Bitcoin (BTC) is seeing new records in network activity as volatility sends BTC price action to fresh five-month highs.

Data from resources including MiningPoolStats confirms that Bitcoin’s hash rate hit new all-time highs on Jan. 26.

Hash rate passes 300 EH/s threshold

In another example of Bitcoin’s blitz recovery from the pits of post-FTX woes, network hashing power is now bigger than ever.

Hash rate, which is an expression of the processing power dedicated to the network by miners, is currently at 321 exahashes-per-second (EH/s), according to MiningPoolStats raw data.

Despite being only an estimate and impossible to measure entirely accurately, the latest readings are quite the feat, having never crossed the 300 EH/s level before.

Mining firm Braiins likewise confirmed the numbers in its live reporting feed.

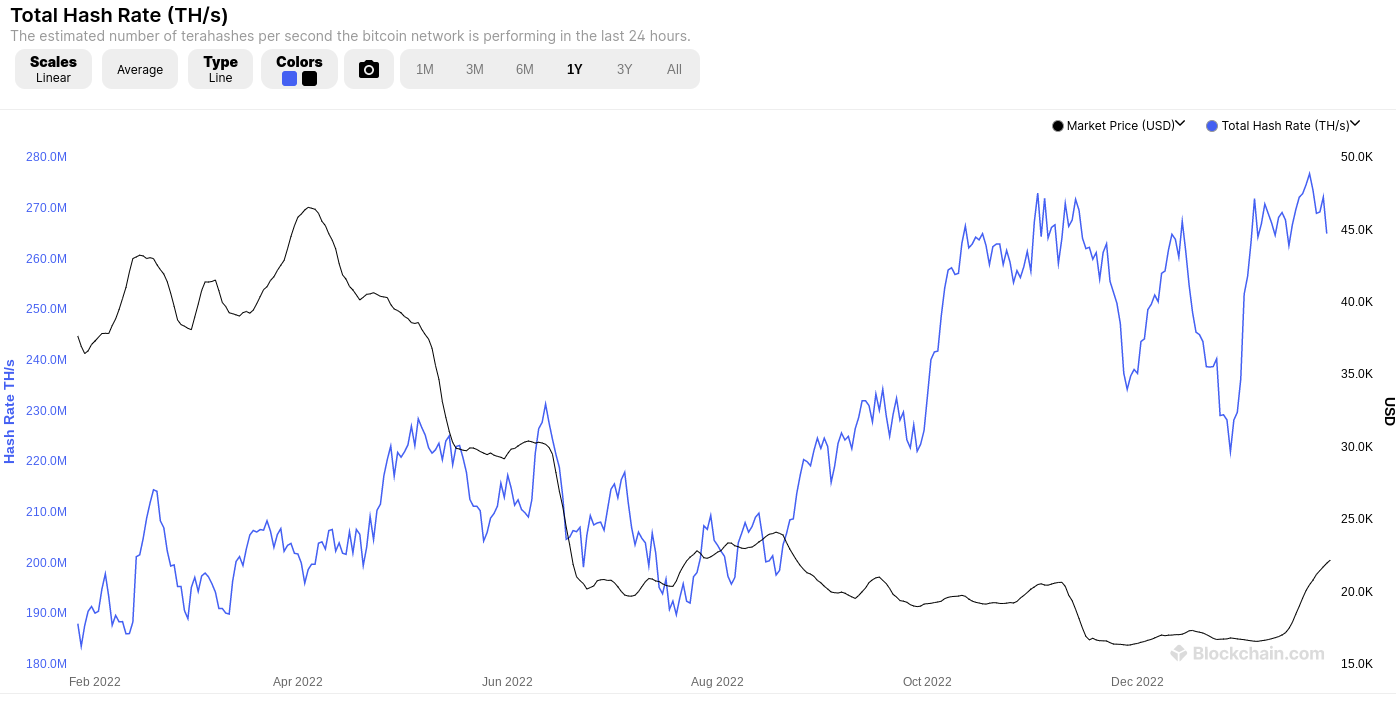

Other trackers from BTC.com and Blockchain.com have slightly lower estimates, both being around 275 EH/s on the day. The latter shows hash rate hitting an all-time high of 276.8 EH/s on Jan. 20.

“Your wealth is more secure than ever!” popular commentator BTC Archive wrote in part of a Twitter response to the data, indicative of improving sentiment across the Bitcoin space.

Hash rate is a key component of Bitcoin security and significant drawdowns result in network difficulty rising to entice more miners to participate.

