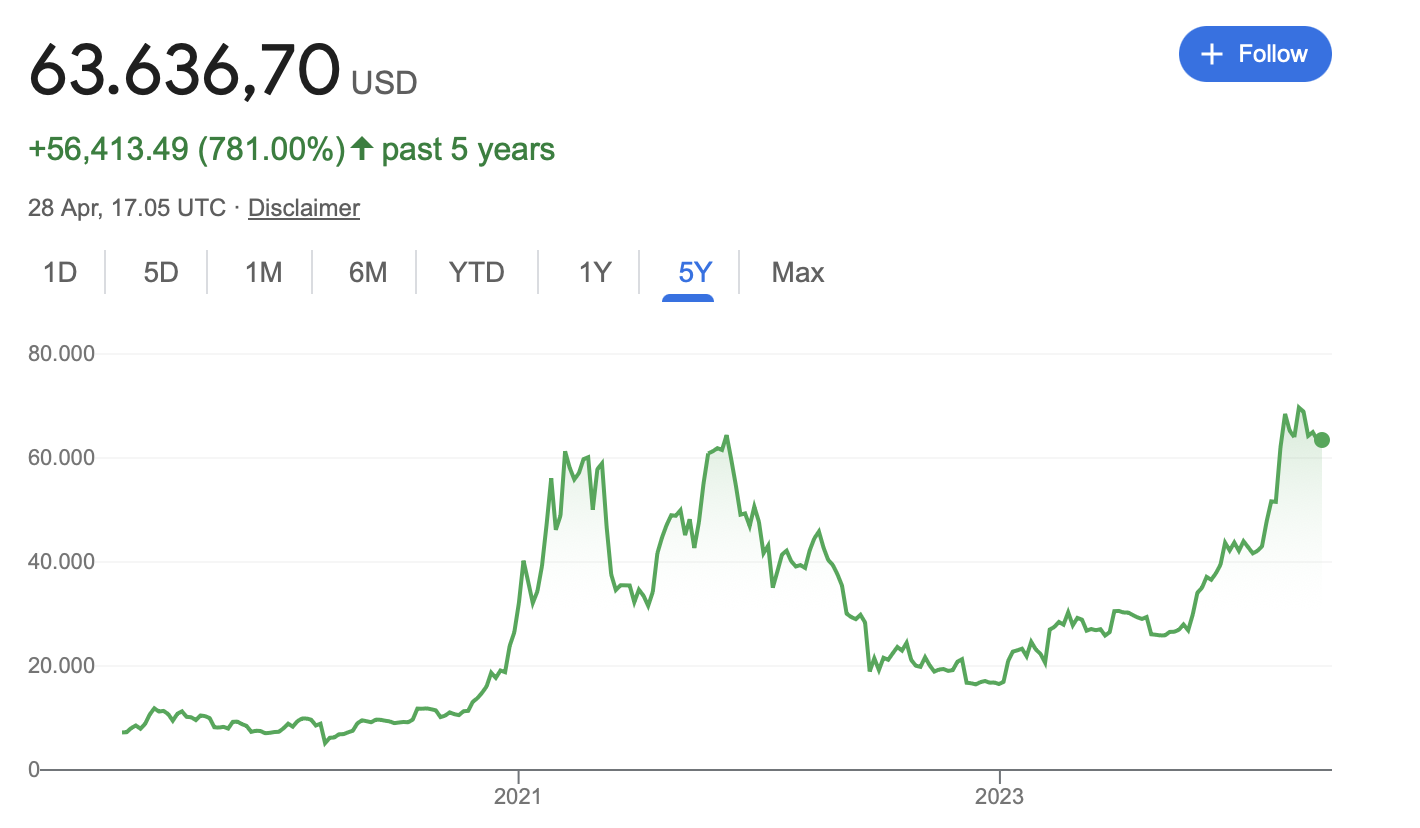

Against this backdrop, Bitcoin (BTC) has experienced wild swings in recent weeks, trading at around $62,000 as of April 29.

