Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin heads into the final days of May with an unusually dense agenda of market-moving events that stretch from Las Vegas to Washington and Wilmington. Beginning Tuesday the 27th, the world’s largest cryptocurrency will be at the centre of its own ecosystem, Wall Street’s macro diary and one of the most closely watched bankruptcy wind-downs in digital-asset history.

Bitcoin Week Of Fire

The epicentre is Bitcoin 2025, the annual industry gathering that this year takes over The Venetian in Las Vegas from 27–29 May. Organisers expect more than 30 000 attendees and have added a new “Code + Country” policy track to underline Bitcoin’s emergence as a political wedge issue. “This is more than a headline moment — it’s a signal,” BTC Inc. chief executive David Bailey said when announcing the keynote roster. “Bitcoin is the most exciting financial innovation in the world. It’s at the forefront of the national conversation.”

Related Reading

For the first time a sitting US vice-president will speak at a crypto conference: JD Vance is due on the main stage Wednesday morning, 28 May. His team has trailed a defence of “innovation, financial sovereignty and a more resilient American future,” and public filings show personal Bitcoin holdings worth up to half a million dollars. Moreover, “Crypto Czar” David Sacks, Bo Hines, Executive Director of President Donald Trump’s Council of Advisers for Digital Assets and US Senator Cynthia Lummis will speak on Tuesday.

The political guest list does not end there. From abroad, Brexit campaigner – and now Reform UK leader – Nigel Farage has confirmed a fireside interview, arguing that national sovereignty and “free speech” run parallel to Bitcoin’s ethos. “We are pleased to announce that Nigel Farage will join the speaker lineup at the Bitcoin Conference 2025 in Las Vegas,” organisers wrote in a statement last week, framing his return as a natural sequel to his 2023 appearance in Amsterdam. Also slated are Eric Trump and Donald Trump Jr., underlining how thoroughly the Republican establishment has embraced the event.

While cameras focus on the Venetian halls, traders will be wiring what the FTX Recovery Trust calls “over $5 billion” to thousands of former customers of the failed exchange. The second distribution round, beginning Thursday 30 May, will see creditors recover between 54 % and 120 % of their dollar-denominated claims, with BitGo and Kraken acting as agents. Because many claimants sold other crypto holdings to cover losses in 2022, analysts will watch whether a fresh injection of spendable dollars feeds directly back into the market.

Related Reading

Macro traders get no respite. On Wednesday afternoon the Federal Reserve releases the minutes of its 6–7 May policy meeting. The Fed’s signaled that, because of persistent inflation risks, a rate cut is off the table for now, even as policymakers express concern over the economic fallout tariffs could trigger.

Twenty-four hours later comes the Bureau of Economic Analysis’ second estimate of first-quarter GDP; the advance print showed a 0.3 % annualised contraction, a surprise that rattled rate-cut odds in early May.

Finally, Friday brings the April Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, with publication set for 30 May at 08:30 EDT. March’s core PCE was flat month-on-month and 2.6 % year-on-year; economists now infer a 0.2 % MoM rebound for April, keeping the YoY pace at 2.6 %. The estimate comes from translating the latest CPI release into PCE weights. Headline PCE inflation has already slowed to 2.3 % YoY in March, its lowest in four years.

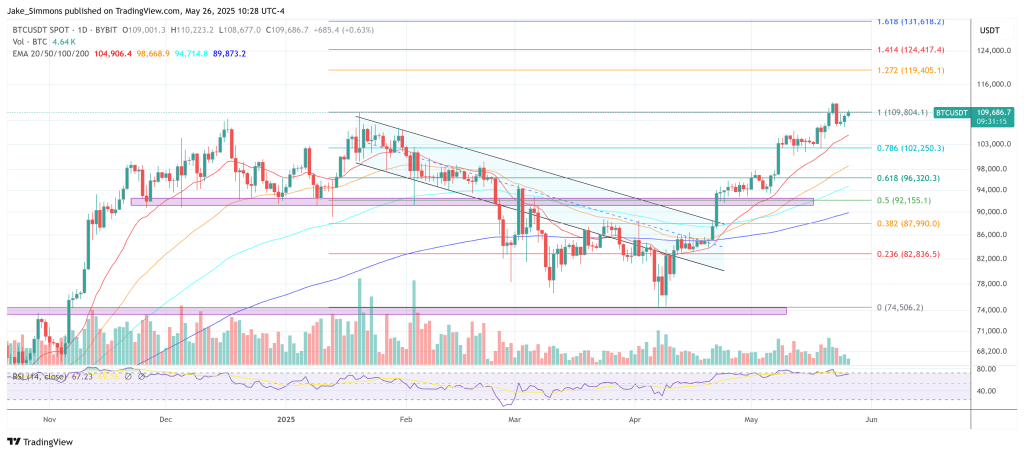

At press time, BTC traded at $109,686.

Featured image created with DALL.E, chart from TradingView.com