Bitcoin (BTC) went on to hit its highest level since Jan. 2 on March 28’s Wall Street open as its latest bull run kept up the pace.

BTC dip nonessential but “would be healthy”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $47,900 on Bitstamp, just $100 away from a new 2022 peak.

The move followed a strong move into the weekly close, which continued on March 28, producing weekly gains of nearly 17%.

It doesn’t have to happen but…

A #BTC dip would be healthy

Because price would be able to go ahead and reclaim a previous resistance as new support

Same goes for many Altcoins that have enjoyed strong moves as of late$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 28, 2022

While some began to call for a retracement to shore up new support levels, excitement nonetheless remained as the driving mood at the time of writing.

“Multi-month regime of both spot premium and quarterlies backwardation + Massive on-chain accumulation by several measures. All we’ve been missing is momentum,” Blockware lead insights analyst William Clemente explained.

“As long as $46K holds, think momentum/trend-based market participants push this back to range highs.”

That perspective was echoed by Rekt Capital, who identified two key moving averages as providing the potential fuel to send the largest cryptocurrency back to all-time highs.

The moment #BTC is able to breach the mid-range resistance…

Is the moment that $BTC will ascend into the upper half of its Macro Re-Accumulation Range#Crypto #Bitcoin pic.twitter.com/cJh2T4eiNP