With its decentralized nature, BTC has garnered both praise and criticism regarding its potential as a store of value. Proponents argue that Bitcoin offers a hedge against inflation and economic uncertainty, while critics point to its price volatility and regulatory concerns as prominent risks.

Given this context, let’s explore Bitcoin’s performance against major global currencies since its inception to determine whether it has truly served as a reliable store of value.

The declining purchasing power of the U.S. dollar against Bitcoin

The U.S. dollar, historically regarded as the backbone of the global economy, has experienced a notable decline in its purchasing power relative to Bitcoin since the latter’s inception.

Once commanding considerable value, the dollar now equates to a modest 0.000016 BTC as of April 29, indicating a 99.5% decrease in value against Bitcoin.

This disparity becomes even more evident when considering Bitcoin’s impressive appreciation of nearly 800% against the dollar in just the past five years.

Traditionally, the dollar’s strength has been rooted in its role as the world’s primary reserve currency since the Bretton Woods Agreement in 1944.

USD’s dominance in global oil transactions and the reliable backing of the American economy have further bolstered its position. However, these strengths are counterbalanced by inherent weaknesses stemming from its status as a fiat currency.

Unlike Bitcoin, which boasts a capped supply ensuring scarcity and, theoretically, value retention, the U.S. dollar is susceptible to inflation and devaluation due to overproduction—a challenge that has historically plagued fiat currencies.

Recent trends in U.S. economic policy have further highlighted these vulnerabilities.

High inflation and rising national debt have raised concerns about potential monetary crises, where escalating consumer prices might compel the Federal Reserve to increase interest rates dramatically.

Such scenarios could endanger the dollar’s stability, as higher interest rates would amplify the government’s debt servicing costs, potentially eroding confidence among foreign creditors.

In contrast, Bitcoin’s design inherently avoids such pitfalls. Its decentralized nature and fixed supply cap offer an alternative to traditional monetary systems, where the risk of government-induced inflation looms large.

BTC vs. other reserve currencies

To accurately assess Bitcoin’s role as a store of value, it’s crucial to analyze its performance against major global currencies, including the Special Drawing Rights (SDR).

Established by the International Monetary Fund (IMF) in 1969, the SDR serves as an international reserve asset, representing a potential claim on the freely usable currencies of IMF members.

Initially linked to gold and the US dollar, the SDR evolved in 1973 into a composite of five major currencies: the U.S. dollar, euro, Chinese renminbi, Japanese yen, and British pound sterling. Its primary function is to serve as a unit of account for the IMF and other global entities.

Now, let’s explore how major global currencies have fared against Bitcoin.

