Glassnode’s latest on-chain metrics show the number of bitcoin wallets holding over 1 BTC has hit a new all-time high (ATH), indicating investor optimism in the crypto markets.

The court decision that XRP is not a security has brought about positive reactions from market participants, as it challenges the Securities and Exchange Commission’s (SEC) stance on token classification.

Ripple CEO Brad Garlinghouse has praised the ruling, asserting that it will likely positively affect other digital tokens operating in the United States. This legal victory has triggered a surge in altcoin prices.

XRP has experienced a short-term price decline after a dramatic surge. It is currently valued at $0.7285. XRP’s price surged by 54.02% during the past week. With 53 billion XRP in circulation, the digital asset’s market cap is $38.2 billion.

The RSI value on the weekly timeframe is 83.84, signaling a strong bullish sentiment. Critical support lies at $0.57, while a decisive close above the resistance zone between $0.95 and $1 could pave the way for further gains.

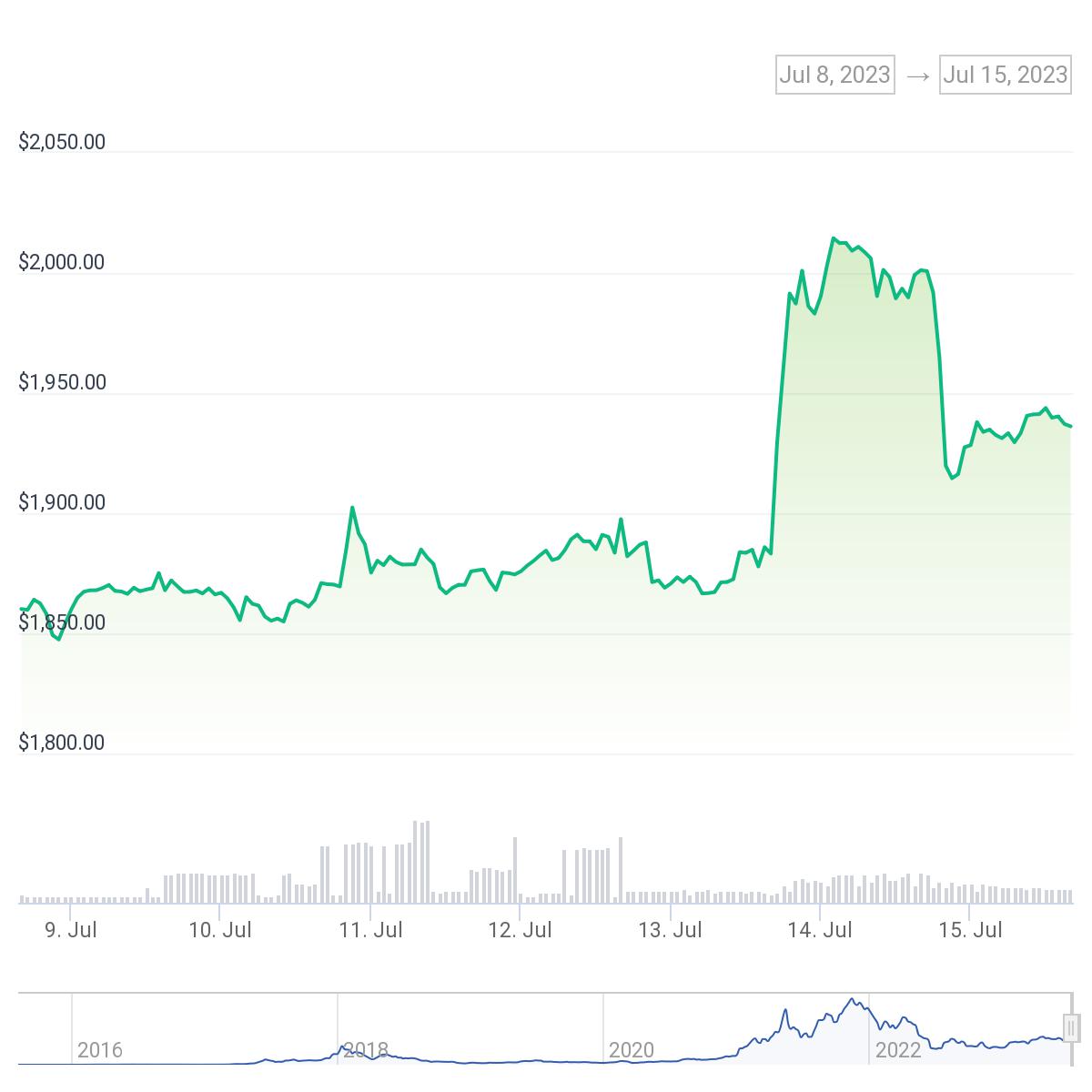

Ethereum holds strong

Ethereum (ETH) has encountered a minor pullback, with its price falling to $1,937. ETH has witnessed a 4.12% price increase over the past week, bringing investor confidence.

With a market cap of $232.8 billion and 120 million coins in circulation, Ethereum continues solidifying its market position.

The RSI on the weekly time frame reads 60.26, indicating a positive trend. ETH faces resistance at the $2,000 level, but a possible breakout from that level could push the price to $2,100 and $2,200.

