After a strong two week performance that saw Bitcoin (BTC) price rise from $7,700 to $9,200, the top crypto asset appears to be consolidating before making another attempt at $9,200. As this process takes place and Bitcoin’s dominance rate dropped slightly, many altcoins rallied with double-digit gains which brought many to test or even push above their 2-year long descending trendlines.

Most notably, the ETH/BTC pair pushed above its long-term downtrend, an occurrence covered in great detail by Cointelegraph contributor Michaël van de Poppe.

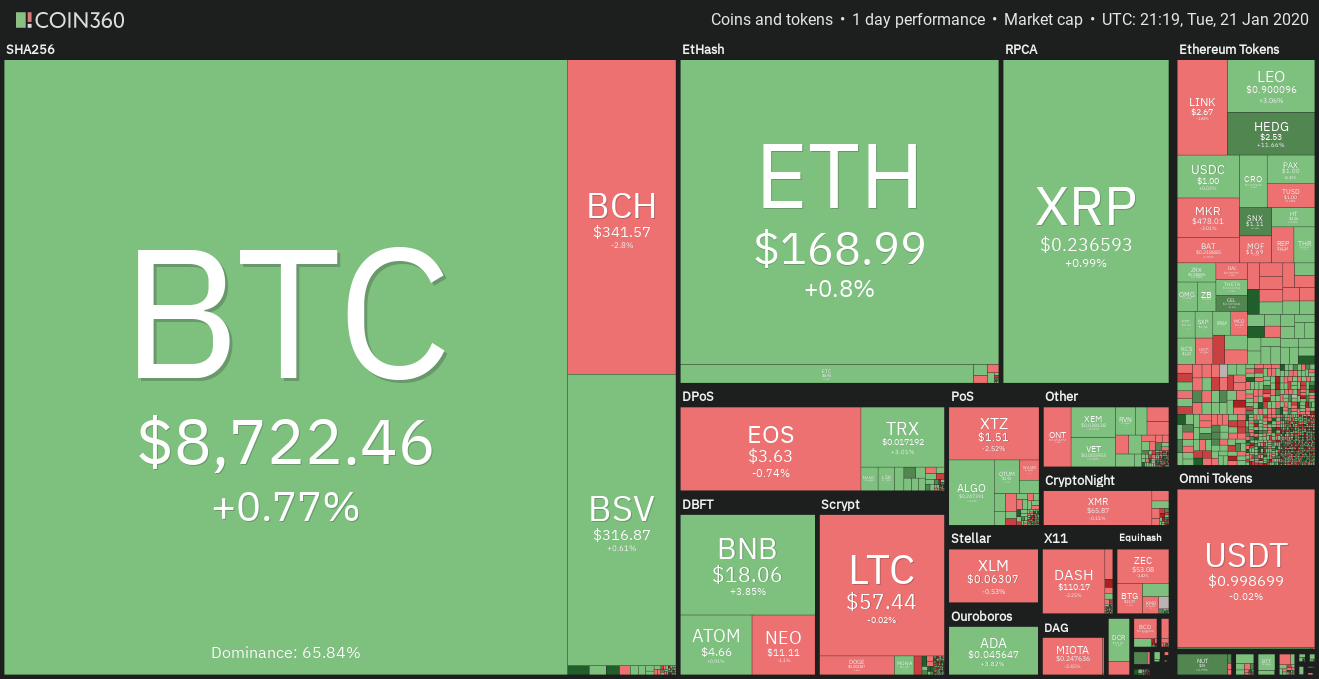

Cryptocurrency market weekly overview. Source: Coin360

The strong rejection at $9,200 on Jan. 18 and following drop from the ascending wedge pattern briefly flipped traders’ sentiment to bearish and calls for a revisit to $8,000 and below the 200-day moving average (200) surfaced. Fortunately, for bulls, traders have done a good job defending the support zone at $8,470 and the shorter timeframe charts currently show Bitcoin attempting to press above the moving average of the Bollinger Band indicator.

BTC USD daily chart. Source: TradingView

Since Jan. 19 the price has dropped to test the $8,475 five times and each time traders have bought into the dip in defense of the support which suggests traders believe Bitcoin’s current set up supports the possibility of another run to $9,000 over the short term.

At the moment, the price rides along with the moving average of the Bollinger Band indicator and the 4-hour moving average convergence divergence (MACD) and relative strength index (RSI) suggest that the bulls will attempt to push Bitcoin price to the upper Bollinger Band arm which is located at $8,983 and also lined up with the ascending trendline which BTC fell below on the Jan. 18 pullback.

Bitcoin’s trading volume also has tapered off, an occurrence that is typical before a sharp shift in price the MACD has converged with the signal line of the 4-hour timeframe which is a bullish signal.

Even if a high volume spike sends Bitcoin price back to $9,000, a more desirable move would be seeing the price push through $9,113 and hold for a 4-hour close. Setting a daily higher high above $9,200 would also restore momentum and show Bitcoin is ready for continuation to $9,600.

Bearish scenario

BTC USD daily chart. Source: TradingView

In the event that Bitcoin falls below $8,470, traders expect the price to drop to the 200-DMA at $8,200. Below this level, a bounce off the main trendline of the former descending channel at $8,124 and 50-DMA at $8,000 is predicted. Below the 50-DMA traders will look for support at $7,600 and after this investor will clench their jaws and rub their sweaty palms as the price approaches $7,200.

Currently, the volume profile visible range (VPVR) shows buying interest at all of the levels mentioned above, including $8,470. Further, the trader’s recent behavior of buying into the pullbacks of the last three days suggests a retest of lower supports will produce even strong bounces as buys who missed the strong rally of the past two weeks may see any price below $8,200 as an opportunity to open long positions.

Bullish scenario

As discussed earlier, a bullish outcome would involve Bitcoin price bolting above $9,133 and flipping $9,200 to support. Doing so would open the door for the digital asset to take out $9,600 and begin the push toward $10,000. $9,800 is likely to present significant resistance and traders will be tempted to take profits at this point, possibly resulting in a sharp pullback.

It is also worth remembering that the price has just broken out of a 7-month long downtrend and the weekly MACD is in the midst of a bull cross.

Thus, regardless of a strong rejection at $9,500 or $9,800 the current trend change is strong and many traders are targeting $11,500 as a target supported by the current market structure.

For the short-term, let’s observe to see if an inverse head and shoulders pattern shapes up with Bitcoin pushing above $9,200 to set a daily higher high.

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.