Bitcoin (BTC) returned to $30,000 after the June 21 Wall Street open in a triumphant continuation of the week’s gains.

Bitcoin price destroys traces of multi-week downturn

Data from Cointelegraph Markets Pro and TradingView confirmed a new multi-month high of $30,340 on Bitstamp.

BTC price action continued to heat up throughout the day as bulls made the most of strength, which had come thanks to various announcements of legacy finance applying to launch a Bitcoin exchange-traded fund (ETF).

In so doing, BTC/USD erased many weeks of downside, adding over 20% versus local lows below $24,800 seen on June 15.

$32,000 #BITCOIN IS A MAJOR RESISTANCE ZONE ON BTC, SO THIS IS MY MAIN BITCOIN TARGET

NO NEED TO GET GREEY ON THIS PUMP. WE KNOW HOW QUICK THINGS CAN CHANGE pic.twitter.com/mdj2YvnakW

— Crypto Tony (@CryptoTony__) June 21, 2023

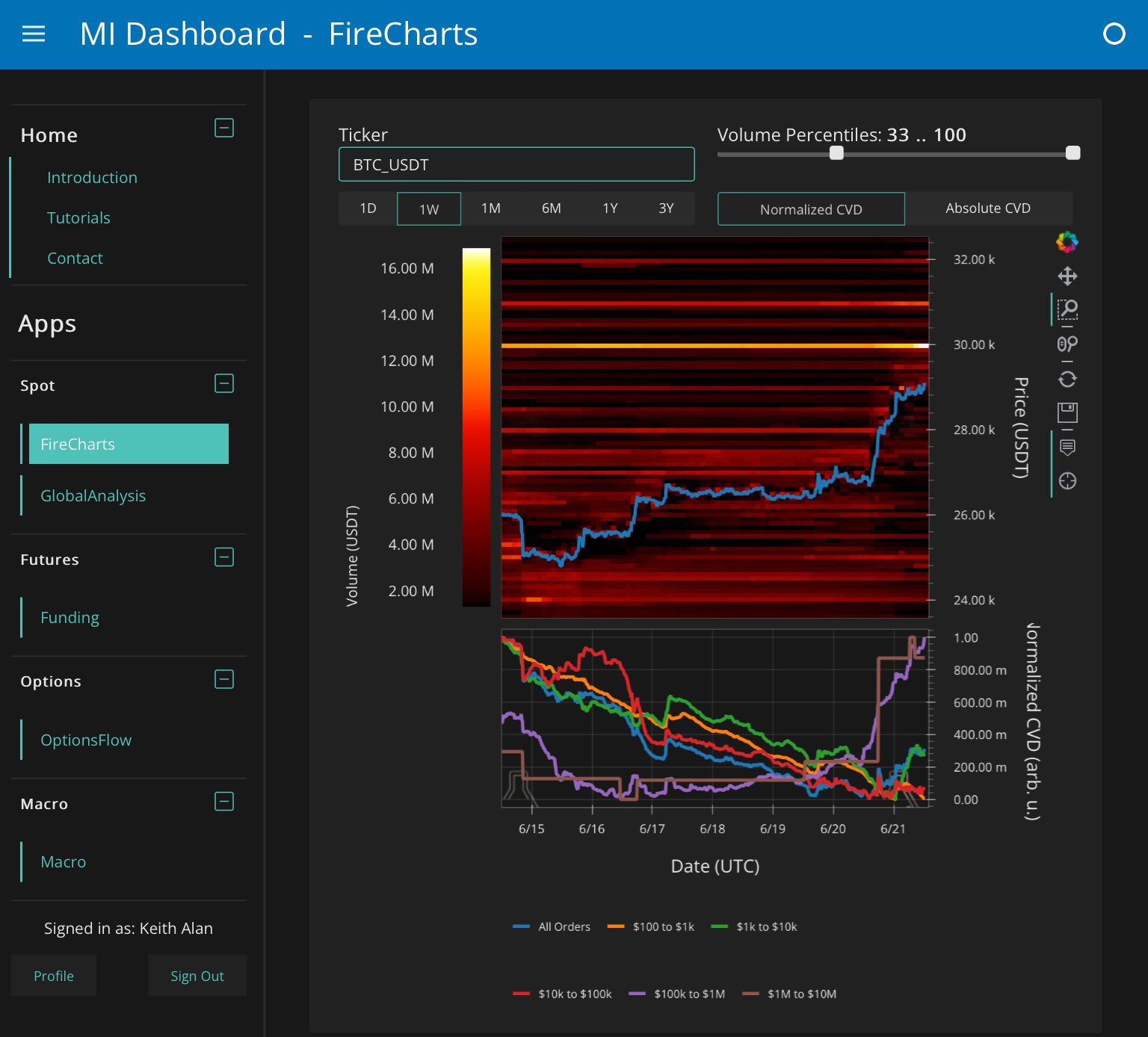

As traders lined up short-term targets, on-chain monitoring resource Material Indicators focused on $30,000 as an important level to overcome.

Uploading a print of the BTC/USD order book on Binance, it noted that “resistance at $30k is building.”

“Watching to see how much bid liquidity moves in to the active trading range to serve as support,” it commented.

“Don’t really expect #JPow to reveal any surprises with his testimony, but these events usually deliver some volatility.”

