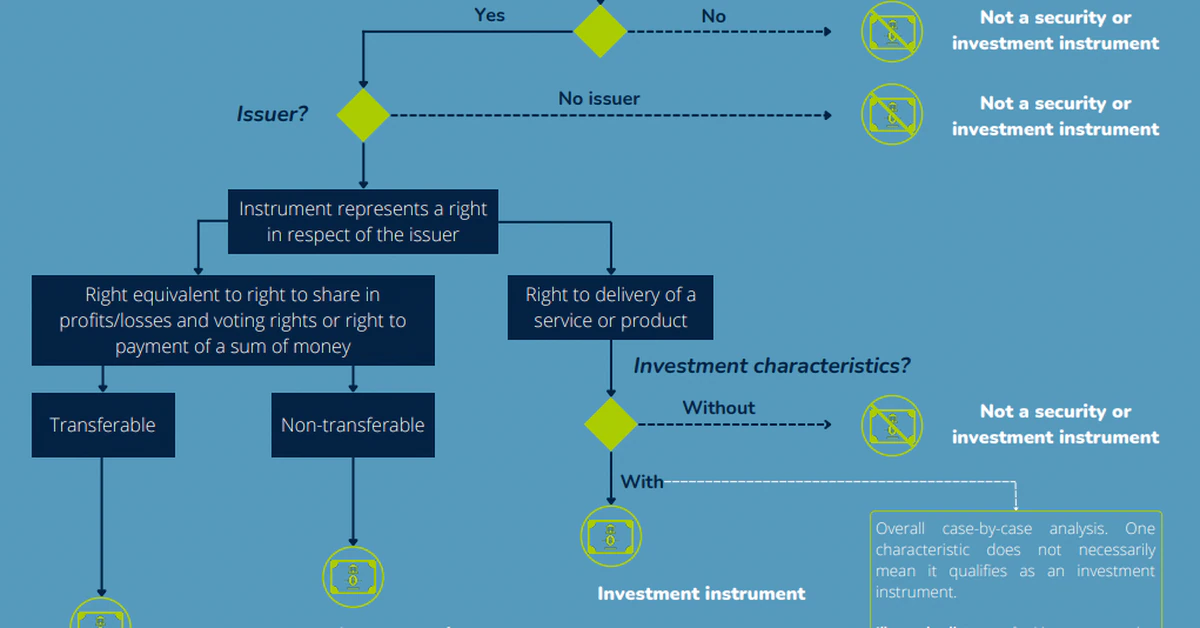

“While awaiting a harmonized European approach, the FSMA wishes to provide clarity about when crypto-assets may be considered to be securities, investment instruments or financial instruments and may therefore fall within the scope of the prospectus legislation and/or the MiFID conduct of business rules,” said the regulator.

Belgium Regulator Ponders Crypto as a Security