Bitcoin (BTC) reached new 2023 highs on July 6 as a fresh bounce off key support buoyed bulls.

Bitcoin analyst warns of “predatory range”

Data from Cointelegraph Markets Pro and TradingView showed BTC price action surging through the top of its recent trading range.

Analysts had previously reckoned on the largest cryptocurrency dropping further, potentially reaching $28,000 to offer a classic “buy the dip” opportunity.

With momentum headed back upward, Michaël van de Poppe, founder and CEO of trading firm Eight, was optimistic.

“I hope your long entries are filled on Bitcoin. Looks quite decent here, and I think we’ll slowly continue grinding to the upside,” he told Twitter followers.

“- Breaking & Flipping $30.8K shall result into fast upwards momentum. – Retesting $30.3K would be equal for longs again.”

The uptick came several hours after Larry Fink, CEO of largest global asset manager BlackRock, called Bitcoin an “international asset” and listed several advantages during a live interview.

BlackRock’s application to launch the United States’ first Bitcoin spot-price exchange-traded fund (ETF) was refiled with regulators this week.

Continuing the analysis, financial commentator Tedtalksmacro was more cautious, warning that derivatives traders could yet influence short-term market direction.

After longs were flushed yesterday, decent spot bid thus far… but perps chasing up here.

Predatory range vibes. https://t.co/T7T2iHkeJC pic.twitter.com/0UrmWaWgrj

— tedtalksmacro (@tedtalksmacro) July 6, 2023

“Nothing but bullish consolidation”

Zooming out, popular trader John Wick said that there was nothing to fear about Bitcoin’s extended consolidation near yearly highs.

Related: Bitcoin analysis agrees BTC price may stall at $35K

#BTC Weekly

Nothing but bullish consolidation below the supply zone.

Green Dots & green bars above the Track line suggest supply zone most likely going to be overcome.

pic.twitter.com/kvWRoIjfUM— Wick (@ZeroHedge_) July 5, 2023

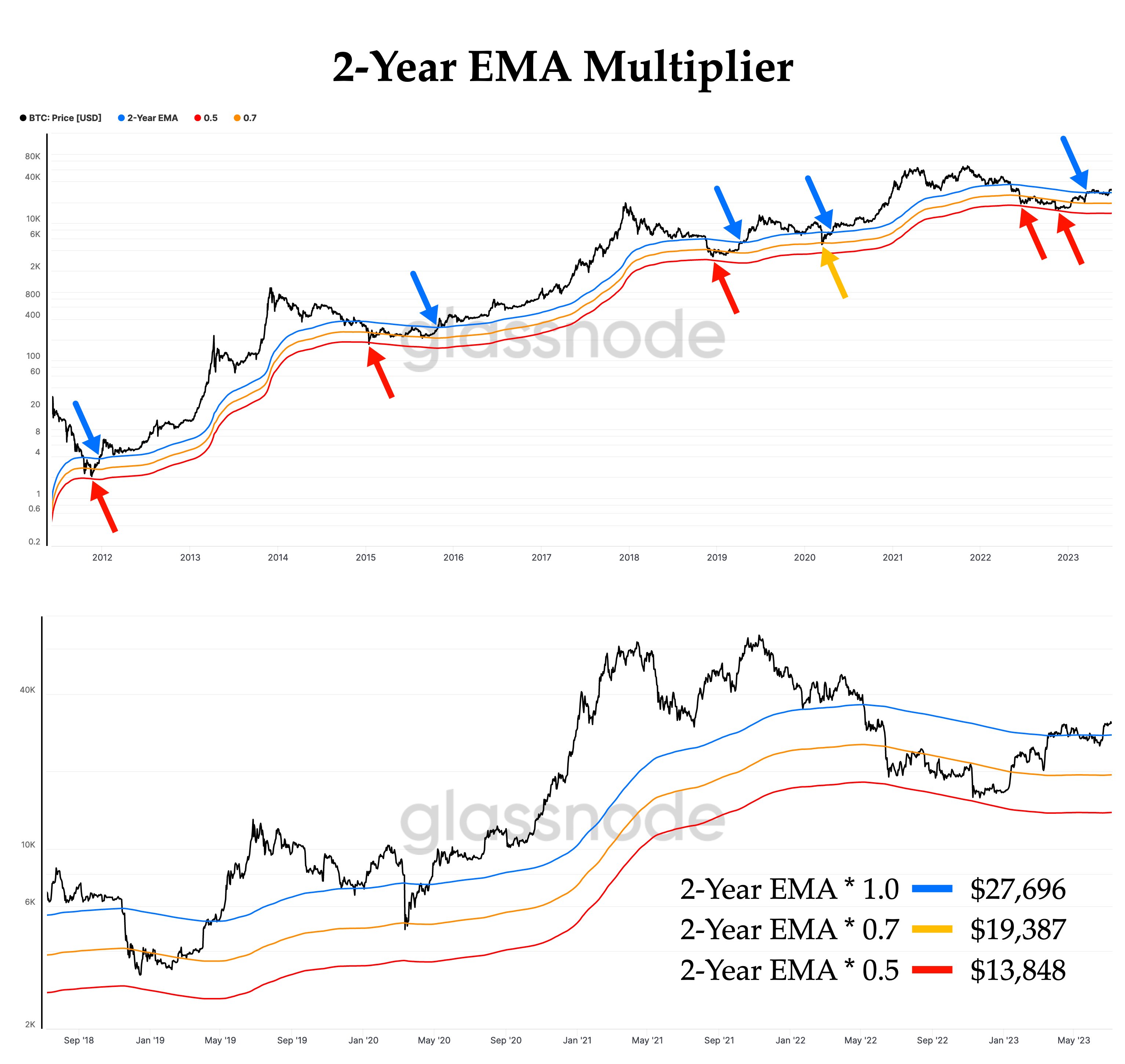

Analytics account PlanC was equally hopeful that the current phase would end in bulls’ favor. Bitcoin’s 2-year exponential moving average (EMA), currently at $28,500, was in focus.

“Bitcoin is battling to stay above the 2-Year EMA; historically, when it does, this is a bullish sign,” its latest tweet stated on the day.

“All previous cycle lows occurred when BTC was 45% to 55% below the 2-year EMA, which has already happened.”

An accompanying chart showed the so-called 2-Year EMA Multiplier, depecting BTC price behavior around its trend lines in years past.

Magazine: How smart people invest in dumb memecoins: 3-point plan for success

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.