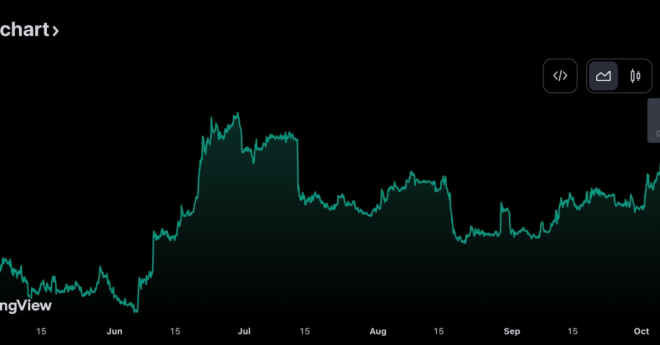

The Bitcoin market dominance rate, which tracks the largest cryptocurrency’s share of the total digital asset market, rose to 51.2% on Tuesday, near a 26-month high of 52% reached at the end of June. The world’s largest cryptocurrency has gained 66% year to date, compared with the second largest cryptocurrency by market value, ether, which has gained 32%. According to LMAX Digital, ether’s underperformance against bitcoin is due to ether’s recent “healthy increase” in ether supply over the past month. LMAX also notes that “decreased transaction activity on Ethereum means less ether being burned, which has translated to an increase in the overall supply,” as a contributing factor to ether’s underperformance.

Bitcoin (BTC) Dominance Continues to Climb