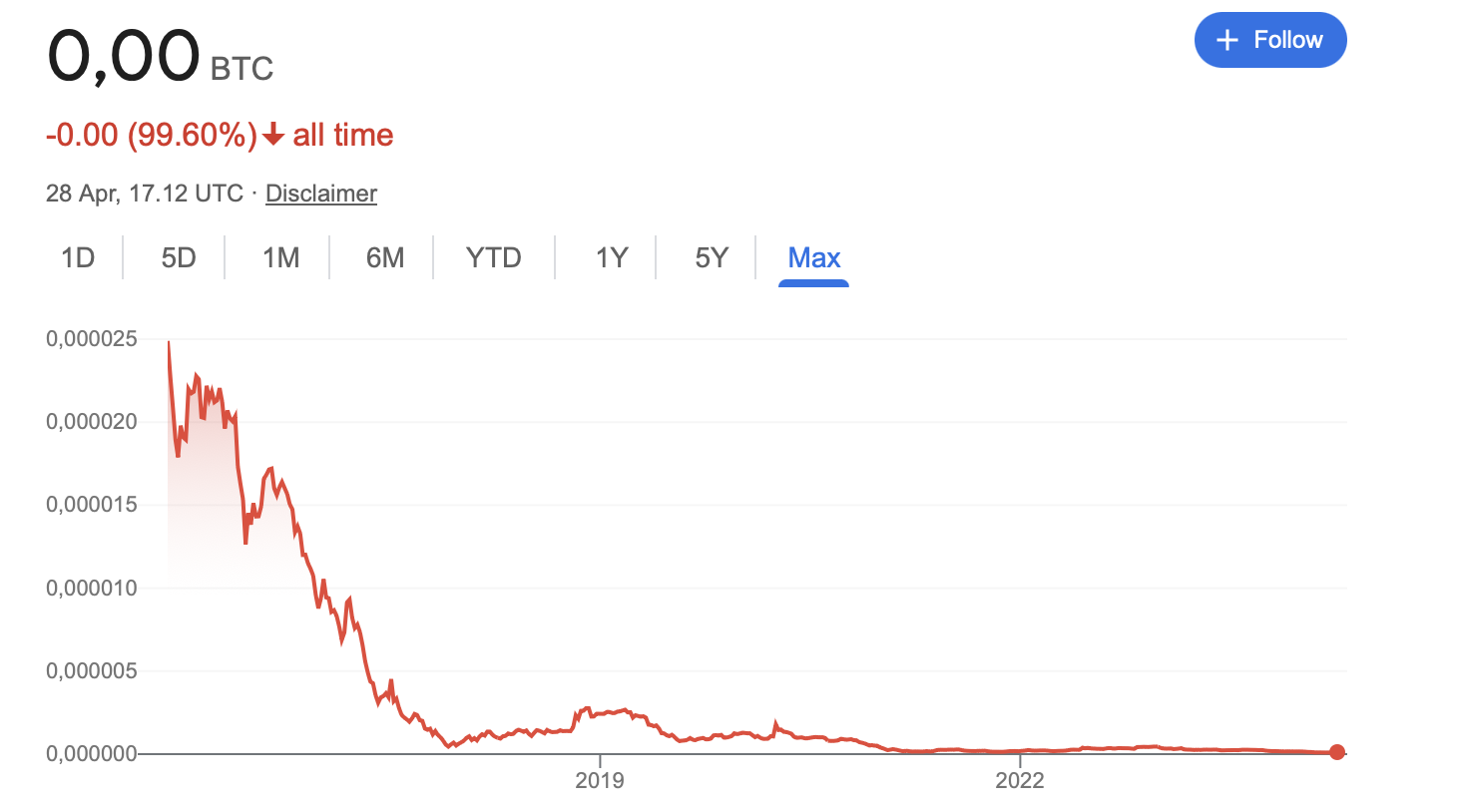

The euro, a key player in the global economy after the U.S. dollar, has seen a notable decline in value relative to Bitcoin. As of April 29, the euro is valued at approximately 0.000017 BTC, indicating a depreciation of 99.49% since Bitcoin’s inception.

