Key points:

-

Bitcoin bounces as liquidation guardrails appear above and below price, making $116,000 a key level to watch.

-

Expectations call for BTC price support to hold above $110,000 should bears take control.

-

ETF flows should provide an insight into market mood next, says analysis.

Bitcoin (BTC) approached $116,000 after Monday’s Wall Street open as bulls targeted sell liquidity.

BTC price stares down major liquidity walls

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD $115,732 on Bitstamp.

A late-weekend rebound continued as TradFi markets reopened, and traders were hopeful that further BTC price gains would follow.

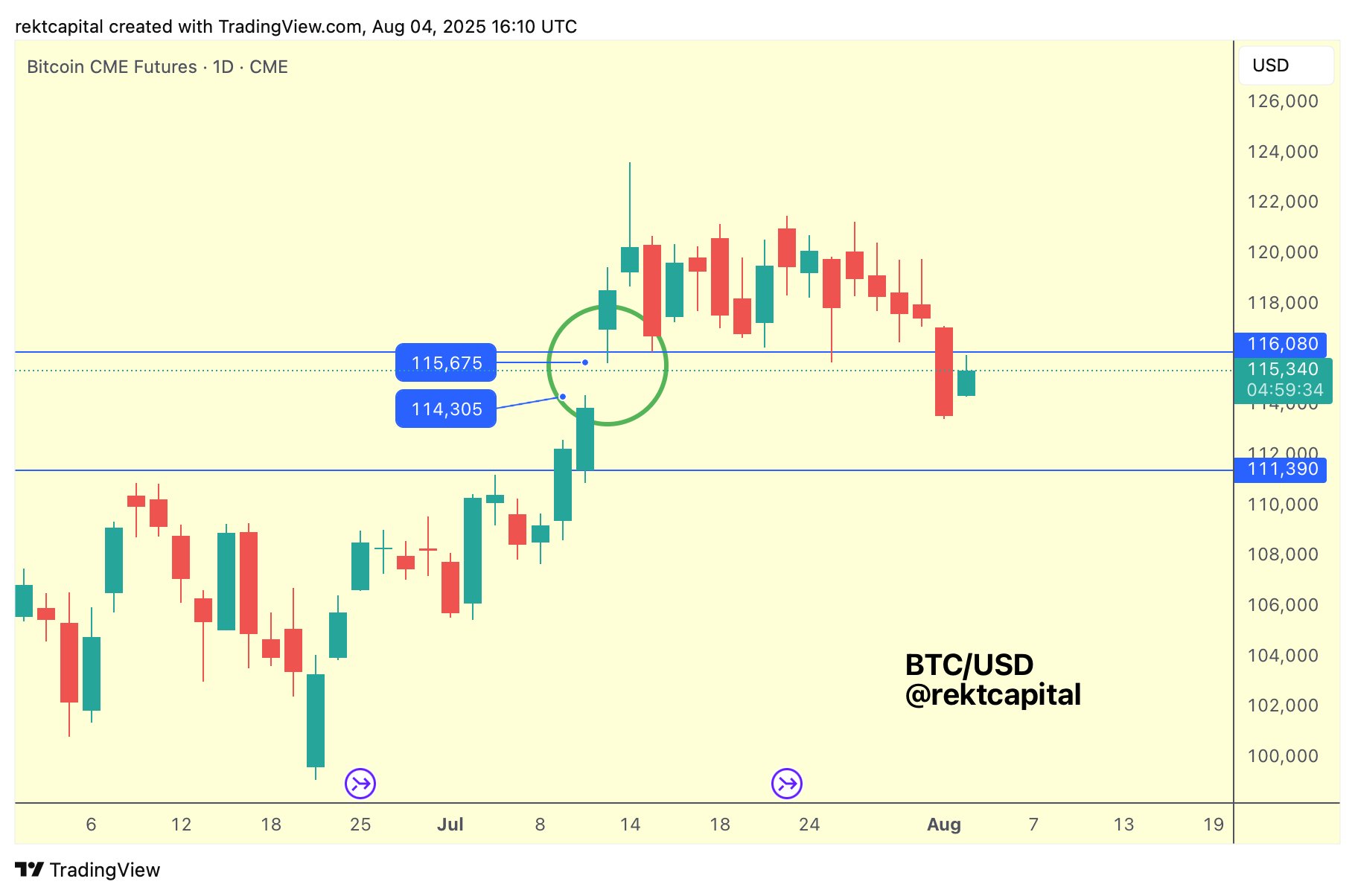

“After completely filling the Daily CME Gap, Bitcoin will now try to exit this Gap in an effort to reclaim the recently levels above,” Rekt Capital told X followers, referring to the gap in CME Group’s Bitcoin futures market — a classic price magnet.

