Key takeaways:

-

A developing bear pennant keeps a BTC price drop toward $56,000 in play.

-

Rising whale inflows to Binance further the downside outlook.

Bitcoin (BTC) may slide deeper into February as its bearish chart structure converges with renewed whale activity on Binance.

Bear pennant setup hints at 20% BTC price decline

Bitcoin has been painting what appears to be a bear pennant setup on its daily chart.

A bear pennant pattern forms when the price consolidates inside converging trendlines after a sharp drop, called the “flagpole.” It often resolves with another leg down, roughly matching the initial decline.

On BTC’s chart, the structure emerged after the steep sell-off toward the $60,000 zone. The price has since compressed into a tightening triangle while remaining below key moving averages, signaling weak momentum.

A decisive breakdown beneath the pennant support could open the door to a move below the $56,000 mark, roughly 20% below the current levels, in February.

Conversely, a break above the pennant’s upper trendline, aligning with the 20-day exponential moving average (20-day EMA; the green wave) at around $72,700, may invalidate the bearish setup altogether.

Whale inflows on Binance add to bearish BTC setup

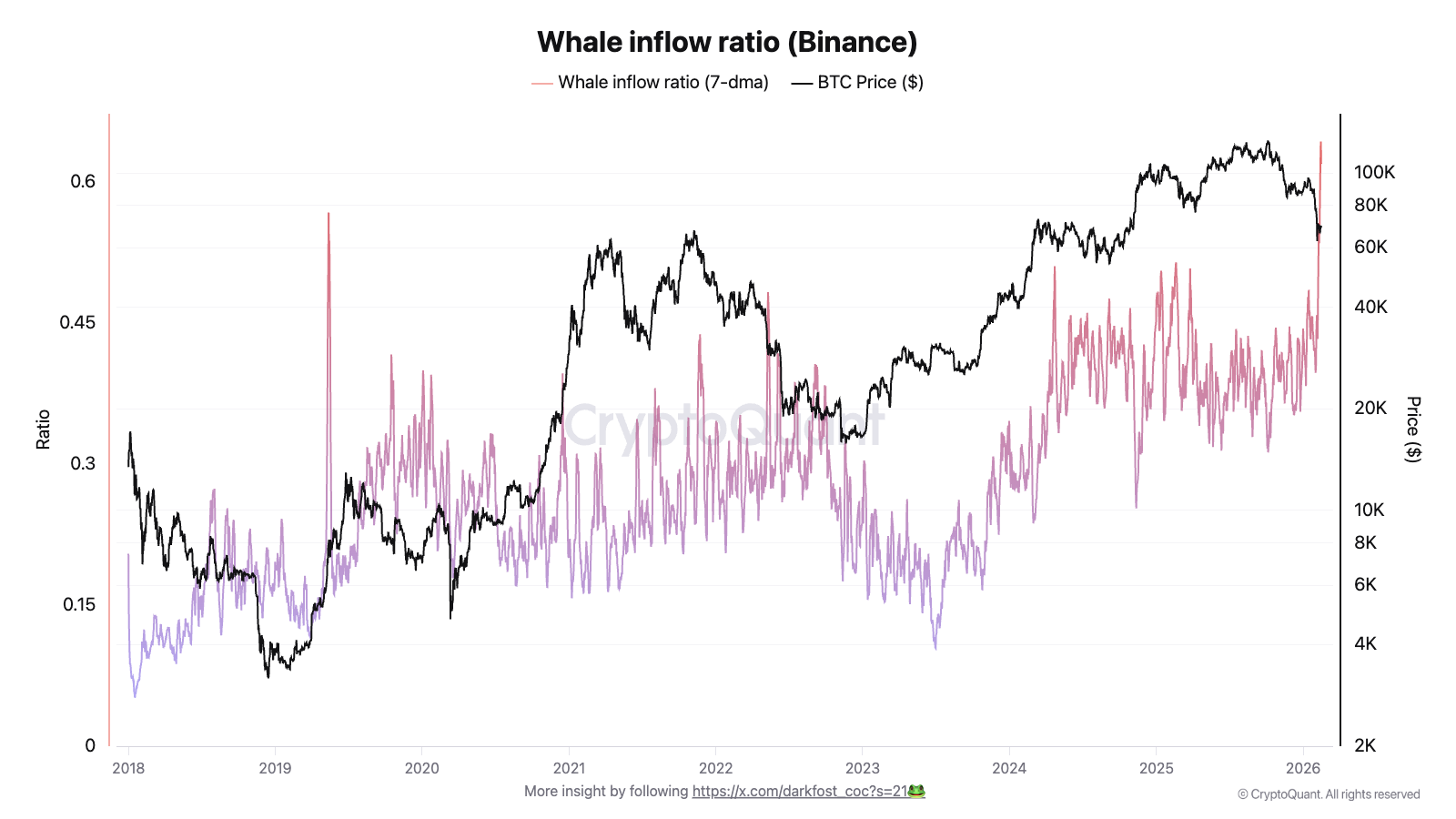

As of Feb. 17, Bitcoin’s whale inflow ratio (7-day average) had spiked to a record high of 0.619 compared to 0.40 at the month’s beginning, according to data resource CryptoQuant.

The ratio compares exchange inflows from the 10 biggest BTC transactions to total inflows. Its rise, according to Darkfost, a CryptoQuant-associated analyst, can be interpreted as rising sell-side pressure from whales.

Part of the recent jump may be tied to a well-known whale believed to be Garrett Jin.

Nicknamed 195DJ, or the “Hyperunit whale,” the entity has reportedly been especially active on Binance, moving close to 10,000 BTC onto the platform in recent transfers, data tracked by CryptoQuant shows.

Bitcoin’s durable bottom is near

Matrixport’s signal introduces a short-term counterbalance to the bearish setup.

As of this week, Bitcoin’s “fear and greed index” triggered a potential bottoming signal: the 21-day moving average has dipped below zero and is now turning higher.

Historically, that combination has lined up with “durable bottoms,” implying sellers may be running out of momentum.

Related: Bitcoin accumulation wave puts $80K back in play: Analyst

That doesn’t rule out another flush lower, but it raises the odds of a relief bounce before any sustained breakdown takes hold.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.