For instance, in the ETF case, an issuer, with the help of the authorized participant, will pool the cryptocurrency and move it to custody, where it sits idle (inactive). However, investors will still take bullish/bearish trades on an exchange through the ETF units.

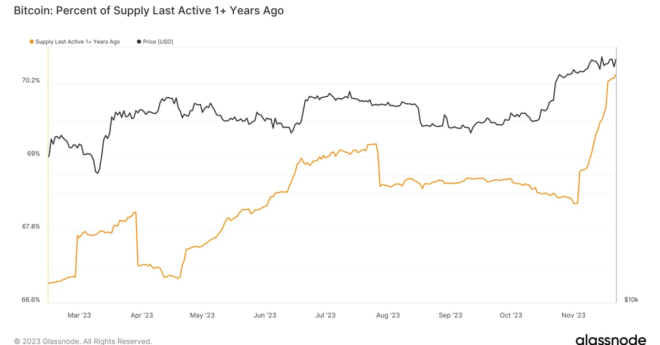

Bitcoin (BTC) Supply Inactive For a Year Hits Record High of 70%