Network difficulty is also set to reach levels never seen before this week in a nod to fierce competition in the mining sector.

According to data from BTC.com, the next automated readjustment will send difficulty an estimated 2.75% higher to 38.62 trillion.

The previous readjustment delivered a 10.26% increase, Bitcoin’s largest since October 2022 and only the second double-digit hike since mid-2021.

Miners get chance to balance books

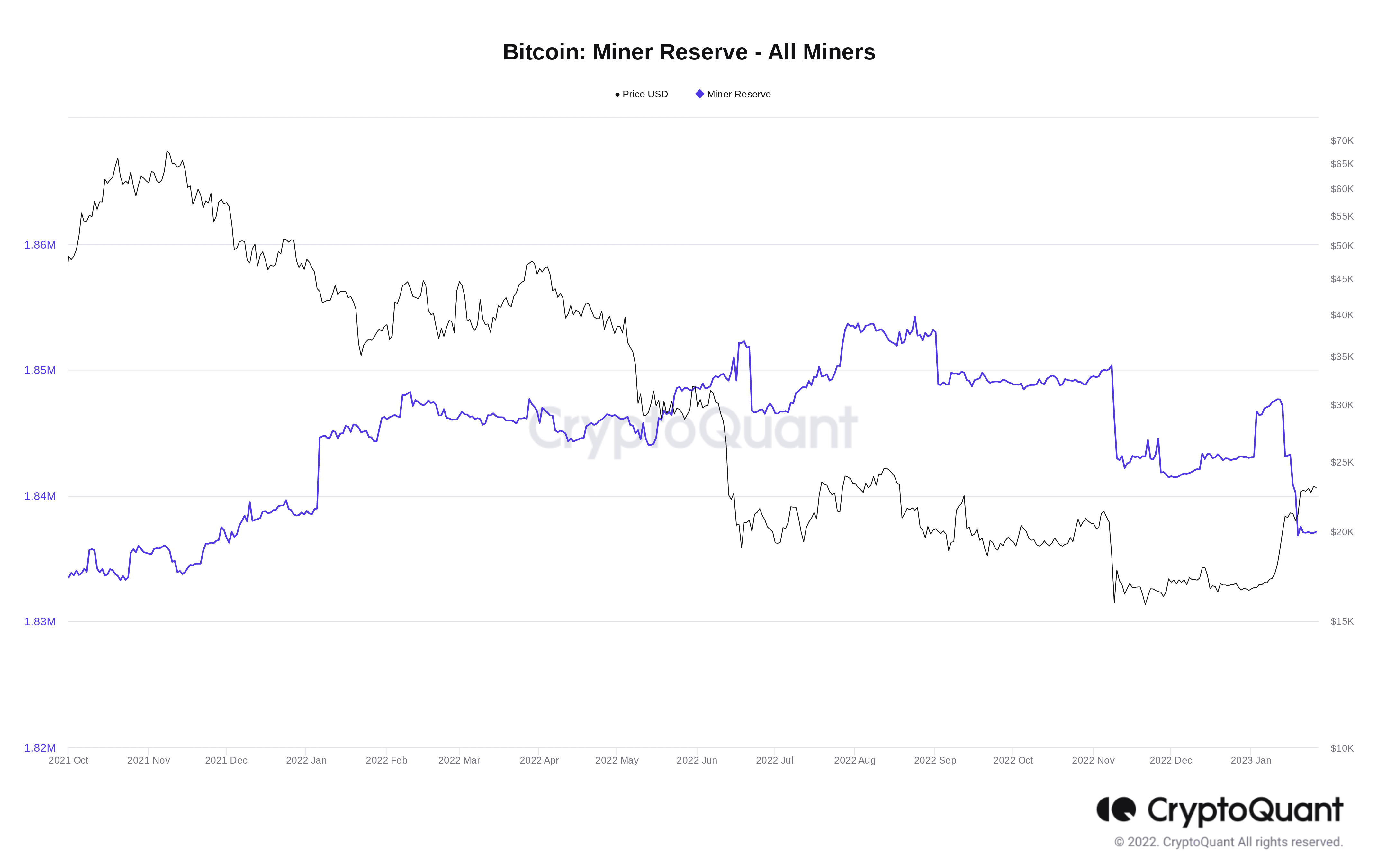

Analyzing the climate, CoinLupin, a contributor at on-chain data platform CryptoQuant, warned that miners are still selling their BTC reserves, possibly to shore up capital in the event of a market reversal.

