Fresh data from Glassnode claims that Bitcoin (BTC) could be in for another “prolonged phase of range-bound” price action if key support levels are not reclaimed.

Key takeaways:

-

Bitcoin is stuck between key cost-basis levels, predicting 2022-type consolidation unless key support levels are reclaimed.

-

Bitcoin price needs to take out the resistance at $72,000 to break out of consolidation.

Bitcoin faces overhead supply challenges

In the Feb. 11 edition of its regular newsletter, The Week On-chain, onchain data provider Glassnode confirmed key supply zones constraining upside follow-through and “creating overhead resistance potential during relief rallies.

The BTC/USD pair is trading within a new range defined by the True Market Mean currently at $79,200 and the realized price near $55,000, closely resembling the structural environment observed during the first half of 2022.

According to Glassnode, Bitcoin’s price is expected to continue oscillating within this corridor until new buyers emerge and gradually accumulate supply.

The chart below shows that the price spent the period between April 2022 and June 2022 trapped between the True Market Mean and the Realized Price before entering an extended bear market, bottoming around $15,000 in November 2022.

Related: Bankers push OCC to slow crypto trust charters until GENIUS rules clarified

A break out of this range would require an extreme catalyst, “either a decisive reclaim of the True Market Mean near $79.2K, signaling renewed structural strength, or a systemic dislocation similar to LUNA or FTX that forces price below the Realized Price around $55K,” Glassnode said, adding:

“In the absence of such extremes, a prolonged phase of range-bound absorption remains the most probable path for the mid-term market.”