Material Indicators referenced ongoing testimony from Jerome Powell, chair of the United States Federal Reserve, before the House Financial Services Committee.

The U.S. was already a focus for crypto market participants, with the ETF announcements fueling a return to accumulation during Western trading hours.

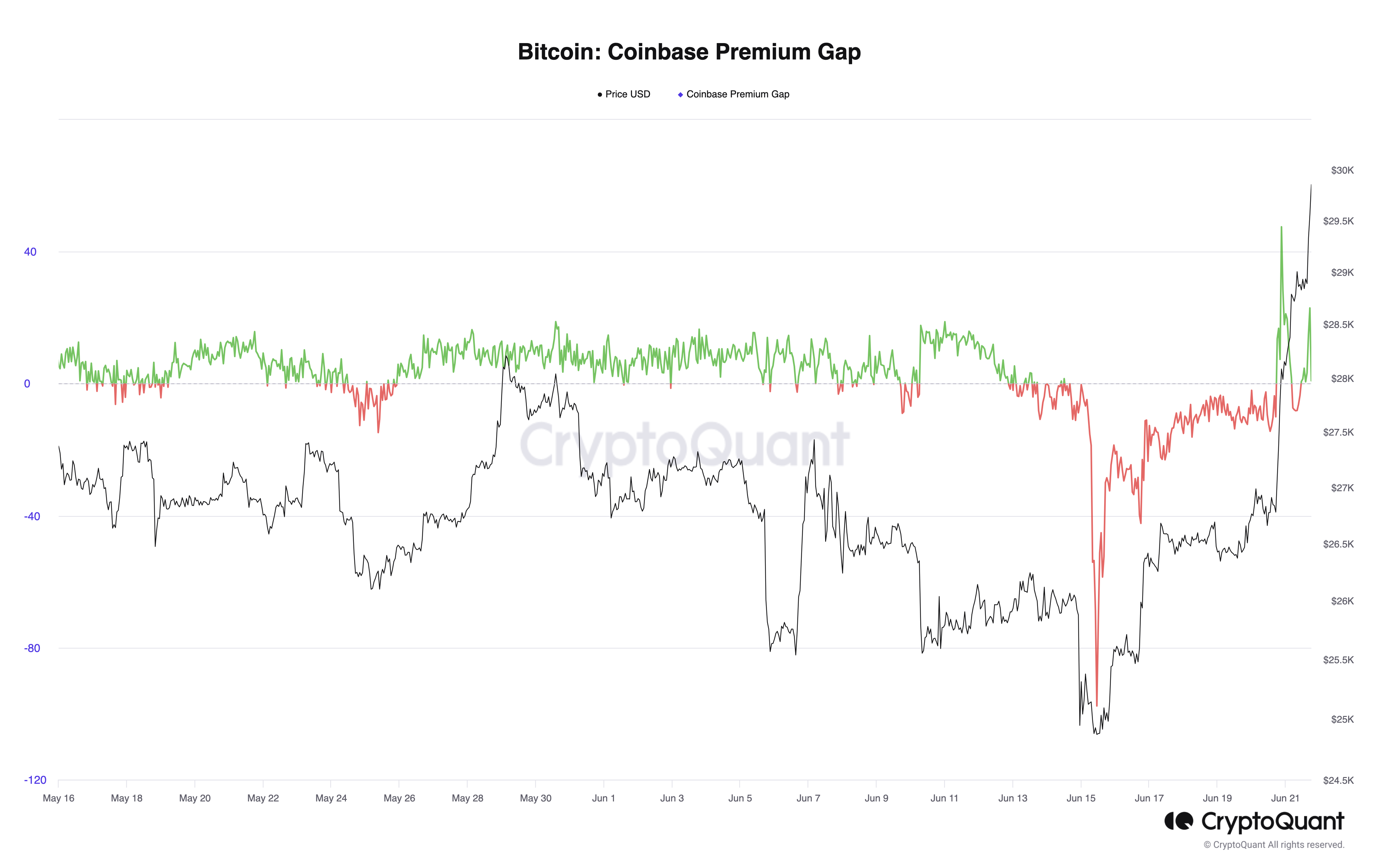

“The Americans are buying,” Maartunn, a contributor at on-chain analytics platform CryptoQuant, continued.

“The intense bidding on Coinbase that took place yesterday commenced at a similar time as it did today.”

An accompanying chart showed the premium for BTC/USD on U.S. exchange Coinbase versus largest global crypto exchange Binance, this signaling “strong buying pressure” on the day.

Previously, Cointelegraph noted the changing possession of the BTC supply from the U.S. to China throughout the past year.

“The real deal”

Others turned their attention to what they considered more organic BTC price action compared to recent local highs.

Related: Bitcoin price ‘sideways boredom’ may last 18 months — New research

In line with popular trader and analyst Rekt Capital, Scott Melker, the trader and podcast host known as “The Wolf Of All Streets,” hoped for continuation.

“This Bitcoin move is spot driven, with minimal liquidations and shorts STILL piling in. Further, spot volume today is as much as yesterday already with 10 hours left in the candle,” he told Twitter followers.

“This is the real deal.”

An accompanying chart highlighted trading volume on the way up to $30,000.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.