Key Notes

- BlackRock Bitcoin ETF alone saw $210 million of outflows on Dec.

- 16, signaling sustained institutional selling pressure.

- On-chain data shows one of the largest sell-offs by Bitcoin long-term holders in the past five years.

- Investors are bracing for heightened volatility ahead of key macro events, including US CPI data and a BoJ rate hike.

Amid the strong Bitcoin

BTC

$86 451

24h volatility:

0.2%

Market cap:

$1.73 T

Vol. 24h:

$43.63 B

price correction, spot Bitcoin ETF outflows have surged simultaneously, clocking another $277 million on Dec. 16. This surge in outflows, along with the sell-off from long-term holders, highlights the waning institutional sentiment. BTC price is currently around $86,500 as analysts brace for further volatility ahead of the US CPI, and BoJ rate hike decisions this week.

Bitcoin ETF Outflows Remain Strong

On Tuesday, Dec. 16, spot Bitcoin ETFs recorded outflows for the second consecutive day at $277 million. BlackRock’s iShares Bitcoin Trust (IBIT) led the most outflows at $210 million, followed by Bitwise’s BITB at $50 million as per Farside Investors data.

Fidelity’s FBTC was the only Bitcoin fund to see positive inflows at $26.7 million, while the rest others saw zero or negative flows.

As per the on-chain data, the BlackRock Bitcoin ETF (IBIT) dumped a total of 2.405 BTC yesterday. However, the trading activity remains elevated with $2.8 billion in total volumes.

BlackRock Bitcoin ETF trading: Source: Trader T

Moreover, the net assets under management (AUM) across all Bitcoin ETFs saw a sharp drop from $169.5 billion to $120.7 billion over the past 60 days. November alone saw net outflows totaling $3.79 billion, reported market analyst Shanaka Anslem Perera.

He added that BlackRock’s spot Bitcoin ETF, IBIT, accounted for a significant portion of the decline, recording approximately $2.7 billion in redemptions over a five-week period. The sustained outflows suggest strong institutional selling pressure in the market.

Bitcoin Long-Term Holders Locking Gains

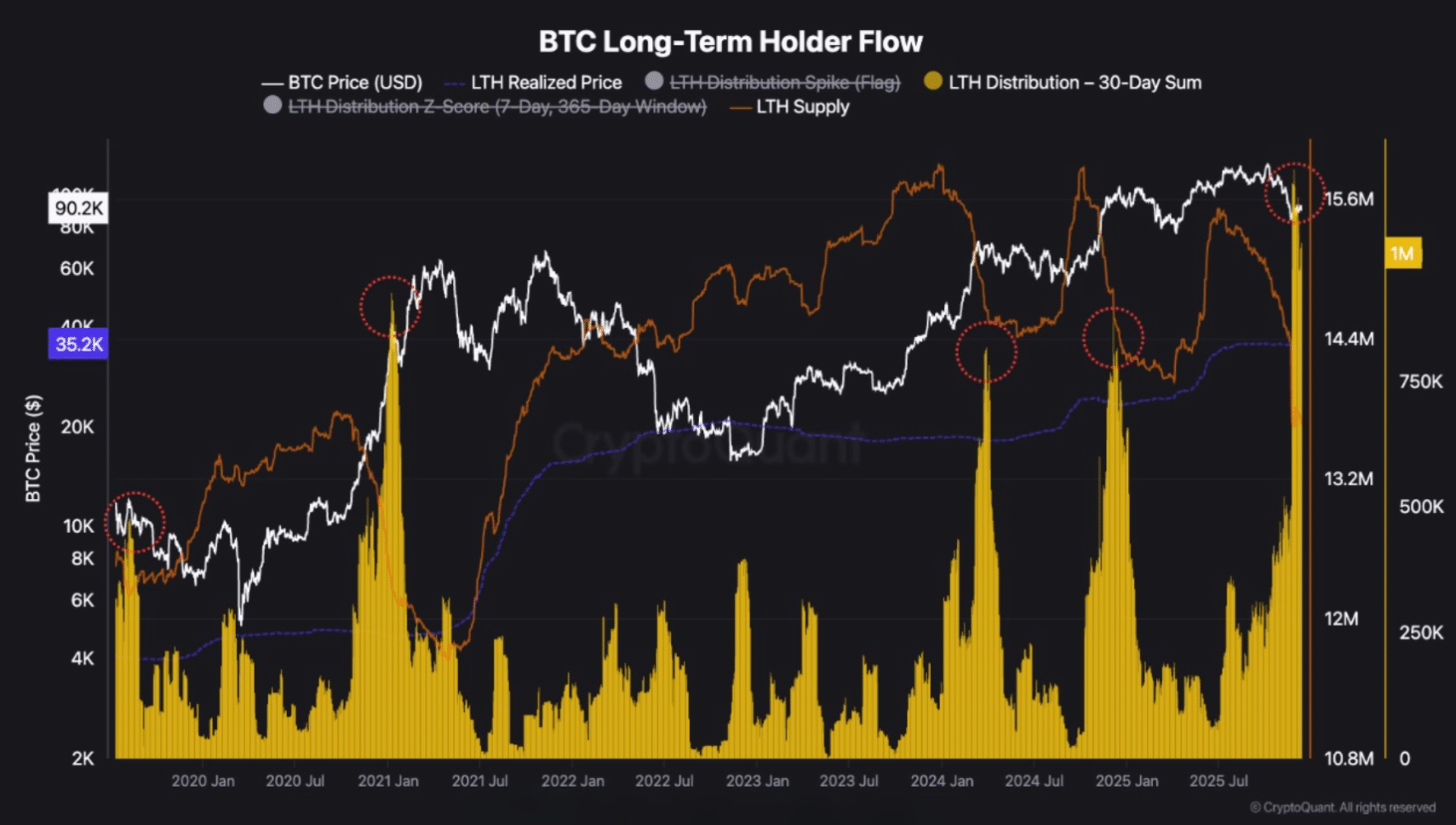

On-chain data shows that long-term holders (LTH) of Bitcoin are locking in gains, while selling on every rise. According to data from CryptoQuant, the recent sell-off from LTHs over the past 30 days is one of the largest in the last five years.

It added that selling by this cohort has historically occurred closer to market highs rather than during price bottoms. Current data shows long-term holder supply declining from record levels, while Bitcoin continues to trade well above the LTH realized price.

This shows that the recent selling reflects profit-taking behavior instead of any panic-driven capitulation. Market experts like Peter Brandt expect an 80% Bitcoin crash from the highs.

Bitcoin long-term holder selloff | Source: CryptoQuant

All eyes will be on the macro events such as the release of US CPI data and the Bank of Japan (BoJ) rate hike. The Bank of Japan is expected to raise its policy rate to 0.75%, making it the country’s highest interest rate level since 1995.

Each of the Bank of Japan’s previous rate hikes has coincided with sharp declines in Bitcoin, with past drawdowns ranging between 23% and 31%.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.