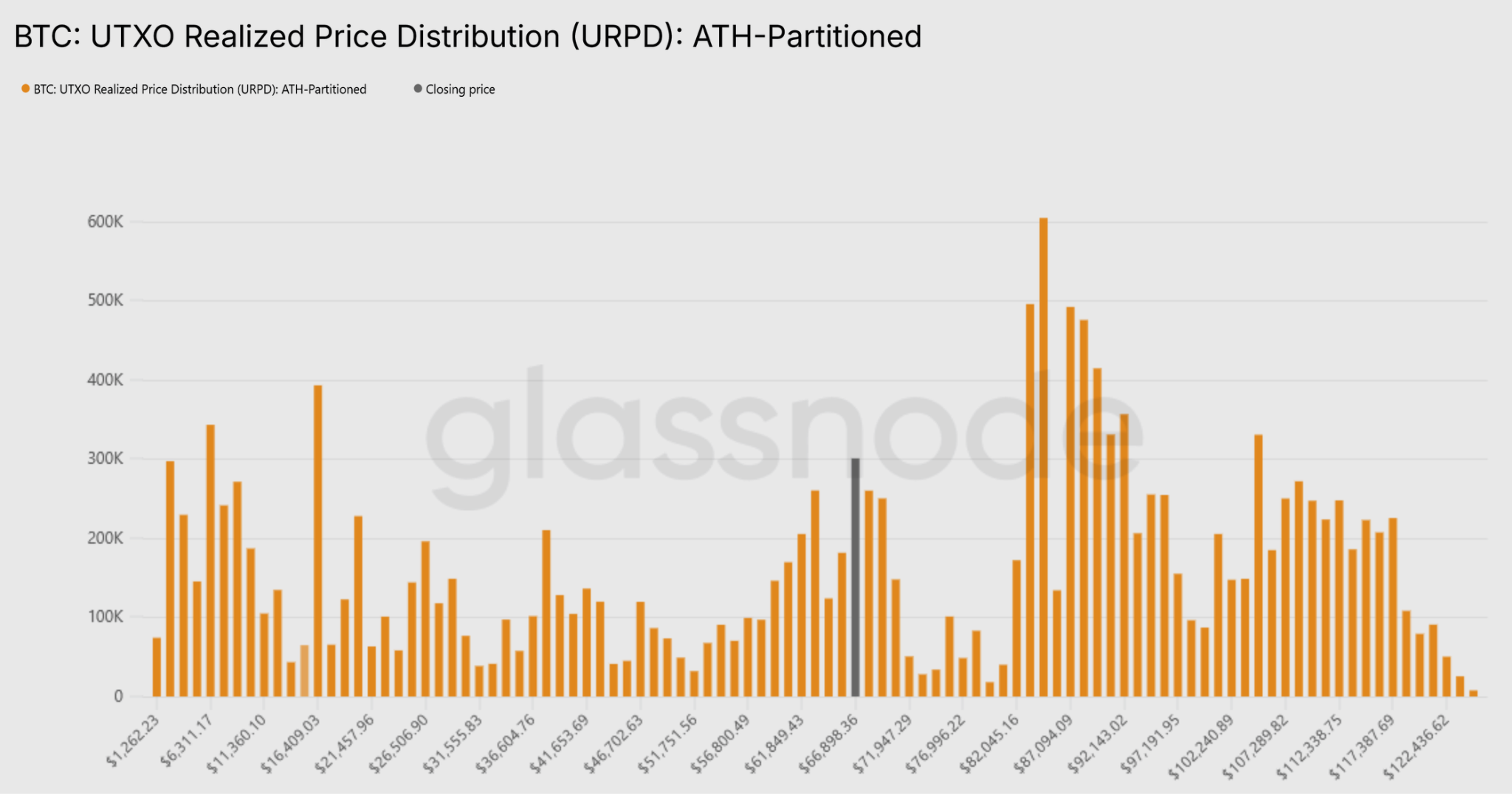

Glassnode’s UTXO Realized Price Distribution (URPD), a metric that shows at which prices the current set of Bitcoin UTXOs were created, also revealed wide and dense supply zones above $82,000 that have been gradually maturing into the long-term holder cohorts.

“Overhead supply remains structurally heavy, with significant clusters positioned between $82K–$97K and $100K–$117K, representing cohorts now holding substantial unrealized losses,” the onchain data analytics platform said, adding:

“These zones may act as latent sell-side overhang, particularly if prolonged time under water or renewed downside volatility triggers further capitulation.”

