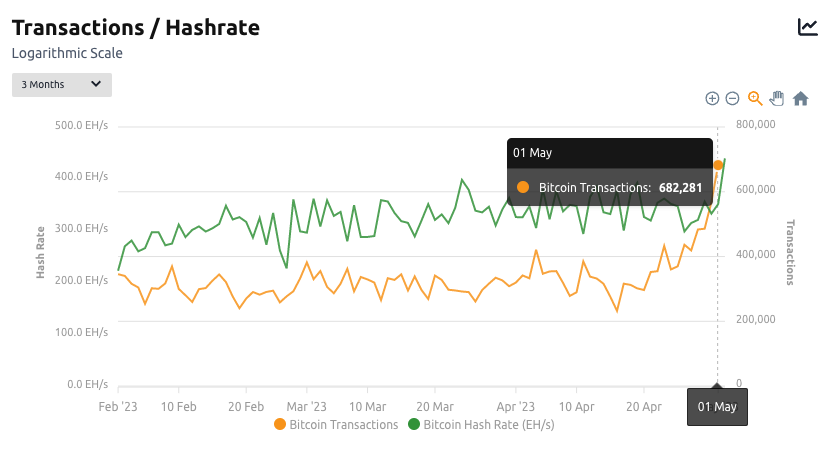

A lot of Bitcoin (BTC) miners just came online. The Bitcoin hash rate, or the total computing power of the Bitcoin blockchain, just soared to 439 exahash per second (EH/s). Moreover, the number of transactions the Bitcoin blockchain processed in one day exceeded 682,000, as over 300,000 Ordinals were inscribed on the Bitcoin blockchain.

These milestones demonstrate the network’s strength and stability, as well as the increasing adoption of Bitcoin for various use cases, all while the banking sector in the United States fractures.

The Bitcoin hash rate, a measure of the computational power dedicated to securing the blockchain, has reached an all-time high, signifying increased confidence in the network’s security. The hash rate is a crucial indicator of the network’s health, as a higher hash rate means more miners are participating, thus making the network more resistant to attacks.

The surge in hash rate reflects growing investments in mining infrastructure despite fluctuations in the price of Bitcoin. More and more territories and regions around the world are mining Bitcoin, with increasing amounts of renewable energy, allaying fears of centralization or environmental impacts that have shrouded Bitcoin mining in the past.

However, as Denver Bitcoin, a well-known Bitcoin miner with Upstream Data Inc, points out, the hash rate surge may be short-lived. It’s important to “Watch 1500-block to 5k-block avg time to get an understanding of true hashrate,” he shared in a tweet:

Sometimes 20-100 blocks get found in quick succession, “current hashrate” readout on websites will show crazy number like 450Eh/s.

Always watch 1500-block to 5k-block avg time to get an understanding of true hashrate.All based on blocktimes there’s no query of “total hashrate.” pic.twitter.com/ijgNsrwzIX

— Adam O (@denverbitcoin) May 2, 2023

The hash rate may be temporarily surging–partly driven by a resurgence in the popularity of Bitcoin ordinal inscriptions. Bitcoin ordinals are unique, non-fungible tokens (NFTs) built on the Bitcoin network, each representing a distinct position in the Bitcoin blockchain. Each ordinal is “inscribed” on a Satoshi (the smallest denomination of a Bitcoin), and owners can prove digital ownership of their Sat.

Ordinals have gained traction among collectors, investors, and enthusiasts, offering a new way to engage with the Bitcoin ecosystem. Bitcoin ordinals fan Dan Held, for example, shares that altcoin advocates engage with Bitcoin for the first time due to their creation.

The number of inscriptions in a 24-hour period exceeded 350,000 on May 1, as the total number of ordinals exceeded 3 million. Given that each ordinal inscription also counts as a transaction, the number of Bitcoin transactions has also soared.

As more people buy, sell, and trade Bitcoin ordinals, the number of daily transactions on the network has significantly increased to 682,000. The mempool, or the “waiting area” for incoming transactions before they are confirmed, is currently very busy. The cheapest transaction fee sits at 8 sat/vB, or about $0.30–way above its lows of 1 sat/vB. If users are looking to send money to wallets on the Bitcoin base chain, the costs are significantly higher than usual due to the surging number of ordinal inscriptions.

Related: Bitcoin Ordinals community debates fix after inscription validation bug

For some, Bitcoin ordinals offer another role for the network that goes above its activities as a store of value and medium of exchange. For others, such as Dr. Adam Back, number 76 on Cointelegraph’s Top 100, ordinals are useless.

Cointelegraph Magazine: Bitcoin in Senegal: Why is this African country using BTC?