— Rekt Capital (@rektcapital) March 28, 2022

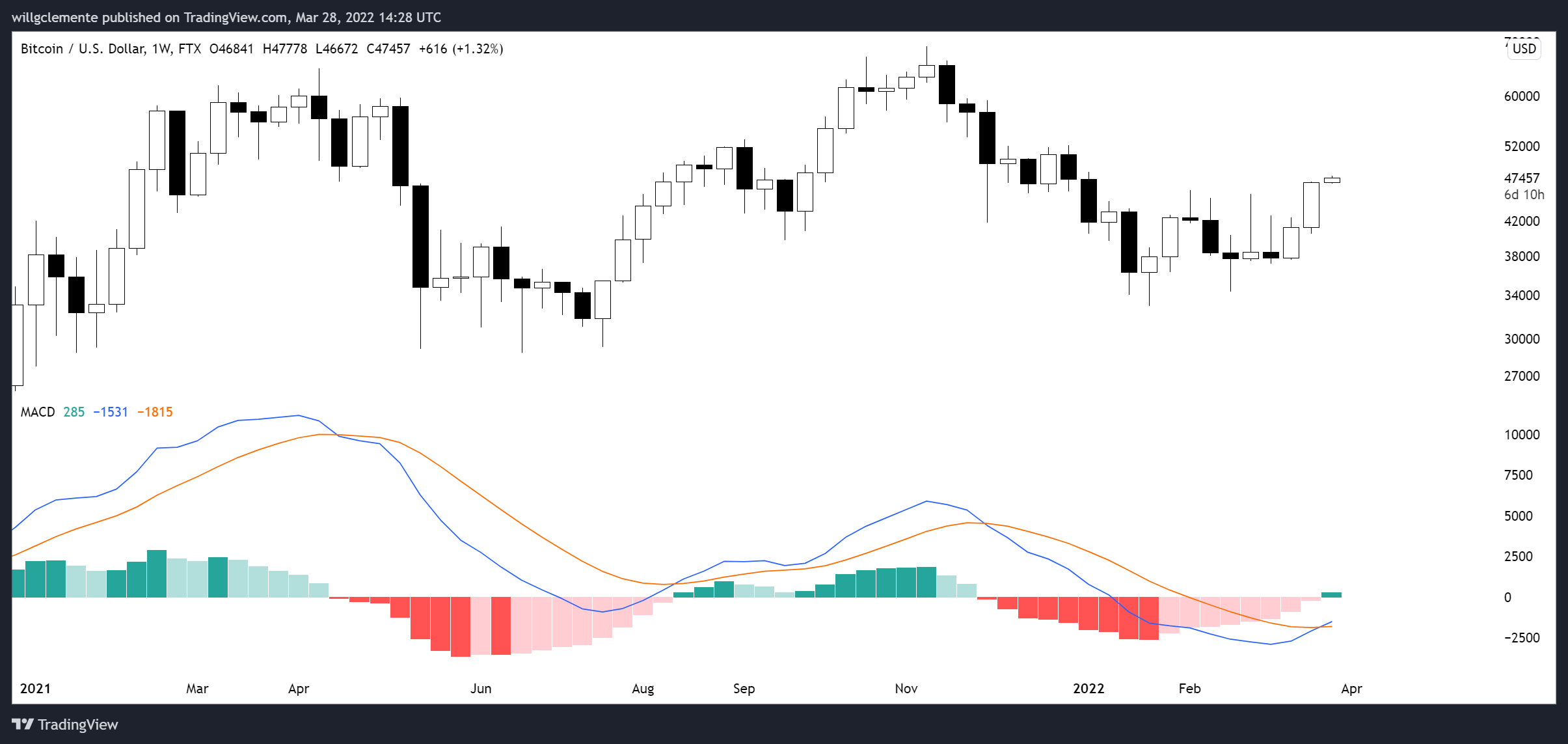

Clemente added a chart showing that Bitcoin’s moving average convergence divergence (MACD) indicator had flipped green, signaling the start of an uptrend, for the first time since November’s all-time highs.

On-chain monitoring resource Whalemap, meanwhile, reiterated that $47,400 was a key area on macro levels thanks to accumulation having taken place there previously.

The macro outlook stays the same as in the tweet below

47.4k is the most important level in the 47k area right now

Lets see how #Bitcoin reacts https://t.co/oAfqKLUKoa

— whalemap (@whale_map) March 28, 2022

In an additional nod to the current rally being more sustainable than previous ones this year, analyst Philip Swift highlighted that funding rates on derivatives platforms remained curiously low despite optimism in both sentiment and market performance.

2022 “won’t be that easy” for risk assets

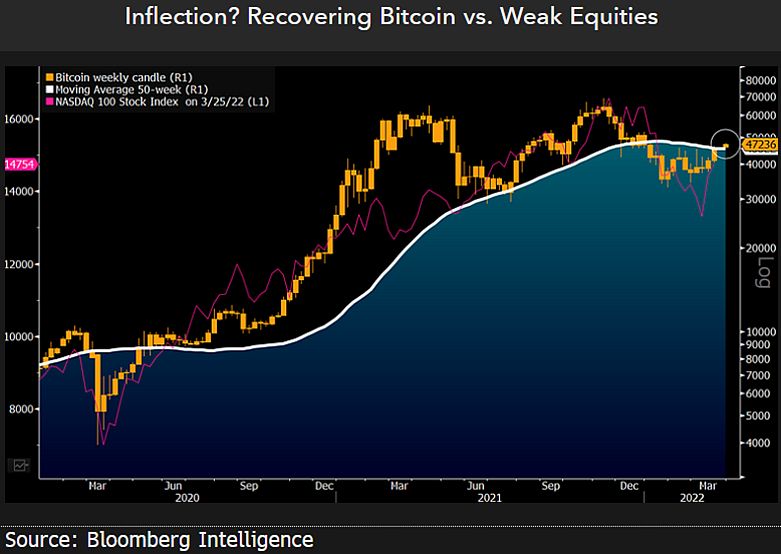

For macro analysts, the focus was on whether Bitcoin was breaking out against traditional assets with its latest gains.

Related: Buy pressure ‘in bull market territory’ — 5 things to know in Bitcoin this week

U.S. stocks were mostly flat on March 28’s open, while gold enjoyed only a modest uptick.

Discussing the trend, Mike McGlone, senior commodity strategist at Bloomberg Intelligence, queried whether BTC might be “taking the risk-off baton.”

“1Q may be just another blip in the trend of rising risk assets amid the highest inflation in 40 years and war in Europe, yet our bias is that the 2022 endgame isn’t likely to be that easy,” he reasoned.

McGlone added that Bitcoin was nonetheless “showing divergent strength.”

The analyst had recently said that BTC/USD could “easily” return to $30,000 before achieving six figures in current macro conditions.