Speculative trading on-chain, either through inscriptions on bitcoin, or transactions interacting with non-fungible tokens (NFTs) on ether {ETH}}, is another retail participation indicator. In bull markets, we tend to see high fee levels as investors speculate on-chain, with the 2021 market top being a prime example. Currently, however, NFT gas usage on ether is only around 2% versus 2021 when the percentage of gas consumed was at 40%, according to Glassnode data.

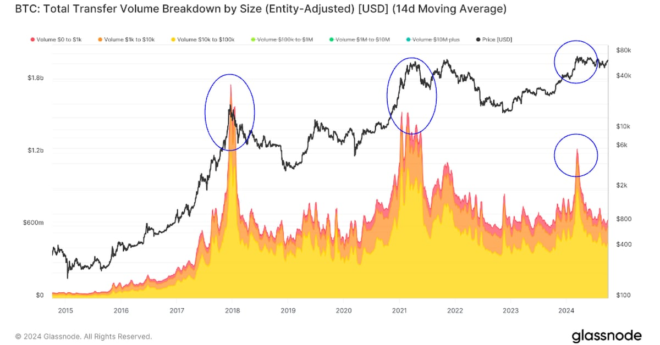

Bitcoin Price (BTC) Could Rise Further Based on Low Retail Activity