Bitcoin price has stagnated around $42,000 since the ‘sell-the-news’ cycle on the Bitcoin ETF narrative triggered a 15% retreat last week.

Bullish headwinds from the Bitcoin spot ETF approval saw Bitcoin price raced to a local top of $48,900 on Jan. 11. However, speculative traders who “sold-the-news” instantly sent BTC price tumbling 15% toward $42,000 within hours.

Can Bitcoin price avoid a downswing below $40,000? On-chain data analysis provides vital insights.

Large institutional investors have continued to buy Bitcoin behind the scenes

Speculative traders took advantage of the price uptick that followed the much-anticipated ETF approval verdict on Jan. 11, to sell at the top, booking sizable profits. In effect, Bitcoin has exhibited relatively flat price action since then.

Interestingly, a vital on-chain metric shows that large institutional investors have remained ressilient amid the price downtrend.

IntoTheBlock’s large holder netflow chart tracks corporate investors’ trading activity, by measuring the total inflows against daily outflows from wallets holding at least 0.1% of a cryptocurrency’s current circulating supply.

The Large Holder Netflow has been trending in positive values since the BTC price decline began on Jan. 11. More specifically, the whales have acquired a total of 15,950 BTC between Jan. 11 and Jan. 17.

The chart above clearly emphasizes that while BTC price has been in decline since Jan. 11, the whales have remained in accumulation mode.

Valued at the current price of $42,700, the 15,950 BTC newly-acquired by the whales in the last 7 days are worth approximately $681 million.

Given growing adoption of the newly-launched Bitcoin ETFs, the participants and fund sponsors are likely to keep up this whale buying trend in the coming days.

If this scenario plays out as expected, Bitcoin will attract sufficient demand to hold up above the $40,000, in the short-term.

Retail investors are gradually taking bullish positions on BTC again

The sell-the-news panic that ensued in the aftermath of the Bitcoin ETF approval saw retail investors switch focus from BTC to ETH and other top-charting altcoins. But recent on-chain data readings shows that the day traders are gradually swinging bullish on BTC again.