Related: Bitcoin faces ‘considerable danger’ from Fed in 2023 — Lyn Alden

“Now they have improved profitability for the first time in a while, and mining costs are lower than Bitcoin prices. Normally, more active mining and holding could occur, but now they seem to see it as an opportunity to secure cash,” he wrote in a blog post, describing reserves as “declining at a rapid” pace.

“One day price adjustment could happen in the section where they get enough cash and start collecting Bitcoin again. They constantly reduce their Bitcoin holdings during the rise.”

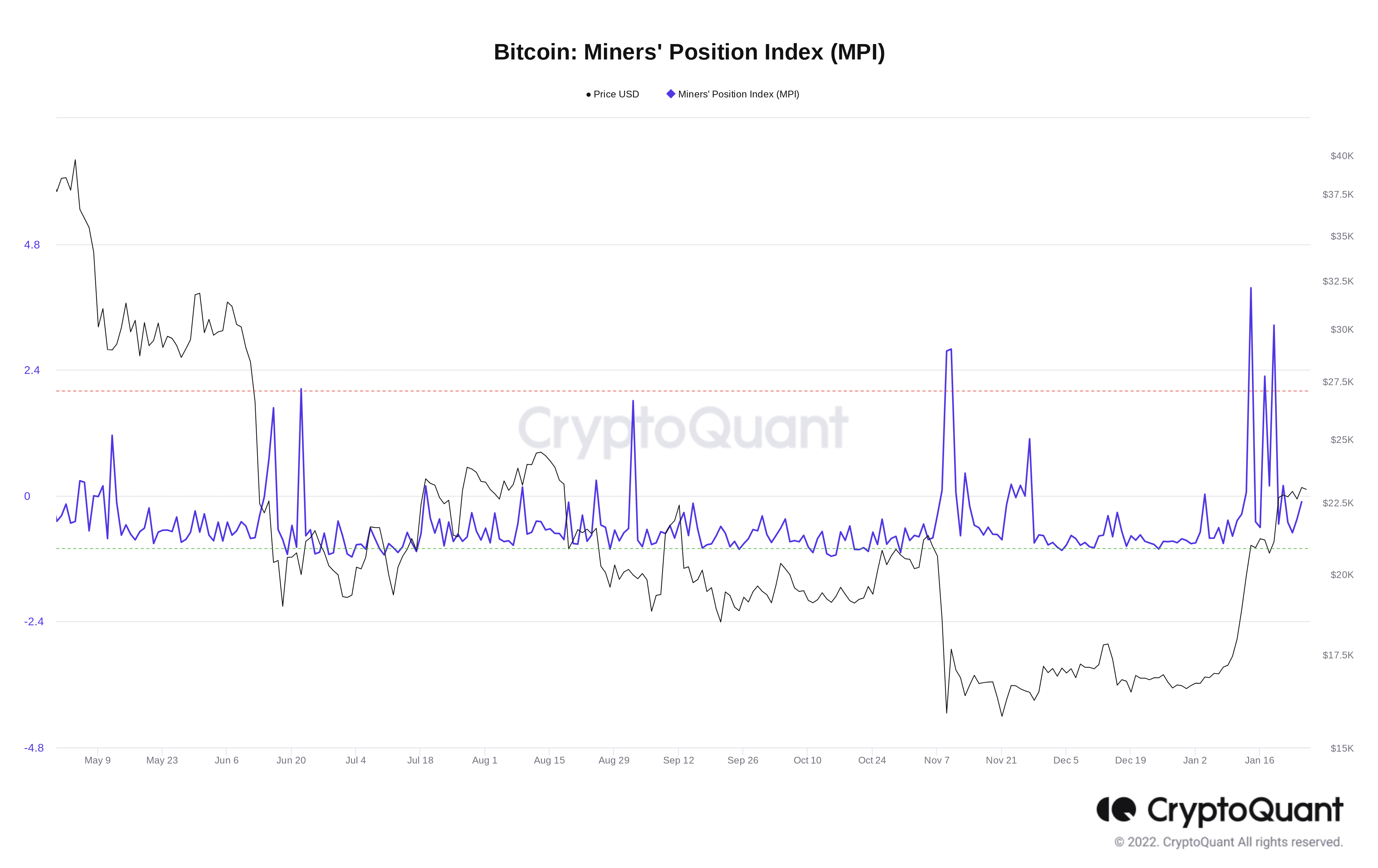

CryptoQuant’s miner position index, which measures BTC outflows to exchanges from miner wallets relative to their one-year moving average, has captured several withdrawal spikes since Jan. 14.

At 1,837,138 BTC, miners’ reserves currently stand at their lowest since December 2021.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.