Bitcoin’s open interest in futures markets recently reached an all-time high amid the latest market upsurge that has seen the asset claim new price peaks.

The Bitcoin (BTC) OI has spiked to $55.7 billion, indicating a massive increase in trading activity and investor interest, according to the data aggregator Coinglass. This latest surge follows a previous slump to $26.65 billion on Aug. 6.

CME accounts for most of this figure, holding about 32.3% of the total Bitcoin futures OI with 197,620 BTC, valued at $18 billion.

Binance, the largest crypto exchange by trading volume, follows, accounting for 19.47% of the total OI, with an open interest of over 119,000 BTC worth around $10.86 billion.

Bybit ranks third with 13.49% of the open interest, reaching 82,580 BTC or $7.53 billion, while Bitget and OKX round out the top five, each holding about 9.9% and 7.91% of the market share, respectively.

The recent recovery in OI comes on the back of a bullish price rally that began around the U.S. presidential election on Nov. 5. As the market reacted to Donald Trump’s election victory, Bitcoin skyrocketed, setting new records along the way.

The cryptocurrency briefly reached a new all-time high of $93,480 yesterday before pulling back slightly. Bitcoin is up 4% over the last 24 hours and is trading at $91,108 at the time of writing.

Bitcoin faces resistance

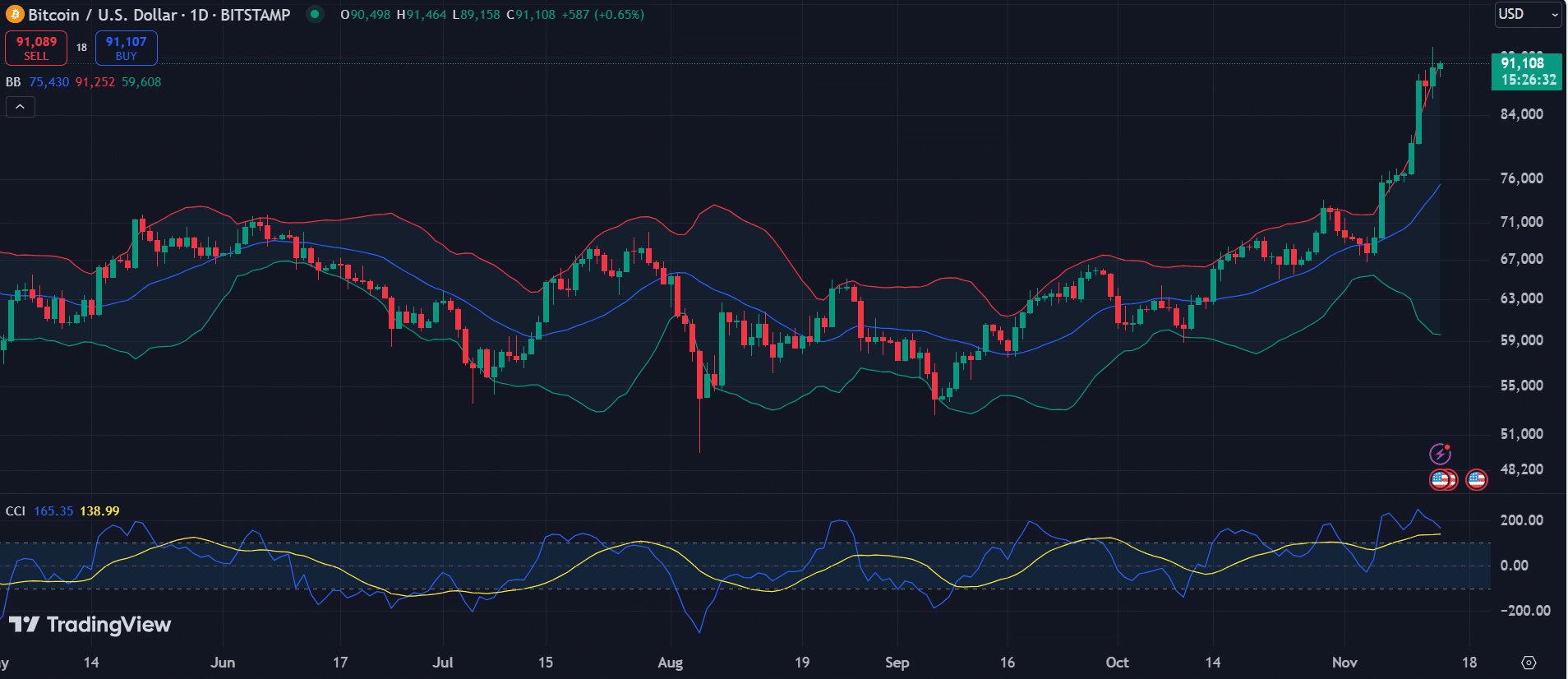

Bitcoin is encountering resistance around the $91,265 level, near its upper Bollinger Band, and will need to overcome this barrier to continue its upward trend.

Amid the upsurge, the Commodity Channel Index recently hit a peak of 247, suggesting that the asset is in overbought territory. Although the CCI has since retraced to 163.35, there appears to be a divergence between this indicator and Bitcoin’s price.

Notably, the flagship cryptocurrency has continued to reach new heights over the past three days, but its CCI has dropped within this period. The divergence between the CCI drop and Bitcoin’s new highs could indicate a potential slowdown.

If Bitcoin fails to break through the current resistance, a pullback may be imminent. In that scenario, the nearest support is at $88,000, with further stability around $87,113 and $83,258 if the decline continues.

Nevertheless, the elevated OI could mean investors are still optimistic, and a successful breach of the $91,265 resistance could lead Bitcoin to retest its recent ATH above $93,000.