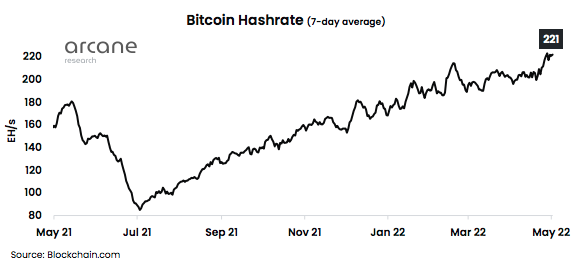

As Bitcoin jumped to $40k in the day following Federal Reserve’s raise hike by half a point, another number on the rise is its hash rate, which hit an all-time high of 221 EH/s.

Bitcoin, Hash Rate, And Price

The Hash Rate is the Bitcoin network’s measuring unit of the computational power and speed used to carry on the mathematical operations that confirm and process transactions on the blockchain. For this reason, the Hash Rate can reflect the global activity of bitcoin mining, increasing or decreasing side by side.

The price of Bitcoin and the measure of the Hash Rate are believed to be related. The higher the Hash Rate, the healthier and more secure the network is, and this can lead to an increase in price. However, this is not a guarantee because macroeconomic uncertainty is an important factor that could dominate the future of its trading value.

Also, many miners allege that the value of Bitcoin has an impact on the Hash Rate and not the other way around as the miners work around the network –joining or not– depending on the moment’s profitability.

Hash Rate And Difficulty Going Up At The Same Time

Just one week ago, Bitcoin difficulty hit an all-time high of 29.79 trillion after reaching block height 733,824. As the latest Arcane Research weekly report notes, the algorithm did this difficulty adjustment in order to lower the block production to the desired level, and now it has never been as difficult to mine bitcoin.

The difficulty was expected to drop 0.07% around next week during the next adjustment. However, the same Arcane report notes that this increase in difficulty has not been an obstacle to a rise in the new hashrate coming online. This means that the next adjustment could rather turn into another increase, “pushing the difficulty even further upwards.”

Although March and April had been slow months for the Bitcoin Hash Rate, it has now accelerated its pace and risen to an all-time high of 221 EH/s.

Related Reading | Bitcoin Hashrate Swells 15% Since Last Week As Analysts Expect Mining Difficulty To Increase

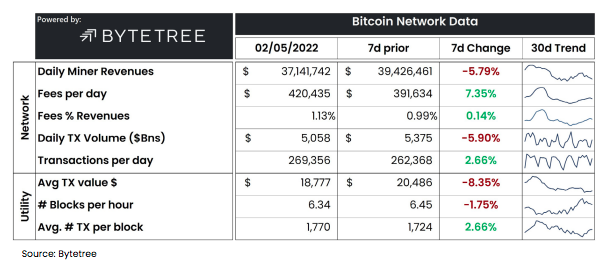

The desired level of block production is 6 blocks per hour, but the surge in Hash Rate a week ago turned into a rapid block production rate of 6.45 blocks per hour.

The Arcane Research data also reports a 7% increase in Bitcoin’s daily transaction fees, going from $391,634 to $420,435 in a week. Ethereum, however, still takes the lead in the high daily transaction fees arena with an all-time high of $231 million last weekend, two times the former all-time high of $117 million.

This happened as a result of Yuga Labs’ minting of 55,000 NFTs, which demanded a great amount of gas given the activity of buyers increased. Ethereum’s scalability problem outshines Bitcoin’s 7% surge in daily fees.

This also highlights the higher earnings of Ether miners compared to Bitcoin’s for over a year.

“Bitcoin transaction fees have been minuscule since the summer of 2021, only making up around 1% of miner revenues, while the rest comes from the block subsidy,” Arcane Research explains, adding that Ether miners find higher profitability because of the elevated gas fees, although their earnings are also more volatile.

Related Reading | Bitcoin Could See 10% Jump, As Volatility Drops To 18-Month Low