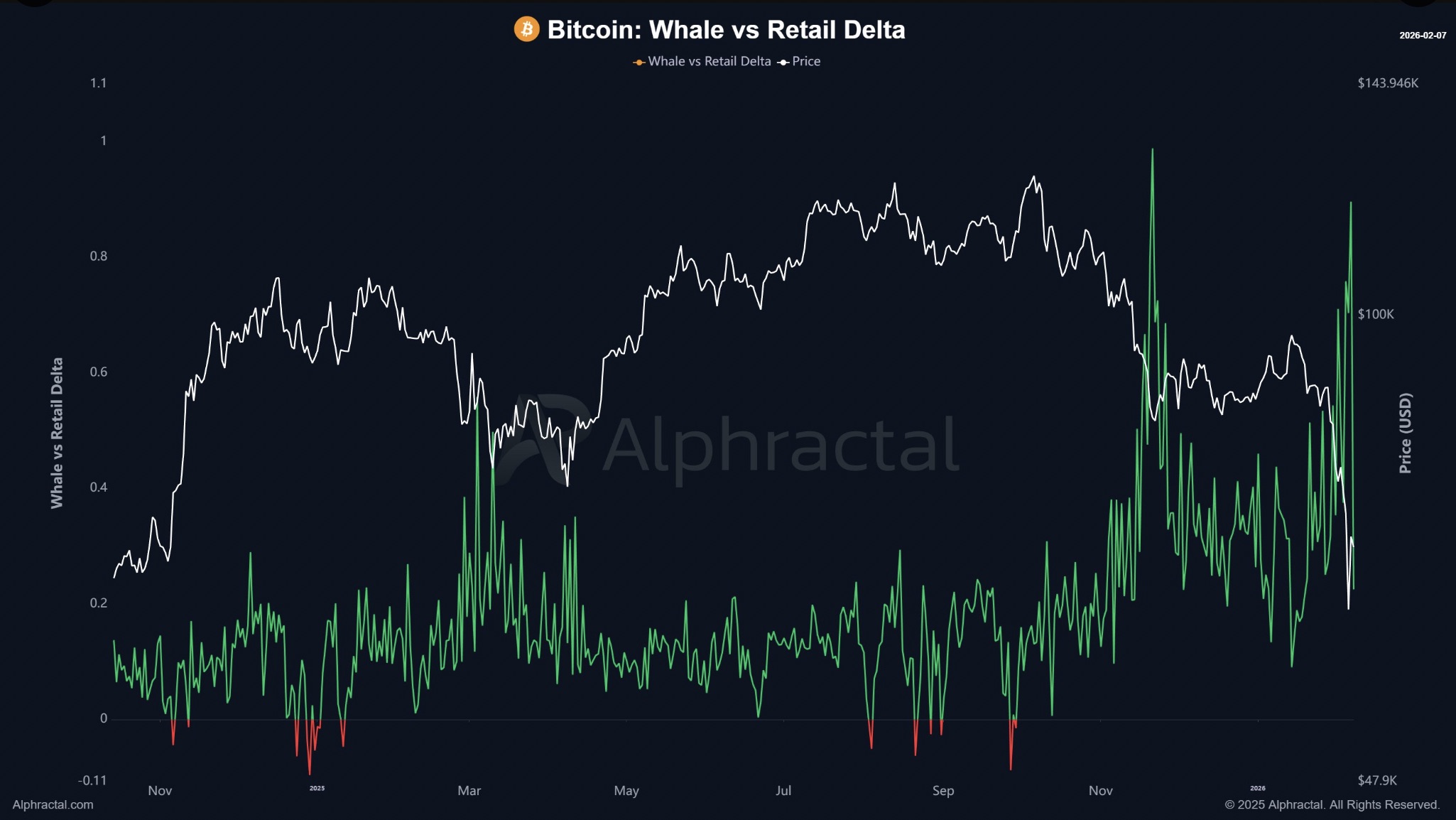

Bitcoin “whales are closing longs and opening shorts relative to retail,” said founder and CEO of Alphractal Joao Wedson in a recent X post, adding:

“There is a high probability that Bitcoin will enter a consolidation phase, ranging and building structure over the next 30 days.”

Bitcoin price is stuck between two key levels

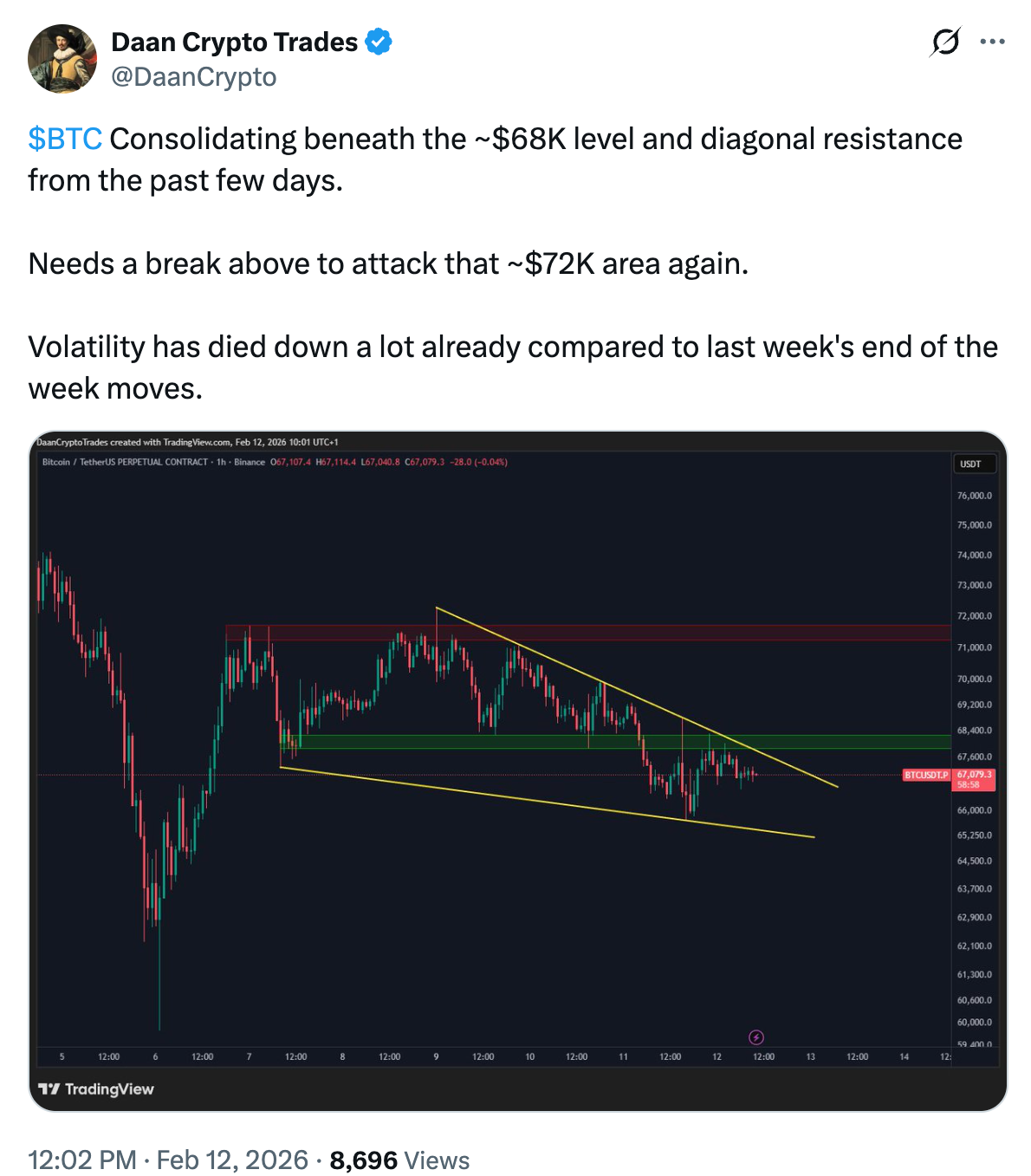

Bitcoin’s 20% recovery from 15-month lows below $60,000 was rejected by resistance from the $72,000 level.

