Bitcoin (BTC) hit new 2026 highs on Monday’s Wall Street open amid concerns over thin market liquidity.

Key points:

-

Bitcoin joins stocks and gold with early-year gains as geopolitics rewards asset holders.

-

BTC price analysis sees a “clear-cut breakout” over the next week.

-

Concerns over a lack of market engagement form the basis for bearish prognoses.

Bitcoin seeks new monthly highs on Venezuela

Data from TradingView confirmed a new year-to-date BTC price peak of $94,026 on Bitstamp.

US stocks gained at the start of the week, continuing a positive reaction to the US operation in Venezuela.

Both the S&P 500 and Nasdaq Composite Indexes were up 1% at the time of writing, while spot gold added more than 2.5%, hitting highs of $4,455 per ounce.

“Asset owners keep on winning,” trading resource The Kobeissi Letter wrote in a reaction on X.

Bitcoin itself has built on its highest levels since Dec. 11, passing the 50-day exponential moving average (EMA) and $91,600 and 2025 yearly open at $93,500.

“Good to see $BTC finally showing a bit of strength,” trader Max Rager commented in his latest X analysis.

“Retesting the 2025 yearly open and a major level for Bitcoin price over the past year. Would like to see a break and hold above $94k and then could see a push back over $100k.”

Commentator Exitpump said that further upside would “depend on spot buyers.”

$BTC Market took the opportunity to pump the price at the daily open when large asks got removed hence orderbook based indicators turned green with some chasing bids being added as well. Now continuation will depend on spot buyers. pic.twitter.com/YzqbC7oDlE

— exitpump (@exitpumpBTC) January 5, 2026

“Final hurdle before $100K: that’s where Bitcoin is currently at,” crypto trader, analyst and entrepreneur Michaël van de Poppe added earlier.

“I wouldn’t expect a clear-cut, immediate breakout; however, I do expect to see it happen in the coming week. The year started bullish.”

Spotlight on crypto volume crash

Bitcoin also fielded its fair share of nerves and bearish prognoses despite short-term strength.

Related: Can BTC avoid bull trap at $93K? 5 things to know in Bitcoin this week

$BTC 1D

I hate to be the bear of bad news but I wouldn’t get too excited about this recent pump.

We’re coming out of a 2 week long holiday period + volume is substantially low.

We’ve seen time and time again where low volume pumps from holidays get completely retraced. pic.twitter.com/3WZLdyA3gT

— Roman (@Roman_Trading) January 5, 2026

Thin order-book liquidity and low trading volume were a cause for concern for Bitcoin OG Willy Woo.

“I think we get a short term pump for January (starting to see liquidity putting in a local bottom),” he told X followers alongside a chart of mempool size and transaction fees.

I think we get a short term pump for January (starting to see liquidity putting in a local bottom).

But this chart (transactions and fees) looks long term (macro cycle) bearish, it’s a ghost town out there. pic.twitter.com/WnOwNI7Ru5

— Willy Woo (@woonomic) January 5, 2026

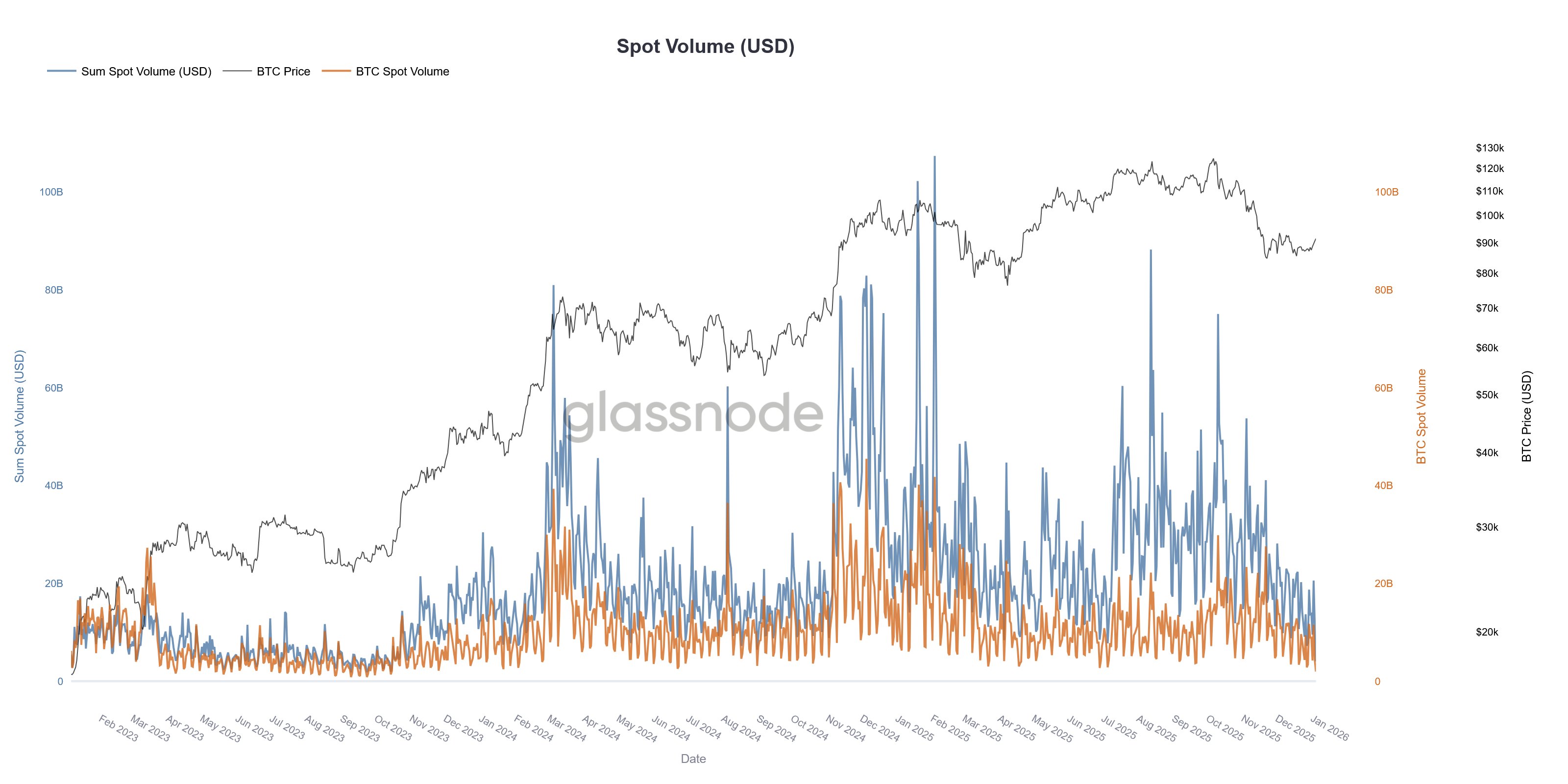

Onchain analytics platform Glassnode, meanwhile, reported the lowest crypto spot trading volumes since late 2023.

“This weakening demand contrasts sharply with upside moves across the market, highlighting increasingly thin liquidity conditions behind recent price strength,” it warned on the day.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.