“It all starts with a reclaim of ~$116k which is the top of the recently filled Daily CME Gap.”

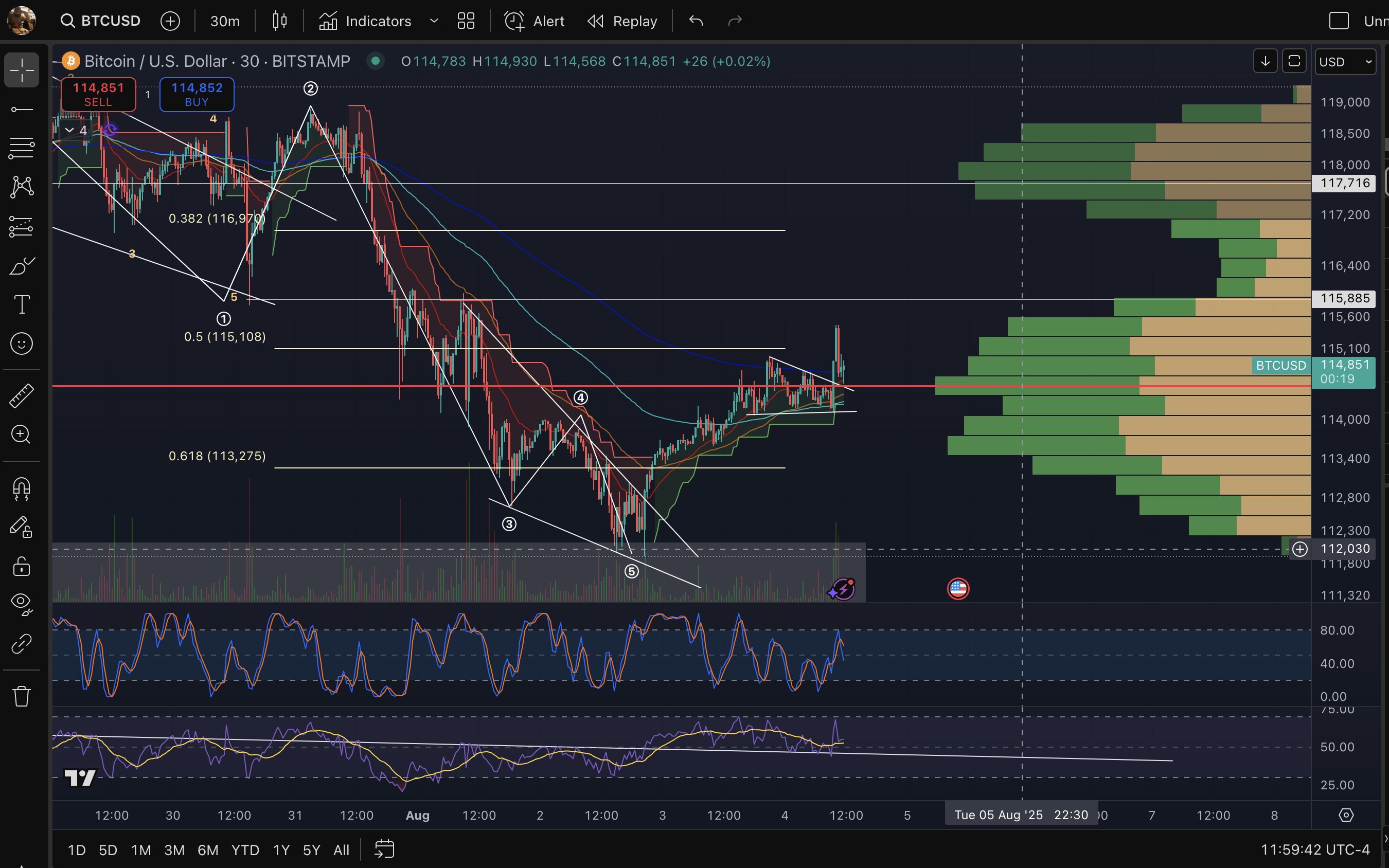

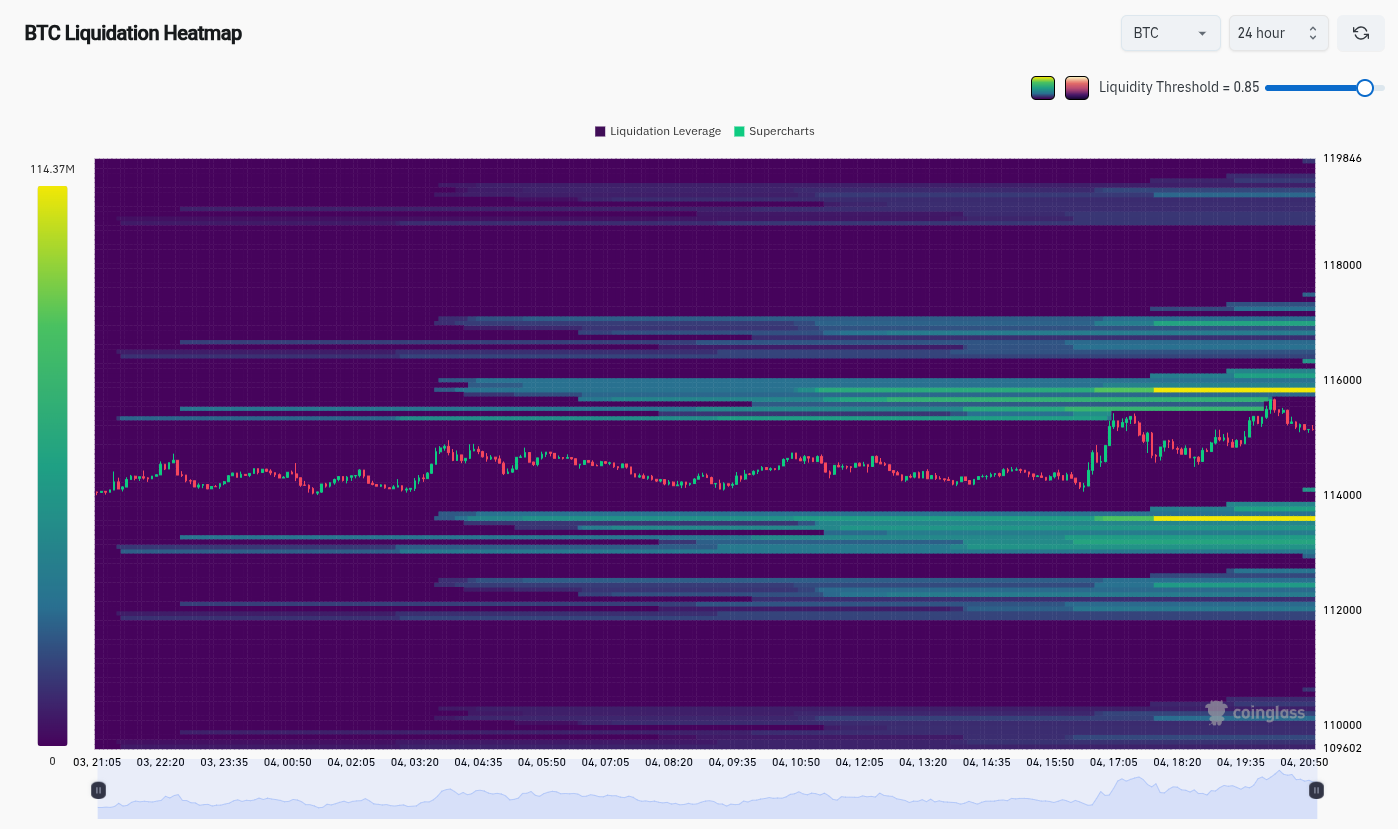

Exchange order-book liquidity data from CoinGlass showed price pinned below a wall of asks centered on $115,800.

“$BTC above $115,850 will confirm that the $112k area was likely the bottom,” popular trader BigMike7335 argued in part of an X post alongside a chart showing key short-term Fibonacci levels.

Bids were laddered from $113,800 to $112,000, with more around old all-time highs near $110,000.

“Likely scenario: If downside gets swept first – expect a bounce near $110.5K,” fellow trader Cipher X summarized on the day.

Spotlight on Bitcoin ETF flows, leverage flush

Discussing whether it was “time to buy the dip” on Bitcoin, trading firm QCP Capital was optimistic.

Related: Is BTC repeating path to $75K? 5 things to know in Bitcoin this week

“BTC’s July monthly close marked its highest in history, and the recent drawdown appears more corrective than capitulatory,” it wrote in its latest bulletin to Telegram channel subscribers.