It is now consolidating within the recently established support below $65,000 and the resistance at $68,000, which analyst Daan Crypto Trades said bulls must “break above to attack $72,000 again.”

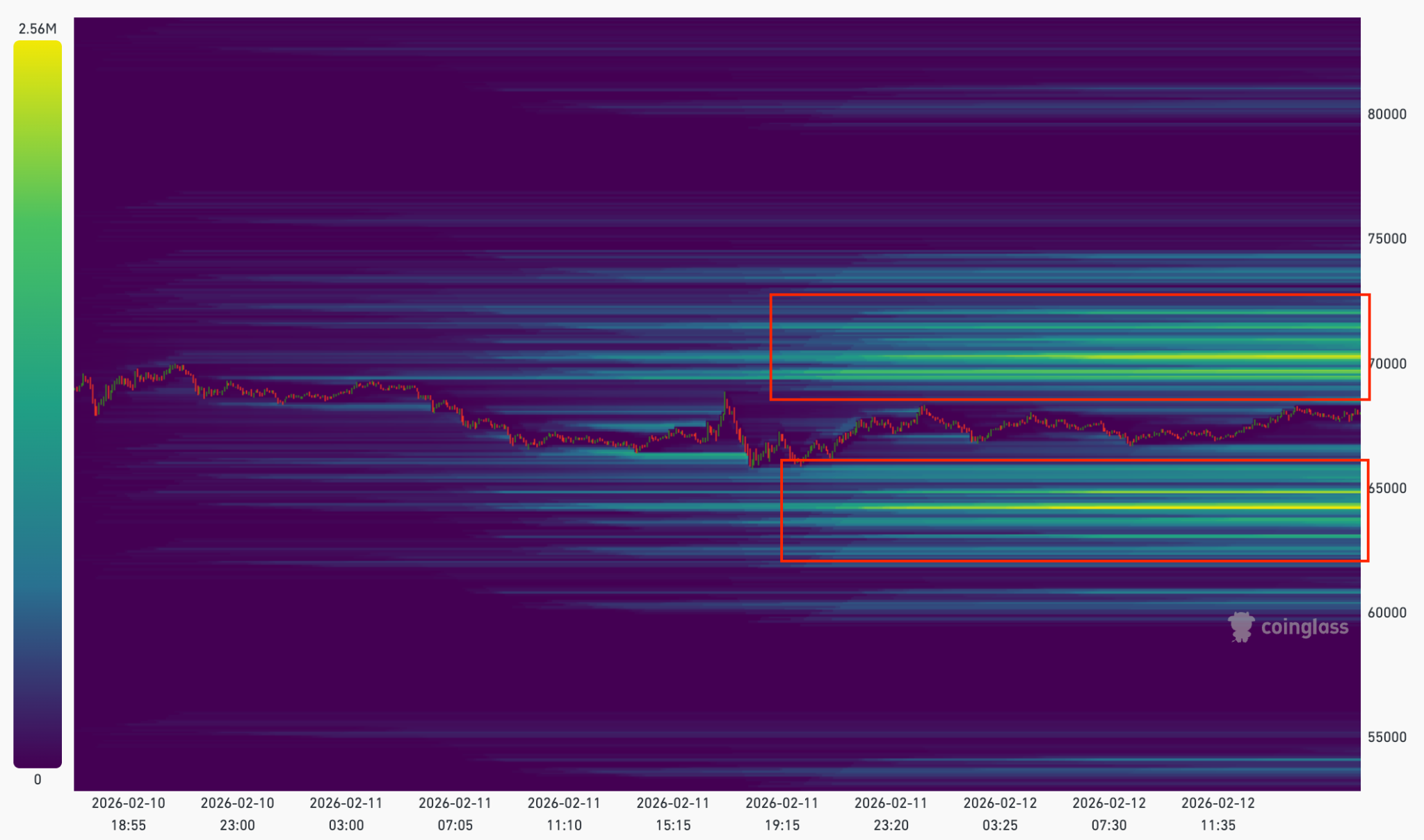

CoinGlass’ liquidation heatmap shows Bitcoin in a classic liquidation sandwich with heavy ask orders between $69,000 and $72,000 and dense bid positions below $66,000, as shown in the figure below. This highlights the relative tightness of the current market structure.

As Cointelegraph reported, Bitcoin must take out resistance at $72,000 to revive the hopes of a recovery toward the 20-day EMA at $76,000 and the 50-day SMA above $85,000, suggesting that the BTC price may have bottomed out in the near term.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.