Bitcoin (BTC) checked losses while United States equities drifted down on June 22 as the Federal Reserve kept quiet on monetary policy.

Powell keeps quiet on Fed moves

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering near $20,500 at the June 22 Wall Street open.

The pair had wicked below the $20,000 mark overnight before recovering, still down from the previous day’s $21,700 highs.

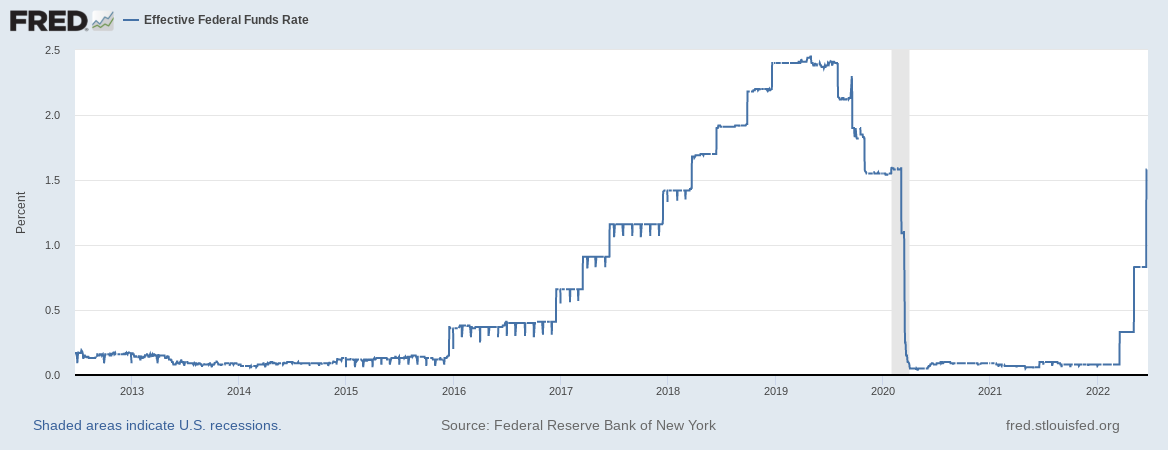

Markets braced for last-minute surprises from testimony to Congress by Fed Chair Jerome Powell on the day, this ultimately providing no fresh insight into the central bank’s approach to taming rampant inflation.

“We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy,” a copy of Powell’s testimony released before his appearance read.

“We will make our decisions meeting by meeting, and we will continue to communicate our thinking as clearly as possible.”

Both the S&P 500 and Nasdaq Composite Index opened slightly down after brisk progress on the day prior, providing similarly non-volatile conditions for crypto markets.

As Cointelegraph reported, the consensus among analysts nonetheless continues to point to further retests of lower levels, with $16,000 particularly popular in the case of Bitcoin.

“Declining volume with a completed impulse wave. Looking for an ABC pullback too long. I had put in a long, but closed due to the structure completion here,” popular Twitter account Crypto Tony explained about the overnight market setup.

His concerns about low volume on an upward impulse move were shared by fellow trader and analyst Rekt Capital, who urged Twitter followers not to place too much faith in the strength of the rally.

“The volume on this recent BTC rebound is very low and seller-dominated,” he wrote.

“This is not the kind of volume $BTC experiences at Bear Market bottoms.”

Report finds silver linings in crypto cloud

Looking on the bright side, meanwhile, trading firm QCP Capital revealed that it saw bearish conditions ebbing after Bitcoin’s reclaim of $20,000 at the weekend.

Related: Bitcoin miners sold their entire May harvest: Report

“On Saturday, support levels broke with BTC collapsing to 17,567 and ETH to 879. For BTC, this is a 75% drawdown from all-time highs (82% for ETH). The crypto credit crisis in full swing,” it wrote in its latest market circular issued to Telegram channel subscribers.

“However, we were pleasantly surprised by the strong bounce off the lows on Sunday and into this week, taking BTC back above 20,000 and ETH above 1,100.”

Continuing, it explained that funding rates on derivatives markets were now more stable and that sell-side pressure into the weekend lows was “more miners reducing inventory.”

On the topic of macro, QCP highlighted falling oil prices as a positive move against inflationary pressures.

“With that said, we remain on guard. Quarter-end fund redemptions are likely to put some pressure on prices along with the possibility of more crypto insolvencies being unearthed,” it added.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.