Bitcoin (BTC) targeted new month-to-date lows at the July 18 Wall Street open as bulls refused to give up on $30,000 support.

BTC price: Heavy resistance risks weekly downtrend

Data from Cointelegraph Markets Pro and TradingView showed BTC price action dropping after a modest rebound from $29,675 — its worst level in July so far.

Little sign of upward momentum and a waning relative strength index (RSI) offered little hope for those seeking a return to range highs.

Traders continued to offer downside targets extending to $27,000, while longer timeframes now also looked increasingly fragile.

“After upside wicking beyond the ~$30600 resistance, BTC has finally been rejected to the point of losing the Higher Low,” trader and analyst Rekt Capital commented about the 1-week chart.

“Weekly Close below the Higher Low will confirm this loss and as long as this HL acts as resistance…. ~$29300 could be next.”

Others were keen to look beyond the current retracement, eyeing the potential for the 2023 uptrend to return.

#Bitcoin Gearing up for its next big move!

Smoothed Heikin Ashi candles flipped green on the 3 weekly timeframe.

Probably nothing. pic.twitter.com/3P5DFpRTKd

— Titan of Crypto (@Washigorira) July 18, 2023

Looking for something like this on Bitcoin. Hope everyone has a good start to their week. pic.twitter.com/ETdnUoxTnt

— TraderKoz (@TraderKoz) July 18, 2023

“While Bitcoin consolidates below resistance, the RSI is almost fully reset. Find some bid here at support, and we can go for another test of the major resistance level,” popular trader Jelle added in part of the day’s social media analysis.

The RSI “reset” took the daily metric to levels last seen in mid-June, when BTC/USD still traded at around $26,000.

Bitcoin range lows in line for a “sweep”

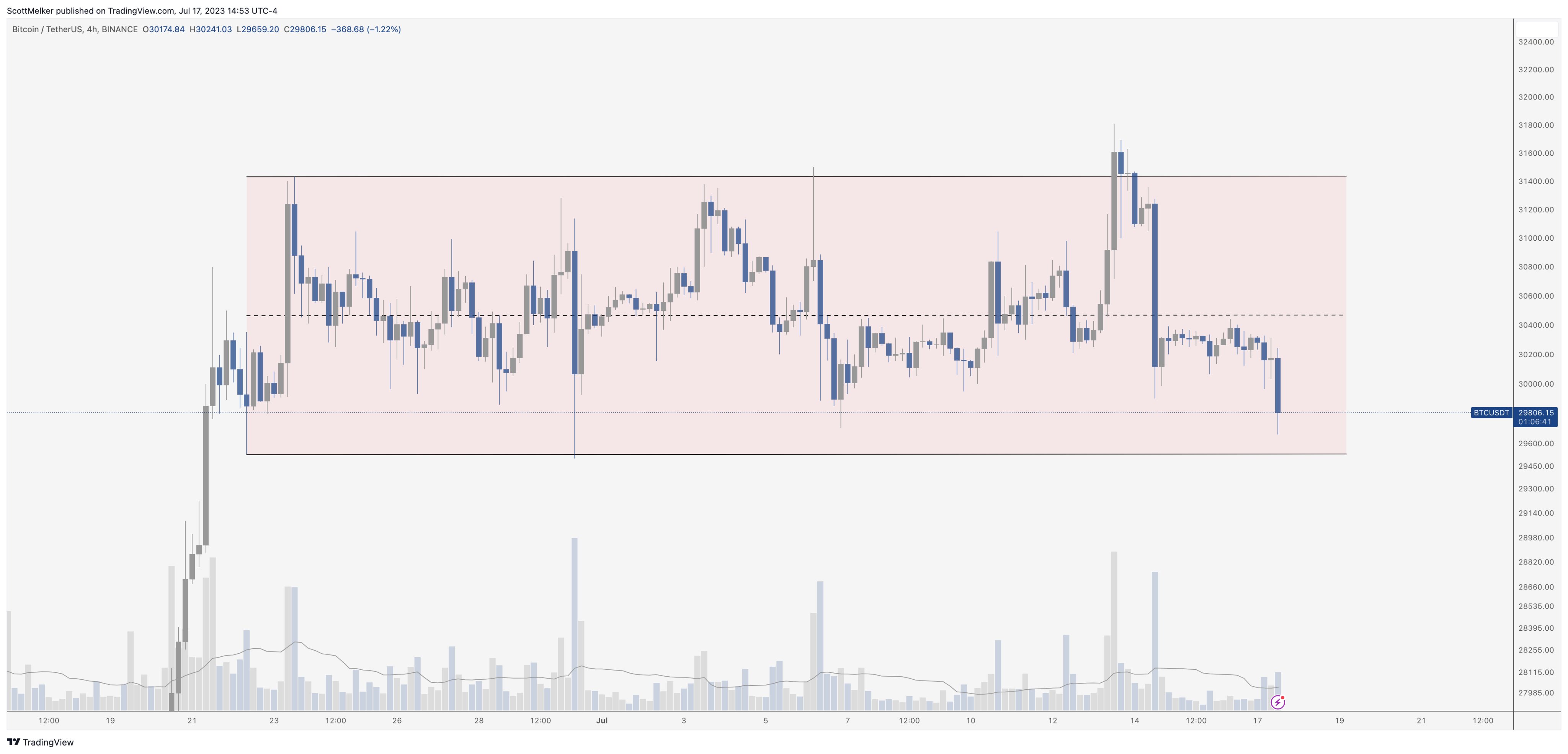

Continuing on the RSI theme, Scott Melker, the popular trader and podcast host known as “The Wolf of All Streets,” saw $28,600 as a likely comedown target.

Related: Bitcoin price is ‘stuck’ at $30K — Here are 3 reasons why

“The daily chart showed a massive overbought bearish divergence, my favorite top signal,” he said in part of a Twitter thread on July 17.

“This built up for multiple divergences and has not been invalidated. Usually this pushed RSI back to oversold. Half way there so far.”

Melker added that “at the very least” a rematch with Bitcoin’s range lows should occur, but was uncertain as to whether this would be sufficient for a local floor.

“My bias is still for a test of $28,600 as support, which was the low of the entire bull run of 2021, basically. My last buy was a similar test of $25,212, which took patience,” he concluded.

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.