Bitcoin has been moving sideways during the past week with a 0.7% profit as it trades at $42,709. The first crypto by market cap has held on to critical support as it was rejected at the mid area of its current levels.

Related Reading | Ukrainian Defense Efforts Bolstered By Crypto Donations

Per a recent report from Bitbank’s crypto analyst, Yuya Hasegawa Bitcoin has seen selling pressure triggered by the possibility of a shift in monetary policy from the U.S. Federal Reserve (FED). In addition, the crypto market could be reacting to the rise in tensions around the Russia-Ukraine situation.

The Russian Federation has been making several bullish announcements regarding cryptocurrencies, but as Hasegawa claims, the country could be preparing to use digital assets in case the situation escalates into a full-on conflict with Ukraine and a NATO intervention. The analyst said:

(…) this move may be a crafty preparation to circumvent the possible financial sanction–like exclusion from the SWIFT–that could be enforced once the country starts to attack Ukraine. If this is the case, it could be bad press for bitcoin and the crypto industry as a whole, and it might spark a discussion to further regulate cross-border crypto payment.

In this scenario, Bitcoin could extend its gains as investors acquire the cryptocurrency and precious metals to protect their wealth. However, any profits could be short-lived if the Russian-Ukraine situation impacts the U.S. stock market.

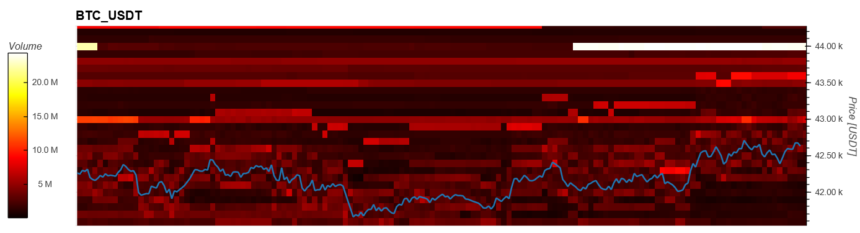

Data from Material Indicators shows that Bitcoin could see support around the $41,000 area as $10 million in bids orders sit at those levels. $40,500 could mitigate any downside in case previous levels fail with $39,700 acting as the last line of defense against a return to previous lows.

To the upside, Bitcoin faces major resistance as there are over $20 million in ask orders sitting at $44,000 alone. These orders could prevent any future bullish momentum to gain significant terrain, but they could also be operating as a psychological barrier and could be removed if the market shows strength.

Bitcoin Investors De-Risk Their Positions

A separate report from Glassnode Insights concurs with Hasegawa’s thesis and the fears about a potential conflict between Russia and Ukraine. These uncertainties were priced-in by the derivatives sector with the “futures term structure curve until March”.

Bitcoin and crypto investors are de-risking their positions in futures and have been taking put options to hedge against any future downside. Glassnode added:

Simultaneously, on-chain supply dynamics are remarkably stable, a likely indication that investors are prepared to ride out whatever storm lies ahead, preferring to utilize derivatives to hedge out risks. Overall, this speaks to the continuing maturation of the Bitcoin market, as liquidity deepens, and more comprehensive risk management instruments become available.

Related Reading | TA: Bitcoin Breaks Key Support, Why BTC Could Dive Below $40K

The spot sector and BTC on-chain inflows seem to be operating in favor of the bulls and dismissing any fear around the Ukraine-Russia situation.