The People’s Bank of China took steps to stimulate the economy, including cutting the reserve requirement ratio for mainland banks by 50 basis points. The move drew little response from crypto prices. Asian stocks, on the other hand, rallied, with Hong Kong’s Hang Seng index climbing 3.2% and the Shanghai Composite index adding 2.3%. “Bitcoin’s lack of response to this news, juxtaposed against rallying Chinese indices, highlights that its current beta appears more tightly linked to Fed policy and U.S. markets, as evidenced by near two-year high correlations with US stocks, particularly following last week’s FOMC meeting,” Rick Maeda, a Singapore-based research analyst at Presto Research, wrote to CoinDesk in a note.

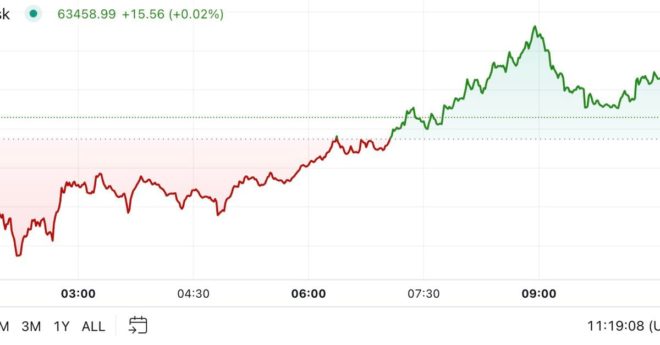

Bitcoin Little Changed in Face of PBOC Rate Cut