Chicago Mercantile Exchange (CME) plans to offer spot bitcoin trading in response to demand from clients, according to the Financial Times. Already the top bitcoin futures exchange, CME is aiming to take on the likes of Binance and Coinbase, who dominate the spot market. “Crypto exchanges might lose some business with the potential debut of a bitcoin spot market on the CME, a global derivatives giant, as the present bull run is particularly driven by institutions, who prefer to trade on regulated avenues,” Markus Thielen, founder of 10x Research, said. The spot trading business could be run through the EBC currency trading venue in Switzerland, the report added.

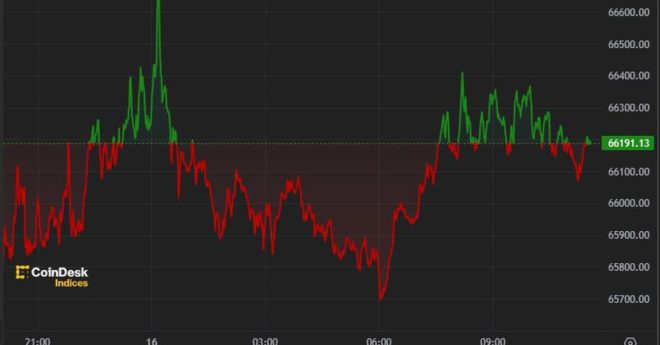

Bitcoin (BTC) Price Tops $66K as Interest-Rate Cuts Loom