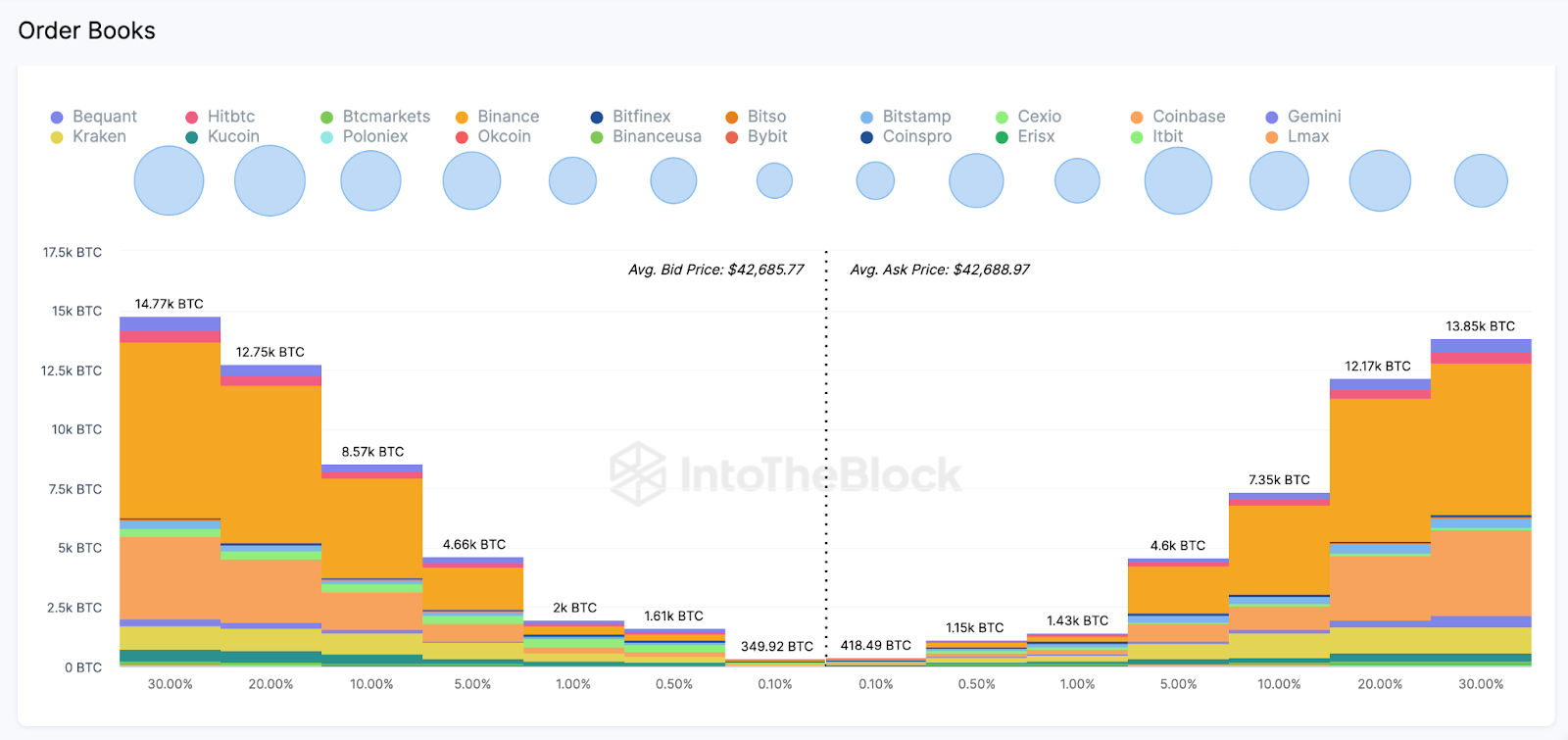

IntoTheBlock’s aggregate exchange order books chart captures the total active buy/sell orders currently listed for a cryptocurrency across multiple exchanges.

Currently, there are active purchase orders for 44,709 BTC listed across 20 crypto exchanges including Binance and Coinbase. Meanwhile, the total active sell orders stand at 40,968 BTC.

The chart above depicts that the market demand for Bitcon has exceeded the active sell orders by 3,781 BTC. Intuitively, when the demand for an asset outpaces supply by such a large margin, it signals that the momentum is tilting in favor of the bulls.

This suggests that as the panic sell-off that followed the ETF approval wanes, retail investors are gradually taking bullish positions again.

In summary, the whales’ resilient buying pressure and the excess market demand for BTC are two vital short-term indicators pointing towards a BTC price holding up above $40,000 in the days ahead.

BTC price forecast: breaking above $44,000 could catalyze more gains

Drawing inferences from the whales’ buying trends and active Bitcoin trading orders analyzed above, BTC price looks set to consolidate above the $40,000 in the short-term.

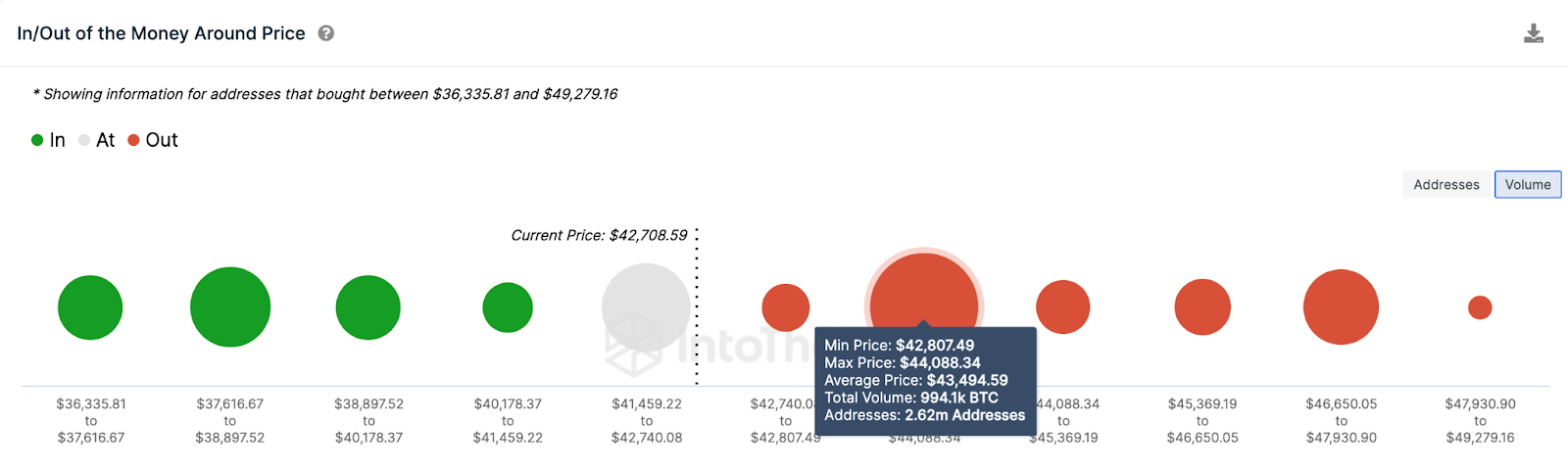

But for the bulls to gain control of the market, they must first scale the $44,000 resistance level. IntoTheBlock In/Out of the money data, which groups current holders by their historical entry prices. also affirms this stance.

It shows that 2.6 million existing investors had acquired 994,100 BTC at the maximum price of $44,088. If those holders look to sell as BTC approaches their break-even point, it could inadvertently cause a pullback.

But if the bulls can garner enough momentum to smash through the $44,000 sell-wall, it could open the doors to a possible $50,000 retest.

Alternatively, if things take a bearish turn, the bulls can rely on the historically significant buy wall at $40,180 for initial support.

The chart above shows that 731,800 addresses acquired 336,060 BTC at the maximum price of $40,178. If they make frantic efforts to cover their positions, Bitcoin price can stage an instant rebound from that range.