Key points:

-

Bitcoin investors are making the most of the highest price levels in several months by cashing out profits.

-

These are averaging $1 billion per day, leading to concerns that the market comeback may stall or even reverse.

-

Institutional participation has not led to a change in mindset, CryptoQuant says.

Bitcoin (BTC) risks a “local top or sharp correction” if current levels of profit-taking continue, new research warns.

In a “Quicktake” blog post on May 8, onchain analytics platform CryptoQuant flagged elevated realized profits among BTC investors.

BTC profit-taking spikes to January highs

Bitcoin realized profits have spiked to multimonth highs this week as BTC/USD reached close to $98,000.

For CryptoQuant, the market is becoming comparable to late 2024, when the pair broke through old all-time highs and hit $100,000 for the first time.

“Even after positive price action after March-April drop in 2025, profit taking is still aggressive. Maybe not like November-December 2024 but still high,” contributor Kripto Mevsimi wrote.

“This is historically consistent with late-stage bull market behavior — where profit-taking dominates, even as price continues to rise.”

CryptoQuant data puts the current 7-day moving average realized profit across the hodler spectrum at approximately $1 billion per day.

“If we look back at similar cycles (e.g. 2021), this phase often preceded a local top or sharp correction, especially when profit-taking stayed high and continuous,” it continued.

No hiding from Bitcoin “investor psychology”

As Cointelegraph reported, some market commentators have argued that the Bitcoin investment landscape has fundamentally changed thanks to increased institutional participation.

Related: Bitcoin pushes for $98K as 2025 Fed rate cut odds flip ‘pessimistic’

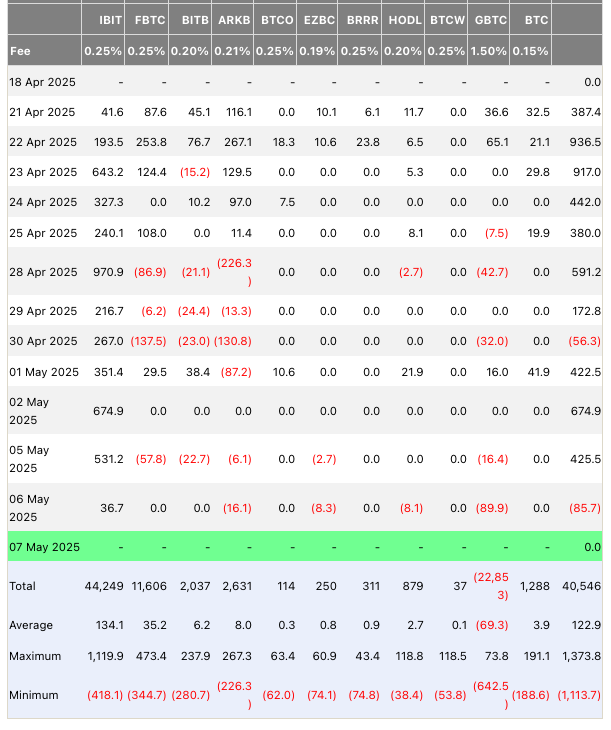

Chief among the new players are the US spot Bitcoin exchange-traded funds (ETFs), the largest of which, BlackRock’s iShares Bitcoin Trust (IBIT), has seen net inflows every day for more than two weeks.

Despite this, Kripto Mevsimi contends that underlying reactions to BTC price changes remain the same.

“Since spot ETFs launched in January 2024, market structure has changed — but investor psychology hasn’t,” he summarized.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.