Bitcoin (BTC) can hit $105,000 within weeks as a classic leading indicator stays bullish, says the latest market analysis.

Key points:

-

Bitcoin is enjoying bullish RSI signals on multiple timeframes as price action consolidates.

-

A weekly RSI breakout occurred in December and continues to hold.

-

Concerns about BTC price strength remain as traders still see new lows to come.

RSI offers $105,000 BTC price target

In an X post on Thursday, trader BitBull noted an ongoing breakout on Bitcoin’s weekly relative strength index (RSI).

While BTC price action stays rangebound, an important RSI trend shift has in fact already been in play since December.

A downtrend on the indicator, which measures how “overbought” or “oversold” BTC/USD is at a given level, began in September, with price breaking through it before the 2025 yearly candle close.

“$BTC weekly RSI is calling for more upside here. Broke out of its 3-month downtrend and holding above the breakout line,” BitBull commented.

An accompanying chart compared the latest breakout with one from earlier last year, which resulted in several months of BTC price gains after April’s local lows of $75,000.

“I think BTC could hit $103K-$105K in 3-4 weeks,” he added.

This week, James Easton, host of crypto trading podcast DeCRYPTion, had good news about RSI on the two-week chart.

The indicator, he noted, is now at lower levels than during the pit of Bitcoin’s last full bear market in late 2022.

“It has also just flipped bullish. Strap in,” he told X followers.

On lower timeframes, RSI signals also appear encouraging, per data from TradingView.

The four-hour chart showed a potential hidden bullish divergence, where lower lows for RSI contrast with higher lows for price itself.

This has the implication of weakening sell-side pressure as Bitcoin attempts to cement $90,000 as a support zone.

“Clear US buyer” battles Bitcoin sell pressure

As Cointelegraph reported, traders still expect lower levels to emerge as the market attempts to find a long-term support base.

Related: Bitcoin ‘not likely’ to make new all-time high in 2026, new research says

Among the more bearish takes is a call for the price to revisit its April lows around $75,000. A trip below the 2026 yearly open is also on the cards.

If we cannot fill the resistance to support soon on $BTC I think a sweep of these lows comes next pic.twitter.com/nHpBzdtF00

— Johnny (@CryptoGodJohn) January 9, 2026

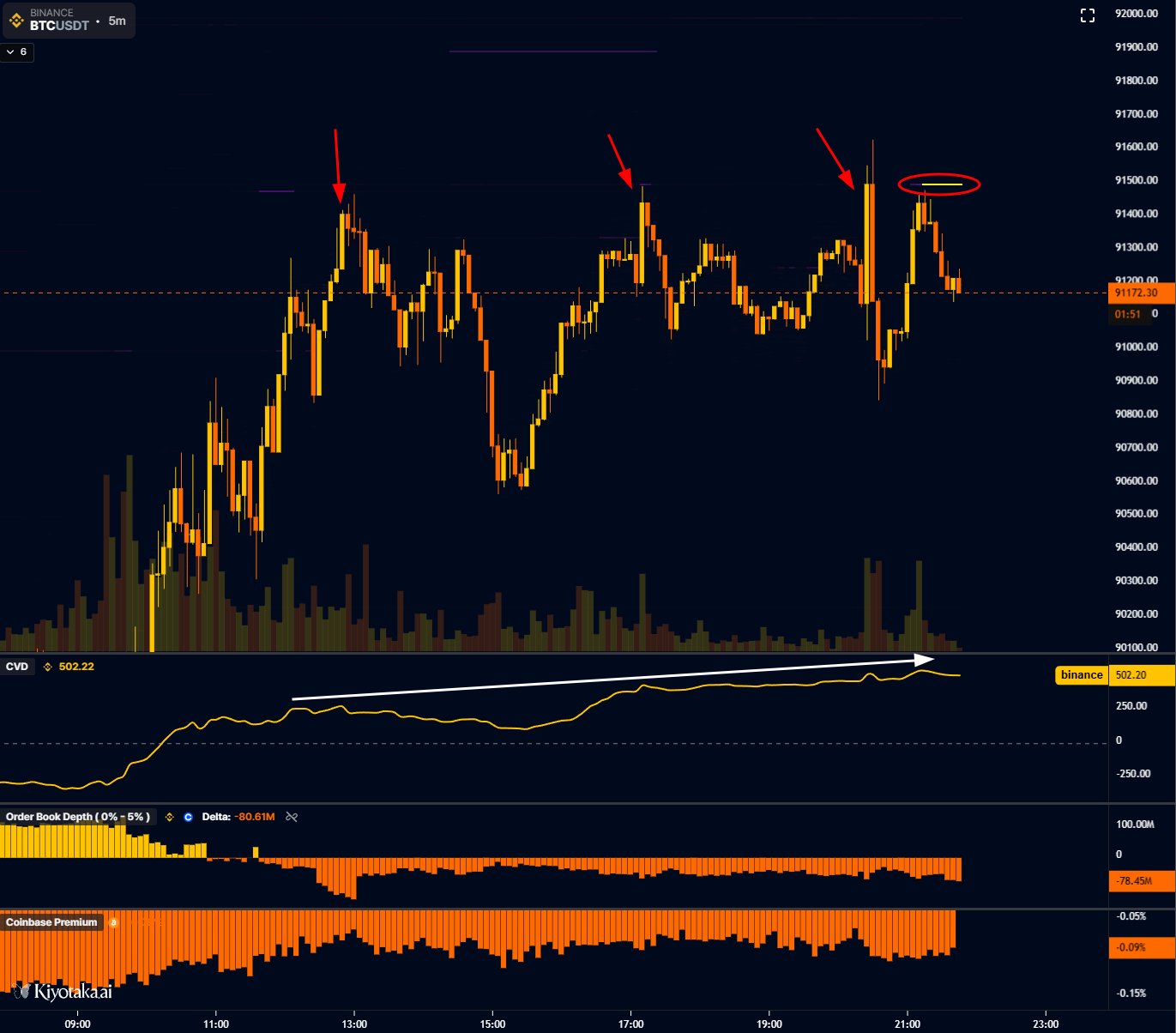

Analyzing exchange order-book behavior on the day, trader Skew flagged a passive seller active at $91,500, keeping price suppressed.

“They’re quoting around 60 – 100 BTC each time so not really that significant but it likely tells me the buy pressure during US session was related to a clear US buyer,” he concluded.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.