Following the Bitcoin halving, three so-called BTC layer 2 protocols have outperformed crypto’s leading token.

At press time, Bitcoin (BTC) traded over $65,000 and had gained 2.9% in the past 24 hours, according to CoinGecko data. The short-term price action following BTC’s halving is not unusual compared to previous cycles.

Historical data shows volatility and price swings leading to the quadrennial events, followed by a parabolic Bitcoin run in the mid to long term. However, previous increases have hardly ever been in a straight line.

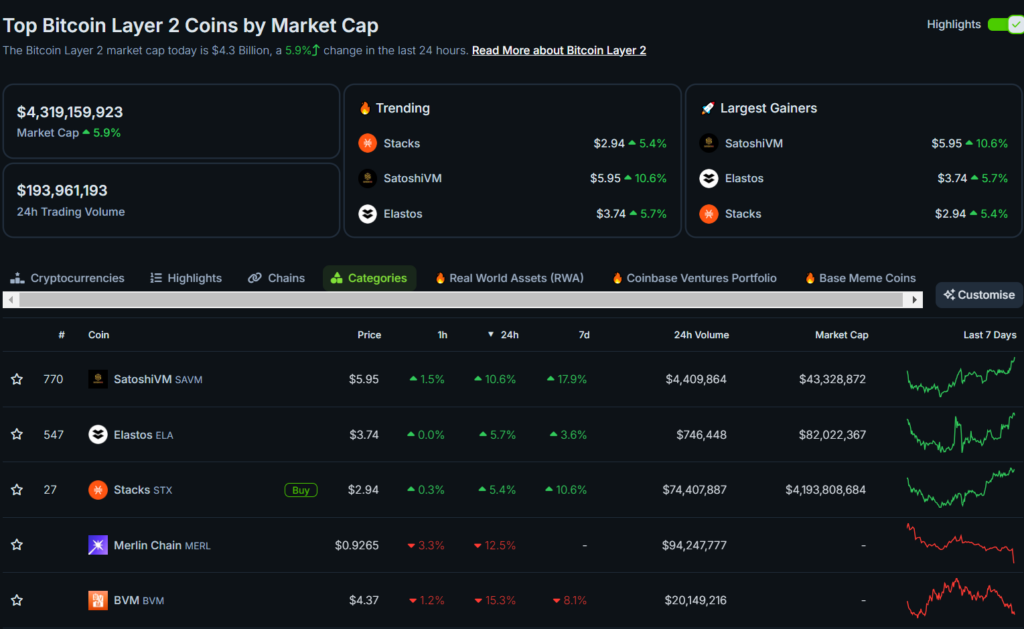

While BTC displayed modest gains after its halving, protocols buildings around crypto’s largest blockchains posted higher increases in the last 24 hours and over the past week. Three tokens stood out from five BTC L2 solutions categorized by CoinGecko, which holds over $4 billion in value.

SatoshiVM

SatoshiVM (SAVM) claims to be a BTC zero-knowledge rollup compatible with the Ethereum Virtual Machine, or EVM, as it’s commonly known in crypto. The protocol uses native BTC as gas fees and allows builders to issue assets, dapps, and solutions linked with Bitcoin’s ecosystem.

SAVM surged 12% over the past day and returned more than 17.9% to holders in the last week.

Elastos

Elastos (ELA) holders gained north of 5.5% in 24 hours but only 3.6% within the past week. The protocol aims to bolster BTC efficiency and scalability by providing its L2 dubbed BeL2, a layer 2 offering built using SmartWeb technology to power smart contracts on Bitcoin.

Stacks

Stacks (STX) tailed Elastos for daily growth at 5.4% but outpaced ELA on the weekly timeline with a 10.6% increase. According to the team, Stacks supports dapp developments and on-chain settlement on Bitcoin.

The protocol says its Stacks layer unlocks around $500 billion in BTC capital through this direct settlement mechanism.