An indicator that we broached earlier this week which bears reexamination is the current level of BTC funding rates. As a reminder, funding rates represent payments to traders that are long or short BTC. They can reflect trader sentiment within futures markets. When funding rates are positive, investors often view this as bullish in nature. Conversely, when funding rates are negative, investors view this as bearish. As it stands, BTC funding rates have been positive every day in July, except July 1, July 10 and July 15.

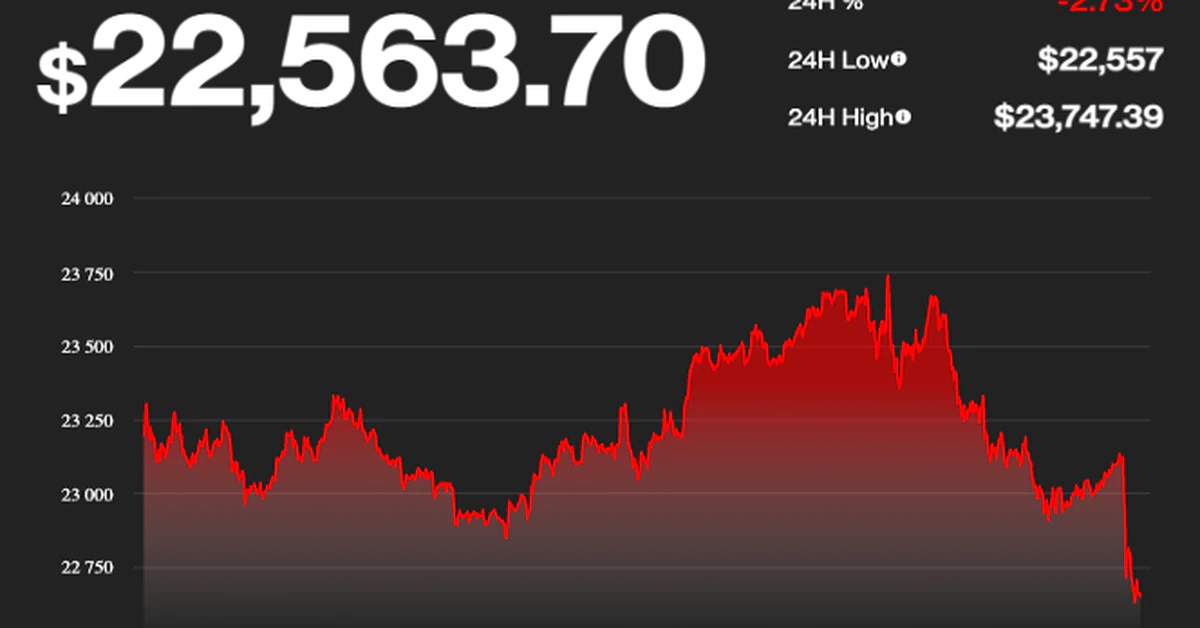

Bitcoin Finishes the Week in Positive Territory Again