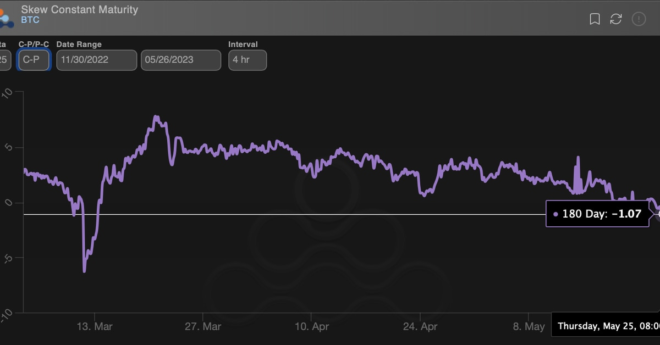

The six-month call-put skew, which measures the difference between what investors are willing to pay for bullish calls and bearish puts expiring in 180 days, has declined to -1, the lowest since March 13, according to data from leading crypto options exchange Deribit, tracked by Amberdata.

Bitcoin Options Market Signals Weakness over Six Months Amid Debt Ceiling Drama