Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Josh Olszewicz expects Bitcoin to endure a grinding, probabilistic market over the next six weeks before conditions improve into the fourth quarter, warning that September seasonality, softening momentum signals, and mixed ETF flow dynamics argue for patience rather than leverage. “The TL;DW is probably chopped and bearish near-term, bullish Q4,” he said in an August 18 video, adding that the path to a cleaner upside impulse is explicitly conditional on a handful of technical and flow triggers rather than a single catalyst.

The Battle Lines Are Drawn For Bitcoin

Olszewicz anchors the near-term roadmap in flows and seasonality. He wants “just nothing—just flatline on [ETF] flows for the next couple weeks and then four weeks of even worse,” arguing that a reset would “set us up for Q4.” While he noted, “We did have $550 million in a week, which is pretty good for any ETF… still a solid number… not zero,” he contrasted that with earlier, much larger weekly tallies and observed that corporate treasury buying—“still a lot of sellers obviously if price hasn’t gone anywhere”—has slowed from peak pace. The implication is not overt bearishness, but “time, not price”: either sharp pullbacks in names that ran or “dead sideways for six weeks.”

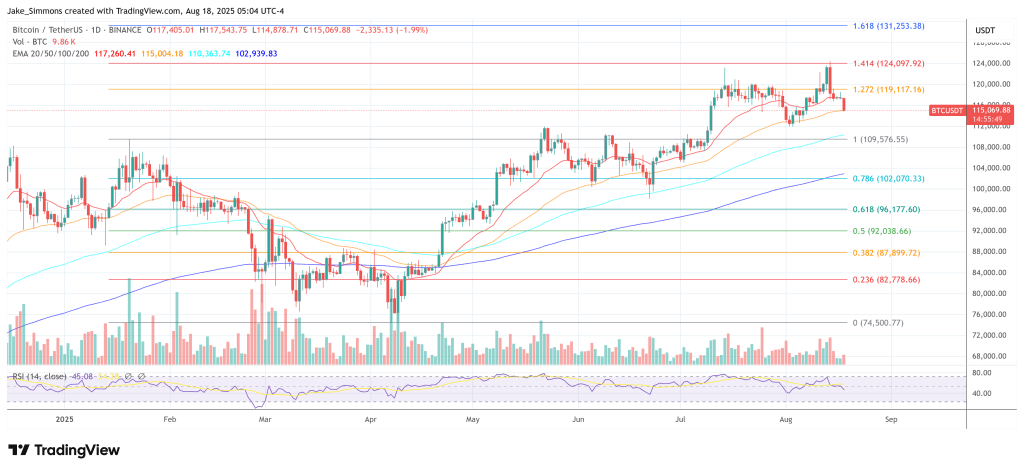

On Bitcoin’s chart, Olszewicz reduces the debate to a well-defined line in the sand and a small set of Ichimoku- and trend-based triggers. “Since July… $121–$122,000 is still the imaginary line in the sand… a daily close above that level, I’m good with higher,” he said, adding, “Above $120,000 it’s easy. I like $150,000.” Until that break, he sees “chop” dominating.

He identifies “the first signs of trouble” as “closing in the daily cloud and/or closing below the 20-week moving average—the yellow line there at $104,000,” and stresses the timing nuance: “If we get a close below the cloud in September, I’m a little less worried than if we get it in October.” A decisive slip late in Q3 rolling into Q4 would be more concerning. “If we close below $100k in October, then I’m closer to this cycle-over, no-more-cycles camp,” he warned, clarifying, “We’re far from that currently… there’s nothing here that’s bearish whatsoever—it’s just momentumless.”

His preferred system-of-confirmation leans on the Ichimoku suite and a separate cloud backtest he tracks on the BTC daily chart. That model “caught [the] April move” early; at present it reads “okay,” but he outlines the precise sequence that would flip his bias: “You need first the bearish TK cross… and then a close in the cloud… then there’s a decent edge-to-edge trade.” It’s a decision tree, not a prediction: “It’s nuanced… if this, then that.”

Macro timing could add friction in the interim. He points to Friday’s Jackson Hole appearance by Federal Reserve Chair Jerome Powell as the only obvious near-term “catalyst,” suggesting a hawkish tone—“not cutting, needing more data, needing more time”—would be a headwind.

He also mused that “Trump may even announce his replacement before Powell speaks… just to steal the thunder,” framing it as a headline-risk factor for risk assets, not a base case. Still, the larger macro backdrop—rising global money supply and debt—remains a structural tailwind for scarce assets, in his view: “That’s going to provide a nice cushion… as they keep printing money everywhere globally.”

Waiting For The Q4 Seasonality

Olszewicz emphasizes that this doesn’t preclude upside, but it does undercut the probability of trending continuation in the very near term. By contrast, he calls Ethereum’s positioning “horrific… for the long side,” even as ETH just printed a record ETF-flow week—an apparent paradox he resolves by distinguishing one-week surges from the “stream of continuous flows” that sustains trends. The comparison matters for Bitcoin because a broad-based crypto risk bid is harder to maintain if ETH’s positioning and overbought technicals stall leadership.

Related Reading

Within Bitcoin’s own market structure, Olszewicz blends tactical caution with the longer-term thesis many cycle investors still hold. He flags that “August has been bullish” so far but notes the historical rarity of “six months in a row” of green closes, and he reiterates that traders looking for “high-conviction moves” with leverage should prefer to wait for signals rather than force exposure in “nothingness.”

Conversely, for long-horizon holders, he cites the power-law corridor as a reason to avoid second-guessing unless the market fails badly into Q4: “If you think there’s a… 30–50% chance that we actually attempt a parabolic move past the midpoint of the power law… it’s probably just worth sitting tight as an investor and saying, okay, show it to me.”

That framework also explains his tolerance for deeper retests without abandoning the larger uptrend. He repeats that there is “plenty [of] room to get angry and go down,” with the 20-week moving average and daily cloud serving as objective guardrails. A September cloud break is a warning; an October cloud break or an October close below $100k would be a far stronger statement about the cycle’s health. Until then, he expects a market “holding levels,” with $121,000–$122,000 as the trigger that would convert “dead momentum” into a genuine impulse.

For Bitcoin traders, the takeaway is spare and unsentimental. There is no “magical setup” this week, and the statistically unfriendly month of September looms. The bullish path into Q4 exists, but it must be earned: In the meantime, Olszewicz’s baseline is either rangebound “nothingness” or opportunistic pullbacks that reset overheated pockets of the market. The contingency that flips that script is clear enough to write on a Post-it: maintain the cloud, defend the 20-week around $104,000, and close decisively above $121,000–$122,000. Only then, Bitcoin could target $150,000.”

At press time, BTC traded at $115,069.

Featured image created with DALL.E, chart from TradingView.com