Bitcoin (BTC) saw multiday lows into Sunday’s weekly close as bulls faced a week of macro uncertainty.

Key points:

-

Bitcoin heads lower as market nerves about upcoming macroeconomic volatility catalysts boil over.

-

Downside risks firmly outweigh the odds of upside, BTC price analysis says.

-

A potential bullish divergence against silver offers a glimmer of hope.

Bitcoin sags into big macro week

Data from TradingView tracked 1.6% losses for BTC/USD, which reached $87,471 on Bitstamp.

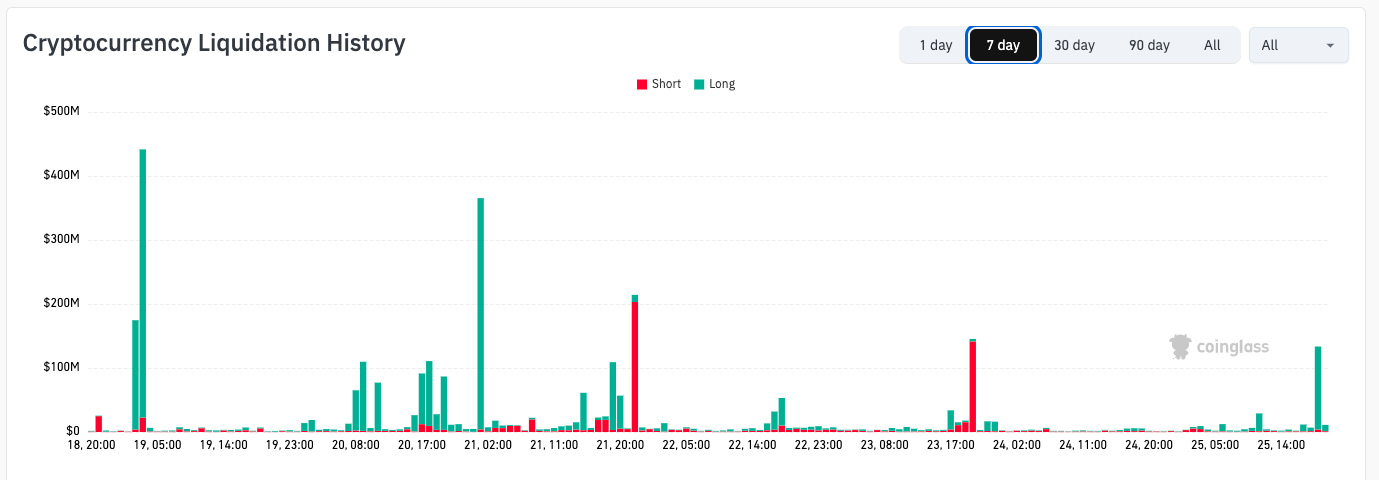

Long positions made up the majority of 24-hour crypto liquidations, which passed $250 million, per data from CoinGlass.

Trading resource The Kobeissi Letter attributed market weakness to the prospect of another US government shutdown in the coming days.

BREAKING: Bitcoin falls below $88,000 as $60 million worth of levered longs are liquidated in 30 minutes.

A government shutdown is now expected and President Trump has threatened 100% tariffs on Canada.

US stock market futures will open in less than 7 hours. pic.twitter.com/40GxrMdRTI

— The Kobeissi Letter (@KobeissiLetter) January 25, 2026

“Buckle up for a huge week ahead,” it told X followers, further highlighting President Donald Trump’s tariff threats on Canada, macroeconomic data releases and the Federal Reserve’s decision on interest rates.