Glassnode’s data reveals key insights

Accompanying Ripple’s triumph, on-chain analytics firm Glassnode has released new data. According to its metric, bitcoin continues to display robust fundamentals. The number of addresses holding 1+ BTC has surged to an all-time high of 1,009,670, surpassing the previous ATH set on July 14.

Furthermore, the amount of hodled or lost BTC has reached a 5-year peak of 7,775,675.766 BTC, reflecting growing confidence among investors holding onto their coins for the long term.

Ethereum, on the other hand, indicates positive sentiment as the amount of supply last active between one year to two years ago has hit a 1-month low of 19,992,944.430 ETH, suggesting reduced selling pressure and potential price support.

These data show optimism in the crypto markets, as both bitcoin and ethereum demonstrate favorable on-chain metrics.

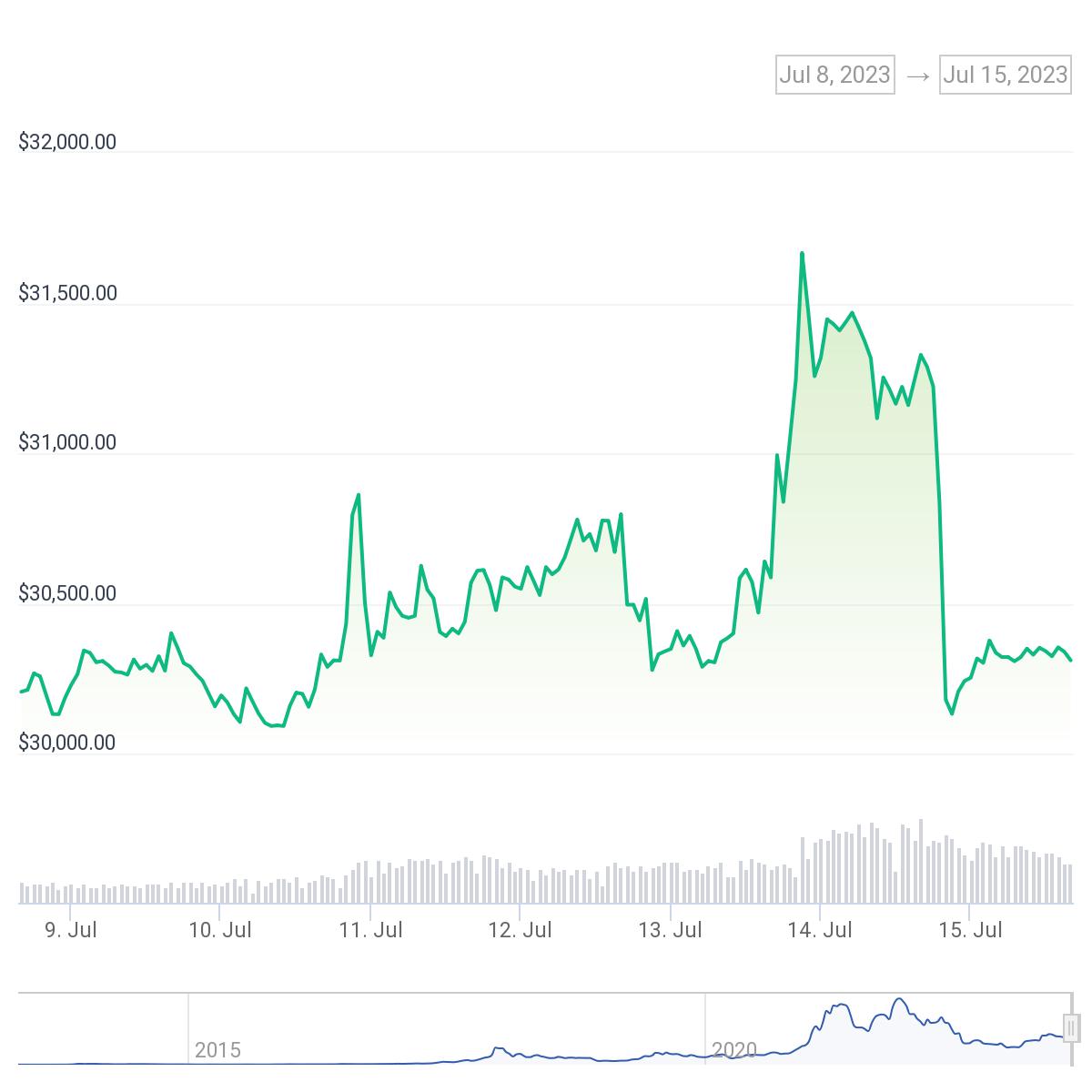

Bitcoin price analysis

Following Ripple’s triumph, the price of BTC rose above $31,800 before experiencing a slight pullback to $30,349.

At the time of writing, bitcoin has witnessed a slight correction. However, with a market cap of $589.6 billion and a circulating supply of 19 million BTC, the king of cryptocurrencies remains a dominant force.

The RSI on the weekly time frame indicates a score of 66.34, indicating a promising outlook.

Key support lies at $30,000, and a close below this level could lead to a potential price decline to $26,000. On the other hand, breaking the resistance between $31,000 and $31,500 could open the door for further advancements toward $40,000.