Key Notes

- Bitcoin average mining cost is at $101,000, according to MacroMicro data, while BTC price hovers around $93,000, creating an $8,000 difference in potential losses.

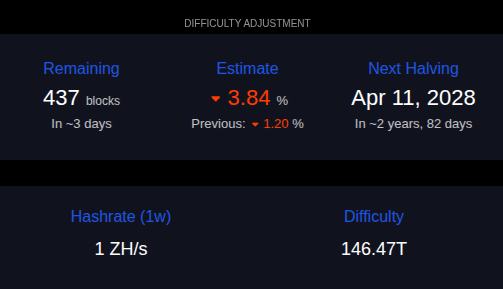

- The network hashrate has been dropping consistently, also causing the mining difficulty adjustment to drop for the seventh time in the last eight readjusting.

- Michael Saylor hints at more purchases and institutional inflow to crypto reaching local highs despite the mining network state.

.

Bitcoin hashrate and mining difficulty have been dropping since November 2025, as Bitcoin miners could have been mining unprofitably according to average cost data.

In particular, data Coinspeaker retrieved from MacroMicro shows a net-negative difference of over $8,000 between Bitcoin’s average mining cost and its market price as of Jan. 19, 2026. By the time of this writing, mining 1 Bitcoin

BTC

$93 024

24h volatility:

2.5%

Market cap:

$1.86 T

Vol. 24h:

$44.54 B

cost approximately $101,000, while the cryptocurrency was trading at around $93,000. The platform gets its average from calculations based on Cambridge University-provided data.

Bitcoin average mining costs and price as of Jan. 19, 2026 | Source: MacroMicro

“Through observing consumption of electricity and daily issuance of bitcoin, provided by Cambridge University, we can find out the average mining costs of bitcoin. When mining costs are lower than bitcoin’s market value, more miners will join. When mining costs are higher than a miner’s revenue, number of miners will decrease,” MacroMicro wrote.

This happens because mining Bitcoin is a competitive activity that requires significant loads of computation and energy. The more miners competing for the prize, the harder it becomes to mine a block, and the more expensive the activity becomes. On the other hand, the contrary effect happens when miners leave the network due to low profitability—balancing the difficulty and average cost accordingly.

However, Bitcoin miners may choose to continue mining currently unprofitable BTC, effectively paying a premium for the coins, if they believe its price will increase in the long run. Again, the opposite is also true, as miners could decide to stop mining if they foresee lower prices ahead.

Bitcoin Mining Difficulty and Hashrate Drop

According to CoinDesk, Bitcoin’s network hashrate—the total computing power securing the blockchain—has declined roughly 15% from its Oct. 2025 peak, dropping from approximately 1.1 zettahashes per second (ZH/s) to around 977 exahashes per second (EH/s). This sharp fall signals widespread miner capitulation, with operators powering down equipment as profit margins narrow amid elevated operational costs and stagnant or declining Bitcoin prices since late 2025.

The ongoing stress is further evidenced by Bitcoin’s mining difficulty, which is scheduled for another roughly 4% downward adjustment on Jan. 22, 2026, marking the seventh negative adjustment in the past eight periods. Onchain data Coinspeaker gathered from mempool.space corroborates CoinDesk’s report, showing an expected 3.84% reduction after a previous 1.20%.

Bitcoin mining difficulty adjustment and hashrate as of Jan. 19, 2026 | Source: mempool.space

Glassnode’s Hash Ribbon indicator, which tracks capitulation by comparing short- and long-term hashrate moving averages, inverted on Nov. 29, 2025, indicating miners have been forced to sell holdings to cover expenses, adding near-term selling pressure to the market, CoinDesk continued reporting.

Nevertheless, Michael Saylor hints at potential new buys for his Bitcoin treasury company Strategy, joining other optimistic movements from institutional players. Last week, crypto inflow hit its largest values since Oct. last year, another signal for institutional interest. Moreover, Blockspace Media has acquired onchain data analytics platform Bitcoin Layers, integrating its data capabilities to expand its Bitcoin-focused media offerings.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.