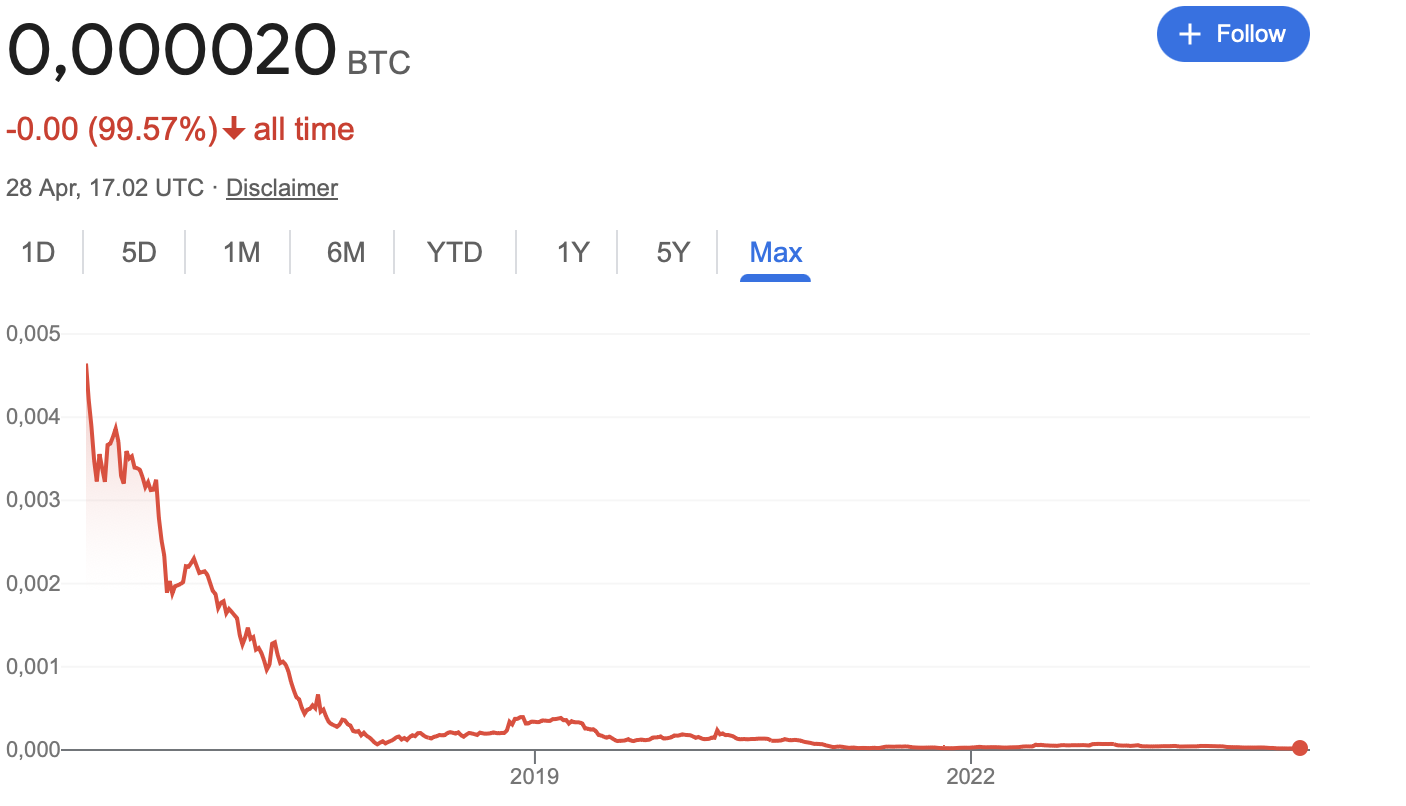

Similarly, the British Pound has depreciated by about 99.57% against Bitcoin, amounting to roughly 0.000020 BTC per GBP.

Despite China’s stringent regulations on crypto usage, the Yuan has depreciated by 99.55% against Bitcoin, now valued at 0.000021 BTC.

Meanwhile, the Japanese yen has experienced a depreciation of over 99.6% against BTC, recently hitting a 34-year low amid Japan’s ongoing struggles with hyperinflation and low-interest rates compared to the U.S. As of April 29, Google Finance shows that one Japanese yen equals zero BTC.