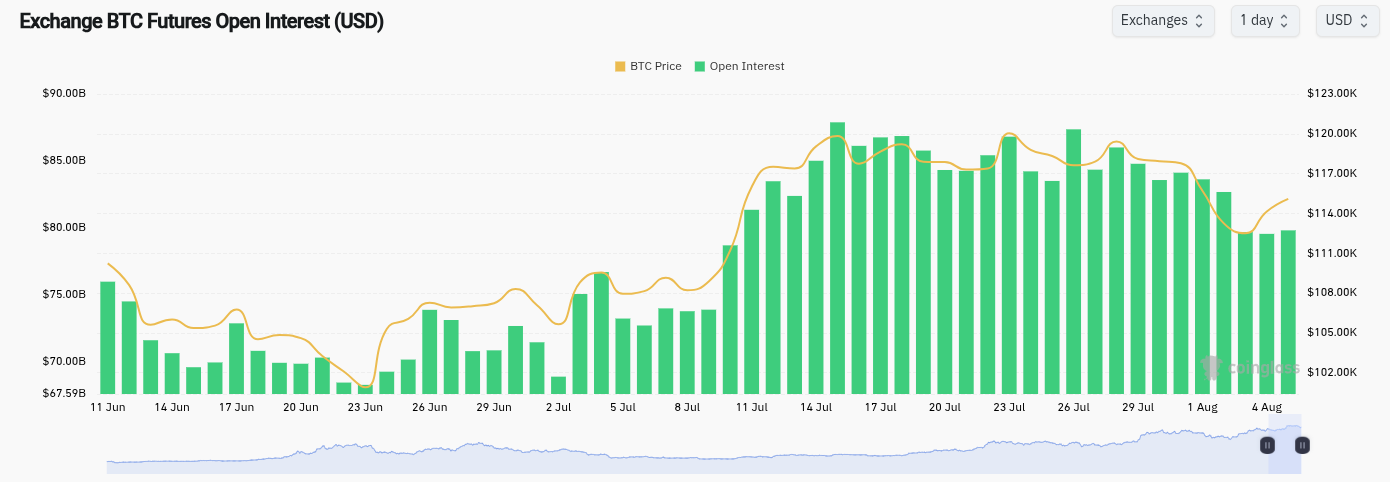

“Historically, such post-rally shakeouts, particularly those that flush out excess leverage, have laid the groundwork for renewed accumulation. Importantly, this comes at a time when macro and structural tailwinds remain supportive.”

CoinGlass confirmed open interest on Bitcoin futures hit its lowest levels since July 10 over the weekend.

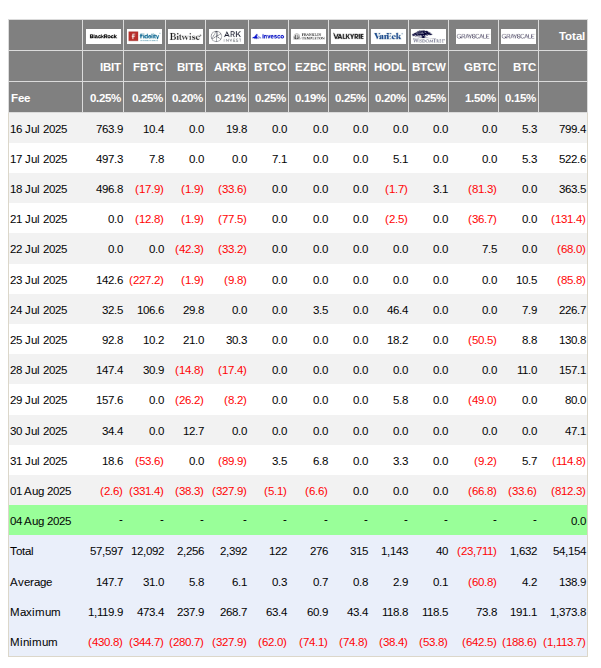

QCP suggested that Monday’s netflows for the US spot Bitcoin exchange-traded funds (ETFs) could provide an “indication” of market appetite.

As Cointelegraph reported, these came out at -$812 million on Aug. 1, marking the second-largest daily outflow on record.

“We remain cautiously optimistic. Spot levels near $112k warrant vigilance, especially amid persistent macro uncertainty,” it said.

“But signs of stabilization, such as renewed spot ETF inflows, declining implied vols and a narrowing of skew, would be constructive signals that institutional sentiment is recovering.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.