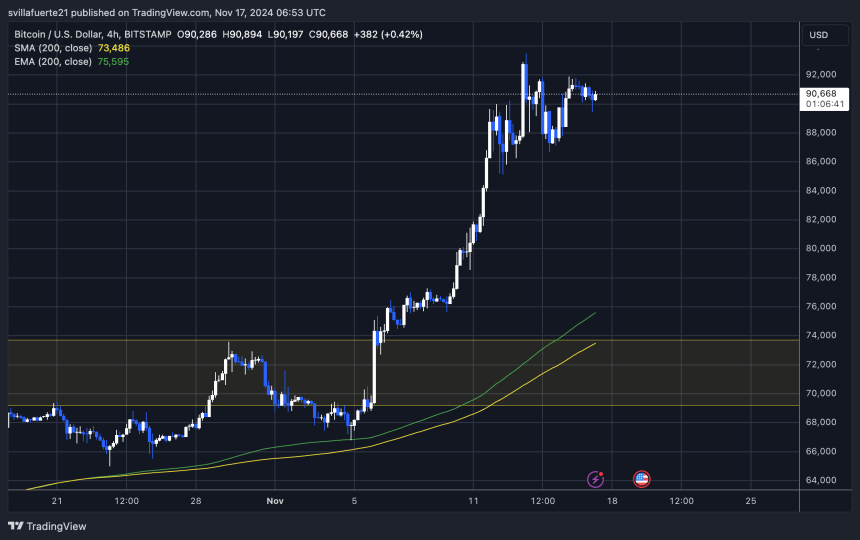

Bitcoin has maintained its bullish momentum over the weekend, solidifying its position above the $90,000 mark. This milestone showcases Bitcoin’s resilience as it continues to captivate investors with its upward trajectory. The market has been buzzing with optimism as Bitcoin inches closer to new highs. However, recent on-chain data suggests that a potential pullback could be on the horizon.

Related Reading

Key data from CryptoQuant reveals that Bitcoin miners have sold over 3,000 BTC in the past 48 hours. This wave of miner profit-taking often signals a cooling phase, as it introduces additional supply into the market. While the selling activity is not uncommon during periods of strong price action, it could lead to a short-term consolidation phase below the all-time high of $93,400 set earlier this week.

Despite this, Bitcoin’s ability to hold above $90,000 highlights strong underlying demand and robust market sentiment. Investors and analysts are closely watching the coming days to see if Bitcoin can absorb this selling pressure and maintain its bullish trajectory.

Bitcoin Looks Very Strong

Bitcoin’s price action has remained robust, breaking all-time highs multiple times over the past 11 days and reaffirming its bullish momentum. However, after such an aggressive upward movement, the market appears to be entering a period of consolidation as some investors and entities lock in profits.

Crypto analyst Ali Martinez shared key data on X that highlights that Bitcoin miners have sold over 3,000 BTC in the past 48 hours, valued at approximately $273 million. This selling activity suggests that miners, typically long-term holders, are taking profits amid the recent surge. Such moves are common during strong bull runs and can indicate that market participants anticipate a short-term price plateau or retrace.

While miner selling is a natural part of market dynamics, sustained activity of this kind could signal a shift in sentiment. If selling pressure persists, it might push Bitcoin toward lower demand zones, providing potential re-entry opportunities for sidelined investors.

Related Reading

Currently, Bitcoin’s ability to absorb this selling pressure will determine whether the current bullish trend remains intact. A brief consolidation phase may be beneficial, allowing the market to establish a stronger foundation for the next leg up. For now, investors are closely watching key levels to gauge the potential for continued growth or a deeper correction.

BTC Holds Steady Above $90,000

Bitcoin is currently trading at $90,600 after a volatile few days that saw its price range between its all-time high of $93,483 and a local low of $86,600. This consolidation comes after aggressive bullish momentum that set new records, leaving investors and analysts watching the next moves closely.

Despite the recent cooling off, Bitcoin’s price action remains strong, supported by increasing demand and overall bullish sentiment. If Bitcoin can hold above the $86,000 level over the next few days, a renewed surge to challenge and potentially surpass its all-time high seems plausible. The market has shown resilience, with fresh demand continuing to emerge even as minor profit-taking occurs.

Related Reading

However, there is a risk of a deeper retracement. Should Bitcoin lose support at $86,000, it would likely test lower demand levels, searching for a strong base to fuel its next upward move. Key support zones could provide the foundation for renewed buying interest and set the stage for the next bullish phase.

Featured image from Dall-E, chart from TradingView