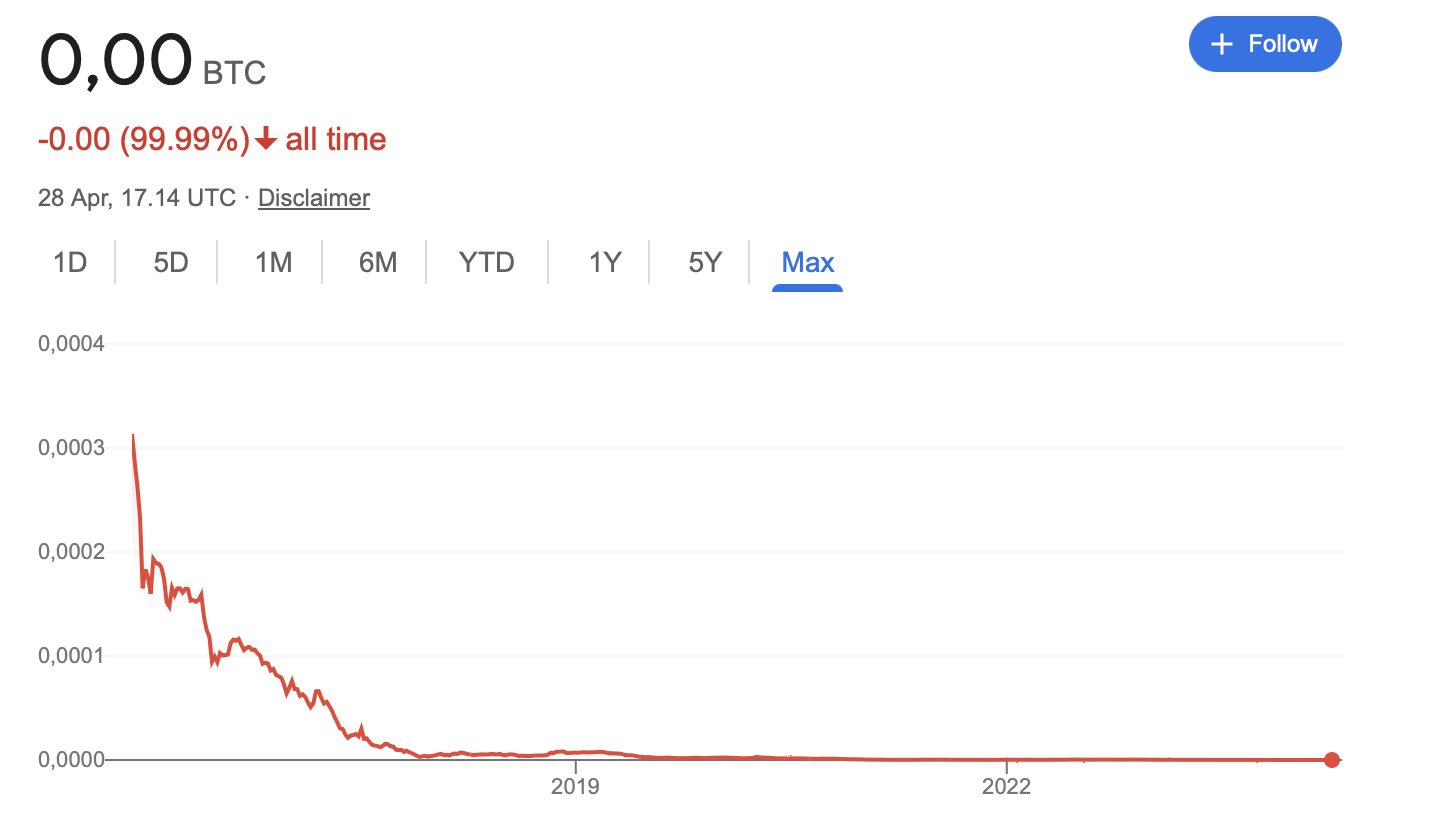

An even more drastic situation unfolds with the Argentine peso, which has nearly eroded in value against Bitcoin by over 99.99%.

This sharp decline aligns with Argentina’s battle against a 211.4% inflation rate in 2023, reaching a 34-year high.

Could BTC become the next store of value?

To assess Bitcoin’s potential as a trusted store of value, we must consider historical examples of how reserve currencies evolved and the factors that drove their adoption.

Reserve currencies gained prominence due to economic stability, geopolitical power, and institutional trust.

The British pound, sterling, and later the U.S. dollar rose to prominence during periods of economic dominance and geopolitical influence.

For instance, by 1920, the pound sterling accounted for 57% of global trade settlement (less than 5% by 2020). Similarly, after World War II, the U.S. dollar became the primary reserve currency (59% as of 2020), supported by the strength of the American economy and the Bretton Woods Agreement.

However, these currencies faced challenges, such as inflationary pressures and geopolitical shifts, leading to transitions in global reserve currencies over time.

Bitcoin encounters hurdles in these areas. Despite its remarkable growth, with an average annualized return of over 671%, its volatile price swings raise concerns about its stability as a reliable store of value.

While Bitcoin’s decentralized nature offers resilience against government interference, it also presents regulatory, security, and adoption challenges.

Concerns about security breaches and illicit activities further undermine trust in crypto among mainstream investors.

Hence, only time will reveal whether Bitcoin can address these concerns and earn widespread trust as a store of value.