On-chain data shows the Bitcoin 30-day long-term holder SOPR hasn’t yet reached the historical bottom level during the current cycle.

Bitcoin 30-Day Long-Term Holder SOPR Has Declined Recently

As pointed out by an analyst in a CryptoQuant post, the long-term holders haven’t attained their maximum pressure point yet.

The “Spent Output Profit Ratio” (or SOPR in short) is an indicator tells us whether the average Bitcoin investor is selling at a profit or at a loss right now.

When the value of this metric is less than 1, it means the overall market is realizing some amount of profit currently.

On the other hand, the indicator having values than the threshold suggests that investors as a whole are moving coins at a loss at the moment.

“Long-term holders” (LTHs) are a cohort of Bitcoin investors who hold their coins for at least 155 days before selling or moving them.

Here is a chart that shows the trend in the 30-day moving average BTC SOPR over the last several years specifically for these LTHs:

The 30-day MA value of the metric seems to have been going down in recent days | Source: CryptoQuant

As you can see in the above graph, the 30-day MA Bitcoin LTH SOPR seems to have hit a specific level around the price bottom in each of the previous two cycles.

These touches of the level in the loss region didn’t exactly coincide with the cycle lows, but they were still quite close, making them good buying opportunities for the crypto.

In recent months, as the bear has taken over, the indicator’s value has declined below the 1 mark, implying the LTHs have been selling at a loss recently.

While the metric has declined deep into the red zone by this point, it’s still not at the level where the historical cycles observed their bottoms.

Though, as the chart shows in the bottom, the DPO (an indicator that’s popularly used for finding cycle tops and bottoms of any quantity) of the LTH SOPR has started turning back up recently.

In the past bear markets, the LTH SOPR reached the bottom level not too long after the DPO reversed trend like this. If a similar pattern follows now as well, it may not be too long until long-term holder loss selling reaches its maximum point.

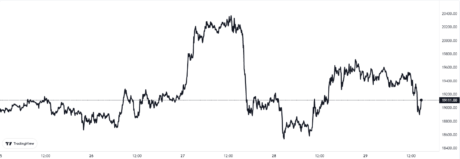

BTC Price

At the time of writing, Bitcoin’s price floats around $19.2k, up 1% in the past week.

Looks like BTC has been moving sideways again during the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com