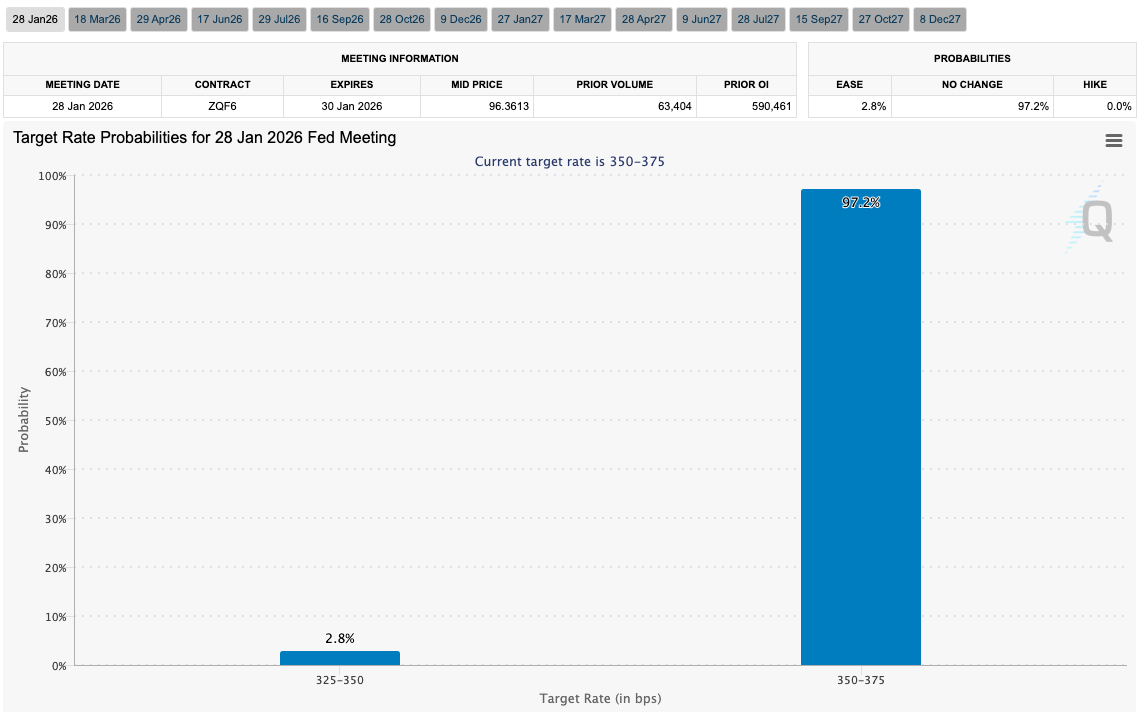

The latter, due Jan. 28, was seen as yielding no change to current rates despite pressure from Trump to cut them further.

The latest estimates from CME Group’s FedWatch Tool put the odds of a minimum 0.25% cut at just % at the time of writing.

“Earnings season has arrived and headwinds are mounting on multiple fronts,” Kobeissi added.

BTC price pumps “potential short opportunity”

Among traders, the low time frame BTC price trading range was first on the list of issues to deal with.

Related: Bitcoin diamond hand BTC selling not ‘repeat of 2017, 2021,’ research warns

“Now, price is currently losing the mid-range which is a bearish sign for continuation to the downside, to the range lows,” trader CrypNuevo wrote in his latest X analysis.

