According to Fidelity’s Jurrien Timmer, Bitcoin is currently undervalued. The benchmark crypto has been pushed back to 2020 levels after losing over 70% of its value in the past months.

Related Reading | Crypto Traders Lose $280 Million Following Bitcoin’s Break Above $22,000

At the time of writing, Bitcoin has begun showing some green as it makes its way back above its 2017 all-time high levels. The cryptocurrency trades at $21,900 with a 1% profit in the last 24 hours.

Bitcoin At 2013 Valuation Levels, Most Underpriced In Years

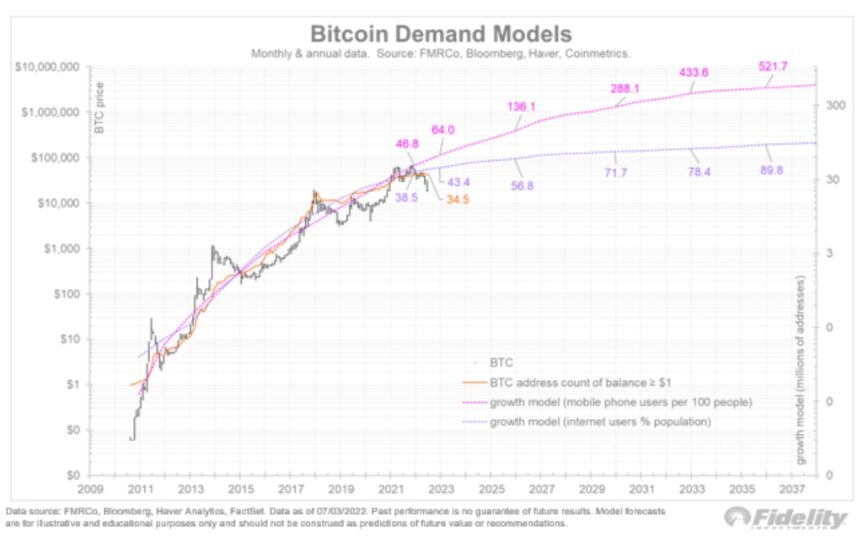

Via Twitter, Timmer wrote about the Crypto Winter and the reasons why BTC’s price is undervalued according to his “conservative” price S-curve model. The expert designed this price model based on the exponential expansion of the internet and mobile phones.

As seen below, the recent downside Bitcoin price action seems to be following the internet’s demand model which could lead to slower network growth and “modest price appreciation”. If BTC’s price continues to follow this model over the coming years, the cryptocurrency could be priced at around $100,000 by 2030

Despite the recent downside price action below its previous all-time high, Timmer claims Bitcoin continues to follow its demand curve. This means that people are still buying BTC despite the price crash.

The expert claims the cryptocurrency reached a 2013 valuation level. At the same time, the number of BTC non-zero addresses is trending to the downside. In other words, as BTC’s price declines, people appear to be buying it. Timmer said:

I use the price per millions of non-zero addresses as an estimate for Bitcoin’s valuation, and the chart below shows that valuation is all the way back to 2013 levels, even though price is only back to 2020 levels. In other words, Bitcoin is cheap.

What A Cheap Bitcoin Spells For Ethereum

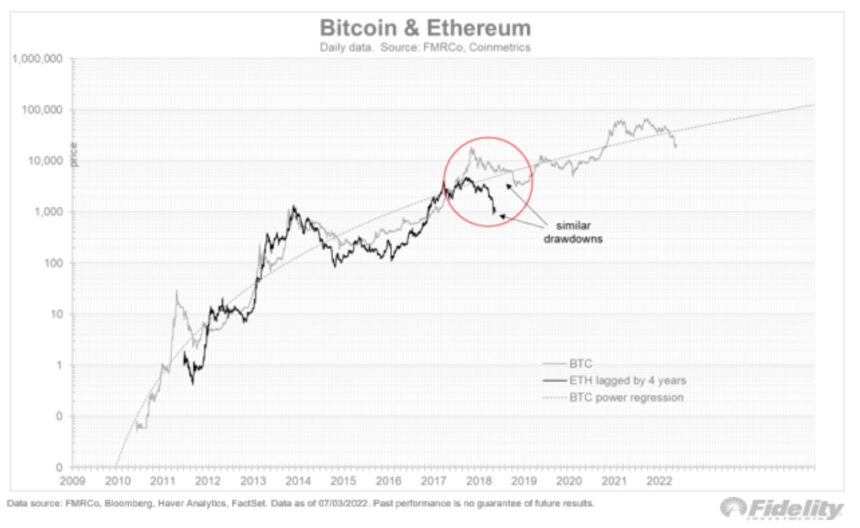

When Timmer compared BTC’s price current valuation to that of Ethereum, he concluded that the second crypto by market cap could be even “cheaper”. ETH’s price has experienced a “similar” drawdown to that of Bitcoin in 2018.

At that time, the number one crypto by market cap rallied from around $3,000 to $20,000. In subsequent years, it would revisit the former level.

Related Reading | Solana Glints With 14% 3-Day Rally – Will SOL Keep On Beaming?

As seen below, Ethereum could be following this trajectory. Timmer explained:

If Bitcoin is cheap, then perhaps Ethereum is cheaper. If ETH is where BTC was four years ago, then the analog below suggests that Ethereum could be close to a bottom.