Bitcoin (BTC) has been consolidating between $25,800 and $26,100 since Aug. 18. However, market intelligence data suggests that the flagship cryptocurrency is undervalued.

According to Santiment, Bitcoin’s market value over realized value (MVRV) ratio on a 30-day moving average has dropped by 8.49%. This suggests that the asset’s price is currently undervalued at this point.

Buy the dip?

On the other hand, the social volume for the term “buy the dip” has dropped significantly after it skyrocketed last week. Per Santiment, the optimism for a “quick market recovery” has faded.

Moreover, the analysis suggests that most optimism came from Reddit, while Twitter and Telegram had a small share that has already been neutralized.

“Believe it or not, it’s a good sign that people are no longer certain that this is a dip buy spot.”

Santiment analyst

Per Santiment, Bitcoin’s social dominance witnessed a massive surge when the asset took a deep dive from the $28,000 mark on Aug. 18.

Furthermore, the analyst suggests that long-term active BTC investors are still profitable, with the 365-day MVRV ratio sitting above 5%. Per Santiment, many short positions remain open on exchanges despite the recent price downturn.

Bitcoin is up by 0.24% in the past 24 hours and trading at $26,070 at the time of writing. The hike comes as the asset’s 24-hour trading volume witnessed a 40% surge, reaching $12.9 billion.

BTC dropped below the $26,000 mark on Aug. 21, while the number of addresses holding at least one coin reached a new all-time high.

Bitcoin whales shuffle

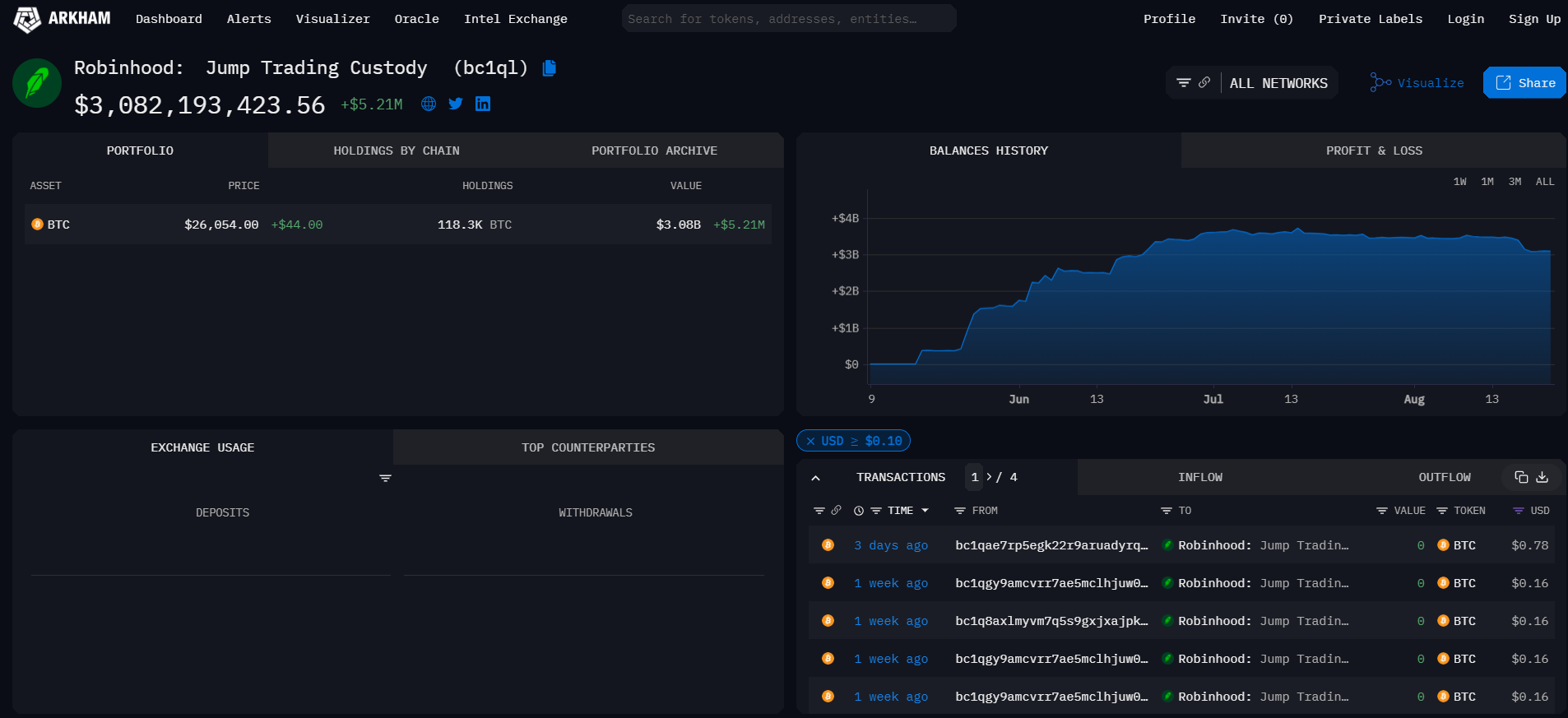

According to data provided by BitInfoCharts, a Bitcoin wallet has accumulated 118,300 BTC over the past three months. The assets in the address are currently worth $3.08 billion at the time of writing.

While some claim the address belongs to the Gemini crypto exchange, data provided by Arkham suggests the wallet belongs to Robinhood.