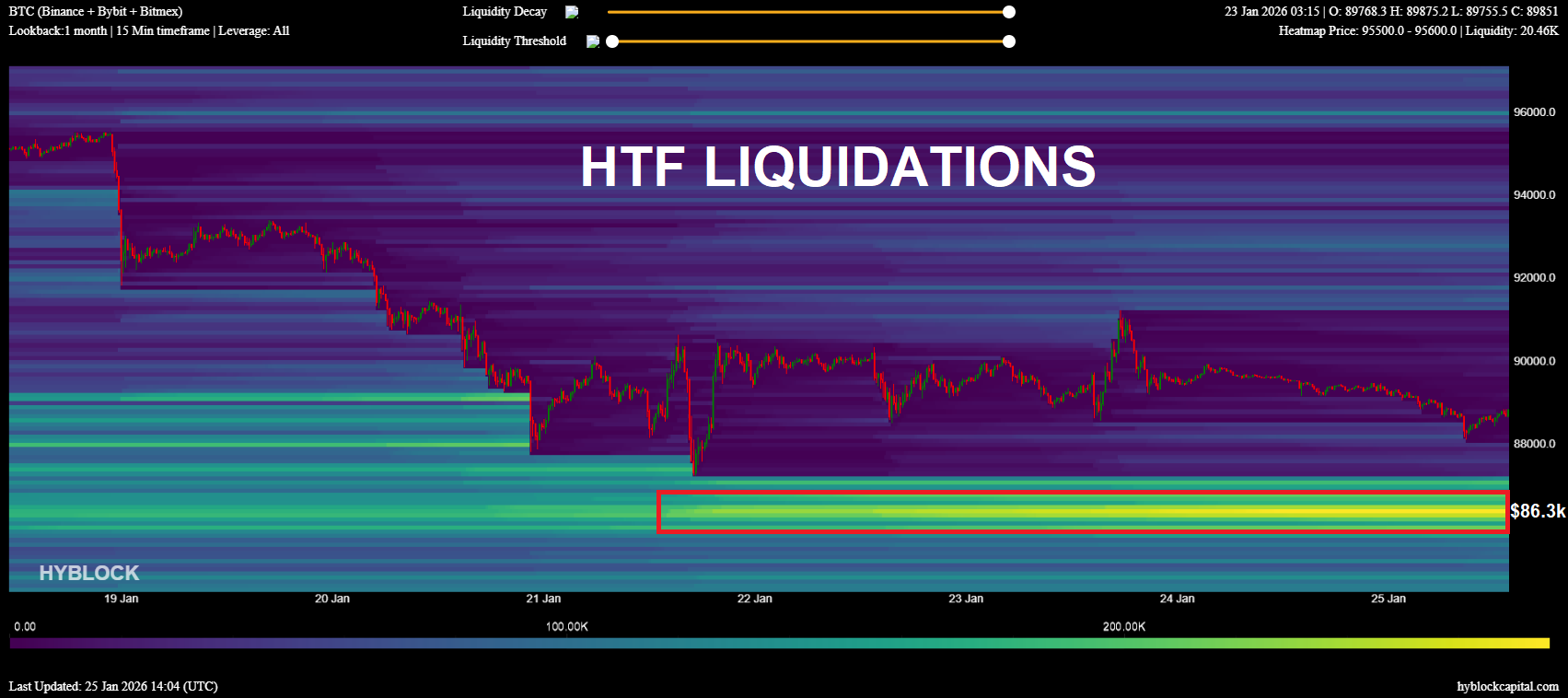

Eyeing exchange order-book liquidity, CrypNuevo put bulls’ line in the sand at $86,300.

“Based on Bitcoin losing the mid-range; HTF liquidations to the downside; and the possible US Gov. shutdown, we still think that the most likely scenario is that Bitcoin drops back to low $80s in the coming weeks,” he concluded.

“Any short-lived pump this week is a potential short opportunity.”

Others drew attention to a marked increase in open interest into the weekly close.

That’s a serious open interest increase… On a Sunday… Right before we have a lot of major macro events…

You guys are nuts.$BTC pic.twitter.com/G14wHhyBbb

— Byzantine General (@ByzGeneral) January 25, 2026

A note of optimism, meanwhile, came from crypto trader, analyst and entrepreneur Michaël van de Poppe.

After both gold and silver printed record highs, Van de Poppe eyed a potential bullish divergence on BTC/XAG.

“For the first time in the history, $BTC might print a bullish divergence against Silver on the 3-Day Timeframe,” he announced on the day.

“What does this say? This does say that the coming week is going to be extremely volatile and could indicate a bottom on this metric and therefore, Silver is likely to peak and money is likely rotating towards other assets.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.