The Bitcoin (BTC) network mining difficulty, the relative computing challenge of adding a new block to the ledger, increased slightly to 148.2 trillion in the last adjustment of 2025 and is projected to rise again in January 2026.

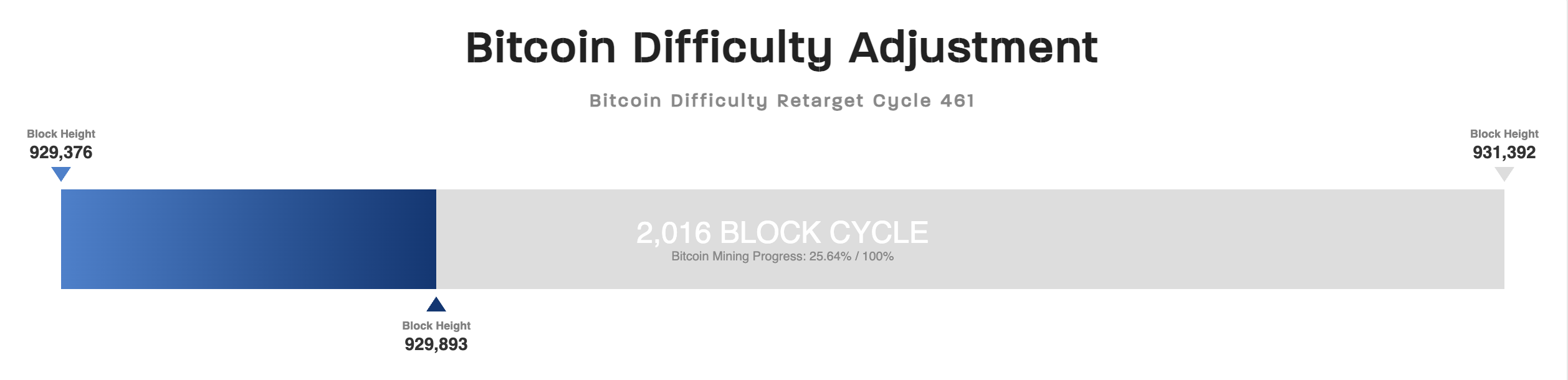

The next Bitcoin difficulty adjustment is projected to occur on January 8, 2026, at block height 931,392 and is expected to raise the network mining difficulty to 149 trillion, according to CoinWarz.

Average block times are about 9.95 minutes at the time of this writing, slightly below the 10-minute target, meaning that difficulty will likely increase to get block times closer to the target.

Mining difficulty reached new all-time highs in 2025, recording two sharp rises in September, during Bitcoin’s uptrend, before the price collapsed in October’s historic market crash.

Rising mining difficulty means that miners will have to expend more computing and energy resources to remain competitive, adding to the list of burdens operators in the capital-intensive sector face.

Related: Bitcoin mining’s 2026 reckoning: AI pivots, margin pressure and a fight to survive

The difficulty adjustment protects network decentralization and Bitcoin’s price

The Bitcoin network’s mining difficulty ensures that blocks are not mined too quickly or too slowly by adjusting the relative challenge of successfully mining blocks and adding the blocks to the decentralized monetary ledger.

Difficulty adjusts every 2016 blocks, or about every two weeks, in response to the average block time. If miners are finding and adding blocks too quickly, the difficulty adjusts up to keep the target as close to 10 minutes as possible, and vice versa.

This dynamic difficulty adjustment ensures that no single miner can take control of the network by suddenly energizing more mining rigs or adding a disproportionate amount of computing power to the network in a short period, keeping the network sufficiently decentralized.

A 51% attack can occur if a single miner or a group of miners collude to control the majority of the network’s computing power, leading to centralization, double-spending, and a collapse of Bitcoin’s core value proposition, which would significantly impact the asset’s price.

Even if no 51% attack occurs, a miner with vast computing resources could continue to mine blocks at an accelerated pace, collecting all the block rewards and dumping the BTC on the market, introducing strong selling pressure that would depress Bitcoin’s price.

Dynamically adjusting the mining difficulty to be proportional to the total amount of computing resources deployed on the Bitcoin network keeps the protocol decentralized and protects Bitcoin’s price by ensuring a steady supply schedule.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea