Bitcoin metrics indicate weak demand, reflecting increased selling amid weeks of muted price action. CryptoQuant’s demand indicator, which tracks the difference between the daily total bitcoin block rewards and the daily change in the number of bitcoin, has not moved in a year or more. Inflows to spot bitcoin ETFs have also waned from a monthly pace of 6% in March to just 1% now, CryptoQuant has said. Still, a few metrics have remained strong. Long-term holders – or wallets that hold the for more than six months – have continued accumulating bitcoin at “unprecedented levels,” with the total balance reaching a record-high monthly rate of 391,000 BTC earlier this week.

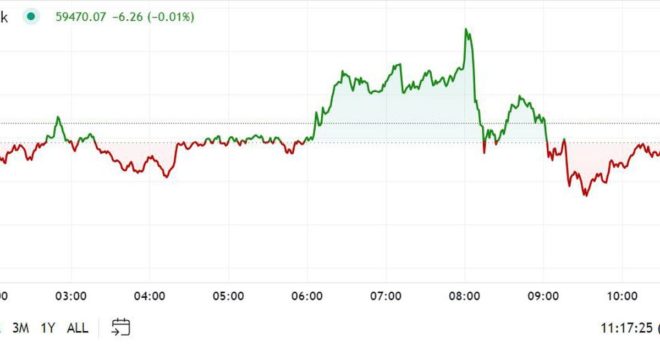

Bitcoin Holds Below $60K Before U.S. Jobs Data Revision