One of Bitcoin’s most popular forks completed its halving roughly two weeks ahead of BTC’s quadrennial change slated for later this month.

Bitcoin Cash (BCH) gained a 10% price increase in 24 hours following its halving today and was one of the top gainers among cryptocurrencies as the markets lulled. Following the event, BCH climbed as high as $660 per CoinMarketCap. Despite the price hike, BCH traded 84% below its $4,355 all-time high, which it reached six years ago in 2017.

Like the Bitcoin (BTC) halving, BCH’s mining reward was reduced by 50%, tightening the cap on new tokens entering circulation. The BTC fork’s new block reward is now fixed at 3.125 BCH until 2028.

Expert: Bitcoin price action post-halving may be different this time

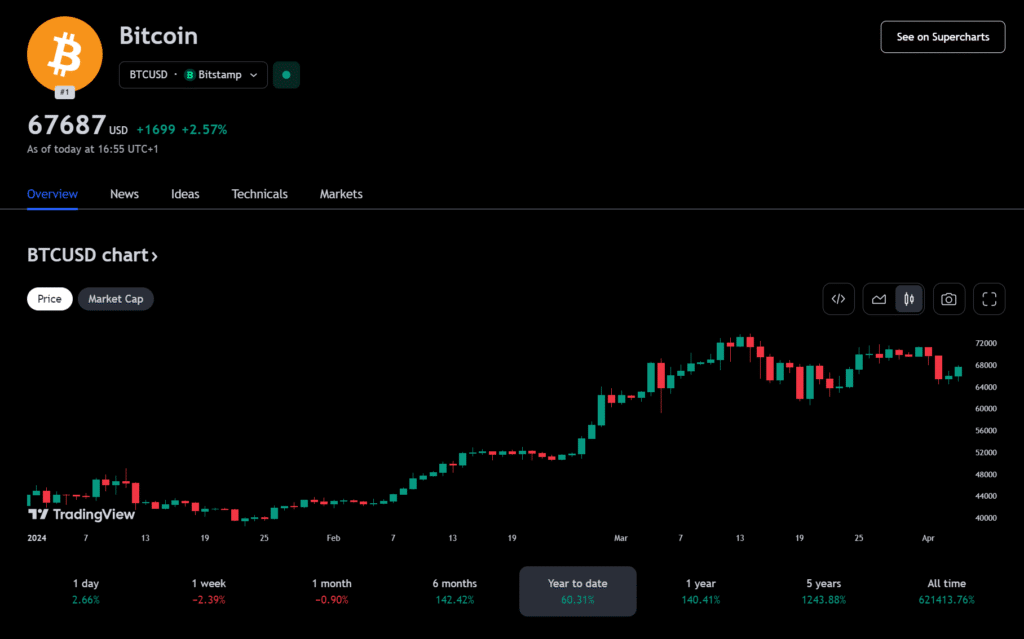

On-chain monitoring tools point to April 20 as Bitcoin’s halving day amid institutional and retail demand underpinned by spot BTC ETFs, which were approved in January. Historically, volatility has swayed BTC and the broader crypto market before the halving.

The asset maintained this pattern to an extent, retracing as much as 14% within 24 hours early last month. Bitcoin declined 20% before its 2020 halving and over 38% in 2016.

Mirai Labs Co-Founder and CEO Corey Wilton opined that the market may record divergent outcomes post-halving compared to previous cycles.

While there has previously been volatility in the months leading up to the halving, I suspect we will see volatility post-halving as institutional investors digest what the halving is and its effects long term. Crypto retail is quick to react, but we have seen that institutional funds don’t possess the same speed and this could easily disrupt our “typical” result.

Corey Wilton, Mirai Labs co-founder and CEO