Weller said that spot ETFs, unlike futures-based products, could “fundamentally alter the supply and demand picture” for bitcoin, making it available for a new set of investors. That’s especially so now that bitcoin has regained its “uncorrelated asset” lure by decoupling from equities and rallying as U.S. stocks have entered correction territory, he added.

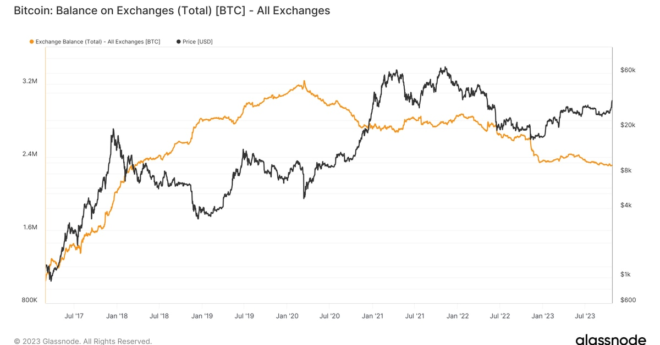

Bitcoin Price (BTC) Primed as Supply on Crypto Exchanges Is at Lowest Since 2018