Spot Bitcoin exchange-traded funds (ETFs) in the US snapped a five-week net outflow streak in the trading week ending March 21.

Bitcoin (BTC) ETFs clocked a net inflow of $744.4 million — the biggest tally in eight weeks — extending their daily inflow streak to six consecutive days, according to data from SoSoValue.

US-based spot Bitcoin ETF net flows get back on track. Source: SoSoValue

Five funds contributed to the inflows, with the bulk coming from BlackRock’s iShares Bitcoin Trust (IBIT), which recorded $537.5 million. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $136.5 million.

The renewed inflows come after a bearish period for both the crypto market and the broader global economy, marked by growing concerns over escalating trade tensions and rising recession concerns.

Related: US recession would be a big catalyst for Bitcoin: BlackRock

Earlier this year, Bitcoin ETFs recorded their largest net inflows of 2025: $1.96 billion in the week ending Jan. 17 and $1.76 billion the following week. Bitcoin (BTC) surged to an all-time high of $109,000 on Jan. 20, the inauguration day of US President Donald Trump.

Bitcoin later dropped into the $78,000 range amid the broader market correction. With the latest inflows — the strongest since January — the price rebounded to $87,343 at the time of writing, according to CoinGecko.

Bitcoin leaves Ethereum in the red zone

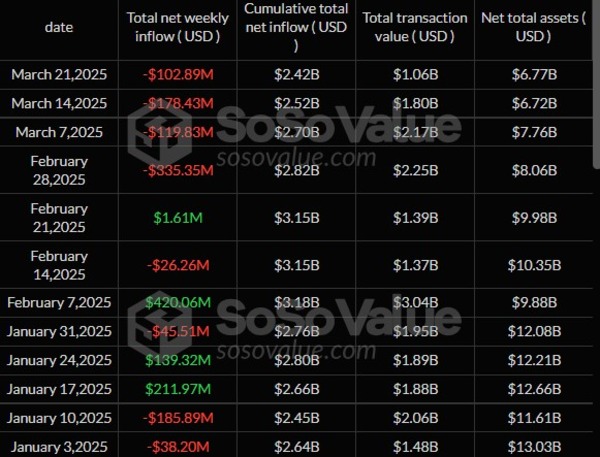

The same can’t be said for Ether (ETH) ETFs, which extended their weekly net outflow streak to four weeks.

Ethereum ETF net inflows continue slumping. Source: SoSoValue

During the week ending March 21, Ethereum funds saw a net outflow of $102.9 million, with BlackRock’s iShares Ethereum Trust ETF (ETHA) accounting for $74 million of that.

Ether (ETH) was trading at $2,090 at the time of writing, up from less than $2,000, a level it had fallen beneath for the first time in over a year.

Still, there was a bright spot for Ethereum, as institutions continue to deepen their exposure to the asset.

Related: Ethereum eyes 65% gains from ‘cycle bottom’ as BlackRock ETH stash crosses $1B

BlackRock’s BUIDL fund — which primarily invests in tokenized real-world assets (RWAs) — now holds a record $1.15 billion worth of Ether, up from about $990 million just a week earlier, according to Token Terminal. The fresh injection of ETH signals growing conviction from the world’s largest asset manager in Ethereum’s role as the leading infrastructure for real-world asset tokenization.

Market sentiment improves, but investors remain cautious

Market sentiment on crypto has improved since the past week, with the Crypto Fear & Greed Index improving to 45% from 32% last week.

Still, Singapore-based investment firm QCP Capital advised caution regarding the likelihood of a sustained breakout.

“Upcoming tariff escalations slated for 2 April could once again pressure risk assets,” QCP Cap said in a March 24 market analysis.

Magazine: What are native rollups? Full guide to Ethereum’s latest innovation