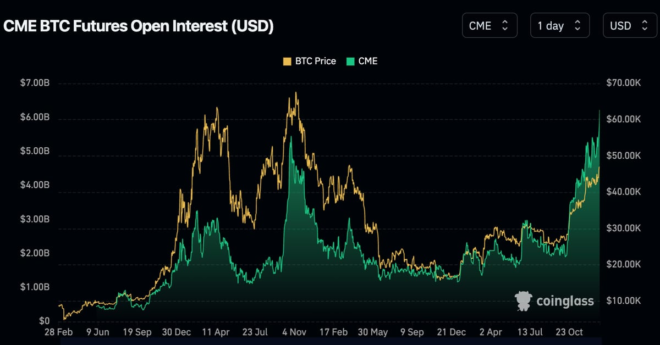

The other 57% of the contracts are held by active market participants, the report follows, whose exposure increased by 128% – to around 75,000 BTC from 33,000 – over the past three months. Holding these positions open is very expensive at the current premium, K33 noted, forecasting that some investors will seek to realize profits after the bitcoin ETF approval.

Bitcoin (BTC) Futures on CME Will Face Sell Pressure If Spot Bitcoin ETF Gets Approved: K33