Key takeaways:

-

Retail traders remain sidelined despite BTC’s rebound, as low funding rates and muted interest point to fragile investor sentiment.

-

Institutional investors are buying the spot Bitcoin ETFs again and corporate buyers building BTC treasuries could help send BTC back to $100,000.

Bitcoin (BTC) price stabilized near $95,500 on Thursday following an 8%, 3-day rally that wiped out $465 million in short BTC futures positions. However, according to web search and derivatives metrics, retail traders have remained on the sidelines. Bitcoin’s pullback from $97,900 may have further weakened investor sentiment.

The Bitcoin perpetual futures funding rate stood at 4% on Thursday, signaling limited demand for bullish positions. Under neutral conditions, the indicator typically ranges between 8% and 12% to compensate for the cost of capital. These derivatives are retail traders’ preferred instruments because their prices closely track the spot market, unlike monthly BTC contracts traded on CME.

Institutional Bitcoin buying offsets weak retail investor interest

The tech-heavy Nasdaq index traded just 1.6% below its all-time high on Thursday as traders gained confidence after chipmaker TSMC reported a 35% increase in quarterly earnings. Still, despite Bitcoin’s recent gains, the current $95,500 level remains 25% below the $126,219 all-time high. More importantly, overall interest in the cryptocurrency market has been declining.

Google Trends data shows global search interest for “crypto” at 27 on a 0 to 100 scale, not far from the 12-month low of 22. Retail traders tend to chase recent winners, particularly as the price of silver has climbed 28% in two weeks. Bitcoin has long been viewed as a direct competitor to precious metals, but crypto traders typically focus on shorter-term performance.

Part of Bitcoin traders’ skepticism can be attributed to socio-political risks and concerns around maintaining the US Federal Reserve’s independence.

The US Justice Department’s criminal inquiry into cost overruns tied to the Federal Reserve’s building renovation has raised concerns about whether the Trump administration is pressuring the Fed to cut interest rates. Fed Chair Jerome Powell’s mandate ends in April, leading traders to anticipate stronger economic stimulus measures in the second half of 2026.

Bitcoin has yet to prove itself as a reliable hedge during periods of economic turmoil, and as a result, even amid gains in stocks and precious metals, retail traders fear the cryptocurrency market could suffer the most during a downturn.

Related: Iran is cut off from the internet–Here’s how crypto could still work

Adding to the tensions, US President Donald Trump has threatened to retaliate against Iran over its violent response to anti-government protests. Iran produces more than 3 million barrels of oil and controls a major global chokepoint for tanker flows. The heightened uncertainty follows a Jan. 3 US military operation that captured Venezuelan President Nicolas Maduro.

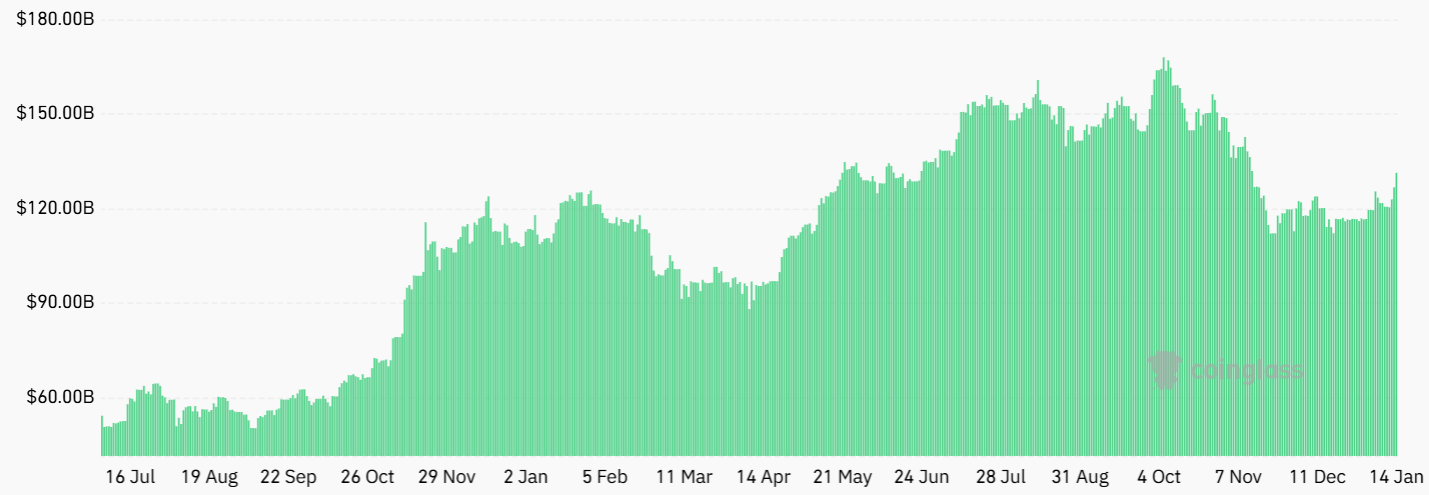

The lack of interest from retail traders is not a death sentence, as the Bitcoin spot exchange-traded fund (ETF) industry has surpassed $120 billion in assets. Public companies continue to follow Michael Saylor’s Strategy (MSTR US) playbook and have purchased more than $105 billion in Bitcoin. Institutional investor demand gained relevance through 2025 and could ultimately be the deciding factor behind a sustained bullish move toward $100,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.