Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) climbed nearly 5% in the past week, reclaiming key support levels over the past three days. The recent bullish momentum has sent BTC toward the $88,000 mark, with some analysts suggesting a reclaim of its previous price range could be near.

Related Reading

Bitcoin Recovery Could Trigger 14% Surge

After being rejected from the $84,000-$85,000 zone several times in the past two weeks, Bitcoin reclaimed this range over the weekend. The flagship crypto has surged 4.7% from last week’s levels, closing the week above the $86,000 mark.

During the start-of-week pump, BTC eyed the $89,000 resistance, hitting a biweekly high of $88,765, but failed to retest the next crucial zone as bullish momentum slowed. Nonetheless, the cryptocurrency has held its current range, hovering between the $86-000-$88,000 support zone for the past 24 hours.

Analyst Alex Clary affirmed that Bitcoin’s momentum “looks awesome” for a break above the $88,000-$90,000 support zone as the cryptocurrency shows a Relative Strength Index (RSI) bullish divergence, a V-shaped recovery, and has broken above its downtrend resistance.

Per the post, a breakout and reclaim of the crucial $90,000 resistance level could propel BTC to jump between 8 to 14% from current prices to the $95,000-$100,000 levels lost in February.

Meanwhile, Daan Crypto Trades noted that Bitcoin “has not moved much in the past few weeks relative to SPX.” According to the trader, BTC’s price has been correlated to the S&P 500 (SPX) and “has mostly been moving hand in hand with each other,” which could explain the flagship crypto’s recent dump and bounce.

However, he affirmed that Bitcoin is still trading “at a solid spot premium during this bounce,” suggesting that a move to new local highs is possible if BTC maintains the current levels and reclaims the post-US election breakout range above $90,000.

BTC Must Hold This Level By Week’s End

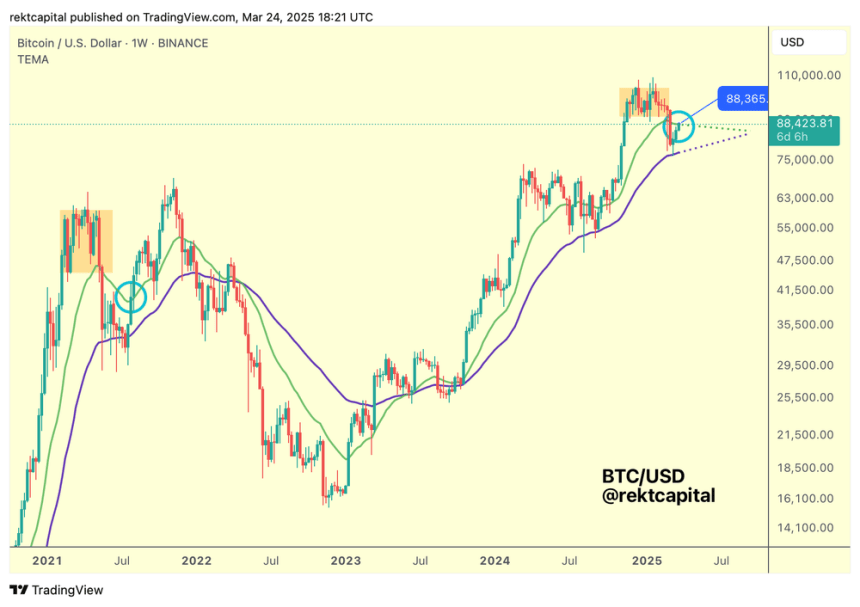

Amid Monday’s market recovery, Analyst Rekt Capital warned that Bitcoin needs weekly closes above $88,400 and $93,500 to end its downside deviation period.

The analyst explained that, over the past five weeks, BTC has been consolidating between the two biggest bull market Exponential Moving Averages (EMAs), the 21-week and 50-week EMAs.

Its price action has recently gotten closer to the 21-week EMA, at around $88,400, ready “for a major trend decision.” According to the analyst, Bitcoin needs a weekly close above this level and a retest into support to target its Macro Range.

“This was the exact confirmation that Bitcoin needed back in mid-2021 when the price crashed -55%,” Rekt Capital noted, suggesting that “things could get volatile both on the upside (trapping FOMO buyers in the upside wick) and the downside (with panic sellers selling into a downside wick),” if history repeats.

A weekly close above it “could kickstart an uptrend continuation towards the Re-Accumulation Range Low of $93,500.” Moreover, after reclaiming the 21-week EMA, Bitcoin will need a weekly close above the re-accumulation range low to “resynchronize with the Range.”

Related Reading

Despite this, he warned that “the Post-Halving Re-Accumulation Range has shown that simple Weekly Closes above $93,500 may not suffice” as it would need “a successful post-breakout retest of the Re-Accumulation Range Low” to confirm resynchronization with the range.

He concluded that failing to successfully retest and confirm the new support could cause BTC’s price to lose this crucial level and deviate to the downside again.

Featured Image from Unsplash.com, Chart from TradingView.com